In the world of investments, the constant battle between risk and reward is a dance that every investor must partake in. In particular, when it comes to gold investments, this delicate relationship takes center stage. As someone who has been immersed in the world of gold investments for years, I believe it is crucial to delve into the intricacies of this relationship to make informed decisions. While gold has long been considered a safe-haven asset, it is important to understand the potential risks involved to fully grasp the potential rewards. In this article, we will analyze the delicate balance between risk and reward in the realm of gold investments, shedding light on the factors that influence this relationship and equipping you with the knowledge you need to navigate this fascinating arena. So, grab your favorite beverage and get ready for an engaging exploration into the world of risk and reward in gold investments.

This image is property of 4.bp.blogspot.com.

The Importance of Risk vs. Reward Analysis in Gold Investments

Investing in gold can be a lucrative endeavor, but like any investment, it comes with its own set of risks. To make informed decisions about gold investments, it is crucial to understand the relationship between risk and reward. By conducting a thorough risk vs. reward analysis, you can evaluate the potential risks involved and assess the rewards you can expect from investing in gold. This analysis will help you make well-informed investment decisions that align with your financial goals and risk tolerance. In this article, we will explore the various factors that you need to consider when analyzing the risk vs. reward in gold investments.

1. Evaluating the Risks

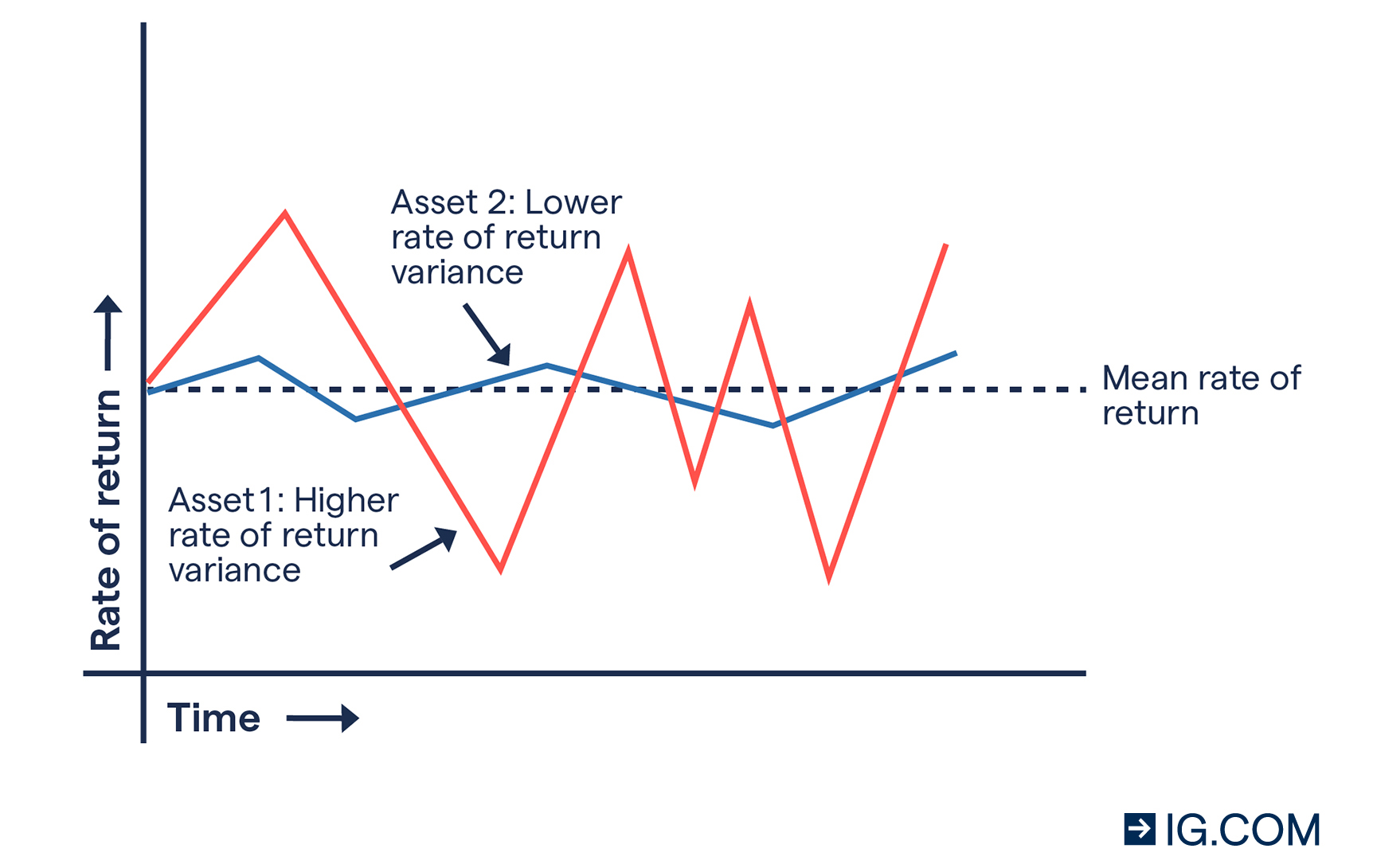

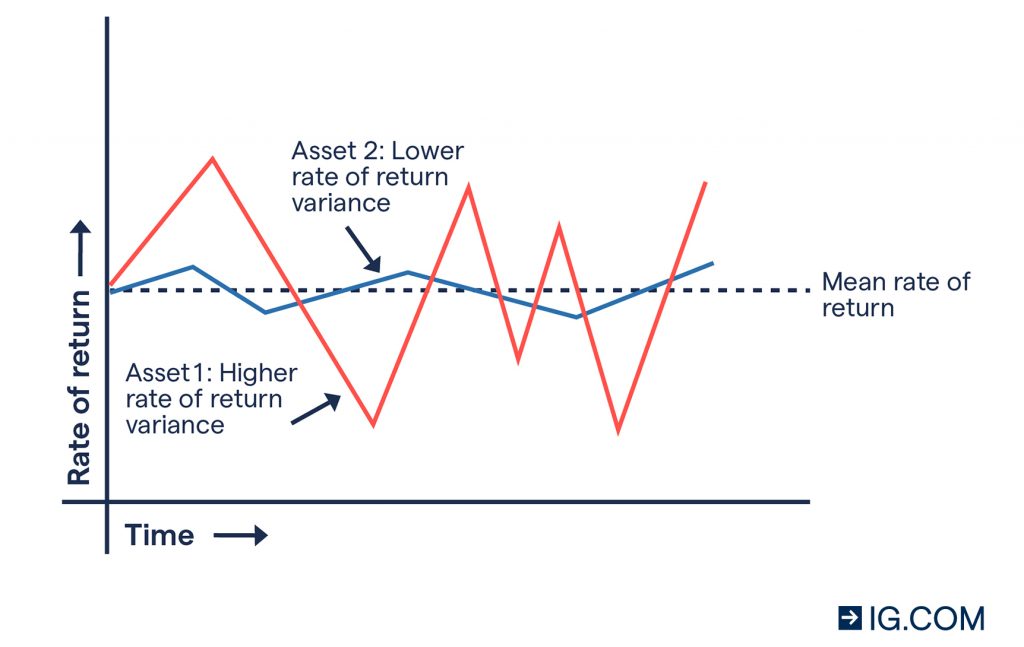

Market Volatility

One of the key risks associated with gold investments is market volatility. Gold prices can experience significant fluctuations in response to various factors such as economic conditions, geopolitical tensions, and investor sentiment. It is important to consider how changes in market conditions can impact the price of gold before making an investment decision. By understanding the potential for volatility in the gold market, you can better assess the associated risks.

Geopolitical Risks

Geopolitical events can have a significant impact on gold prices. For example, conflicts, political instability, and trade tensions can drive investors to seek safe-haven assets like gold, leading to an increase in its price. Conversely, improvements in geopolitical stability can have the opposite effect. Evaluating geopolitical risks is essential in order to gauge how they may influence gold prices and the potential impact on your investment.

Economic Factors

Economic conditions play a crucial role in determining the value of gold. Factors such as interest rates, inflation rates, and economic growth can influence investor sentiment and, in turn, gold prices. Understanding how economic factors can affect the demand and supply dynamics of gold is key to assessing the potential risks involved in gold investments.

Inflation Risks

Gold is often seen as a hedge against inflation. When inflation rises, the value of fiat currencies can decrease, leading investors to turn to gold to protect their wealth. However, the relationship between inflation and gold prices can be complex. It is important to evaluate inflation risks and its potential impact on the purchasing power of gold before deciding to invest.

Counterparty Risk

Another risk to consider when investing in gold is counterparty risk. Unlike stocks or bonds, gold is a physical asset that is not dependent on the performance or solvency of any specific institution. However, if you invest in gold through derivatives or exchange-traded products, there may be counterparty risk involved. It is important to understand the counterparty risk associated with your specific gold investment vehicle before making a decision.

Regulatory and Legislative Risks

Regulatory and legislative risks can impact the gold market and your investments. Changes in mining regulations, tax laws, or import/export restrictions can influence the supply and demand dynamics of gold, consequently affecting its price. Staying informed about any potential regulatory or legislative changes that may impact the gold market is crucial in conducting a comprehensive risk vs. reward analysis.

This image is property of media.wallstreetprep.com.

2. Assessing the Rewards

Historical Performance of Gold

When analyzing the potential rewards of gold investments, one cannot overlook its historical performance. Gold has proven to be a reliable store of value over time, with its price often increasing during times of economic uncertainty or market downturns. By examining the historical performance of gold, you can gain insights into its potential for long-term capital appreciation.

Store of Value and Wealth Preservation

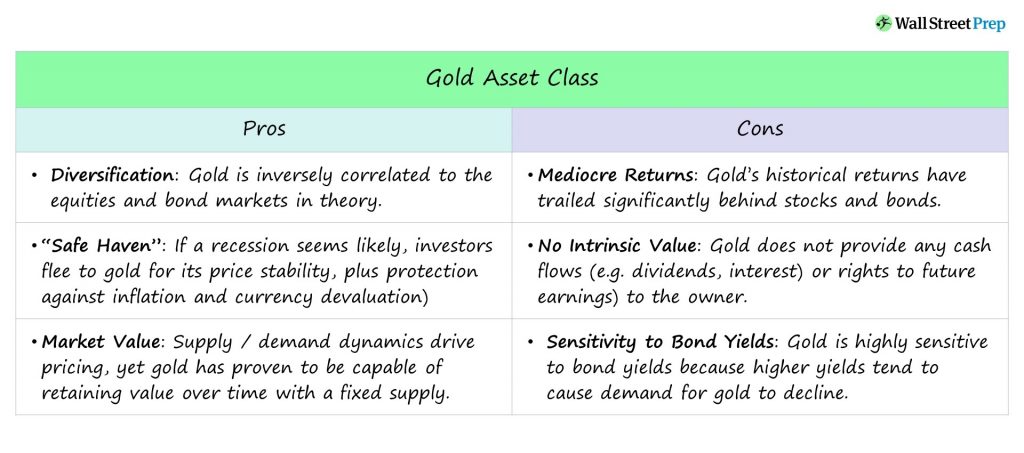

Gold is often seen as a safe-haven asset and a store of value. Throughout history, it has served as a means of preserving wealth and protecting against economic downturns. By diversifying your investment portfolio with gold, you can potentially safeguard your wealth and mitigate the risks associated with other asset classes.

Diversification Benefits

Diversification is a key principle of investment risk management. Adding gold to your investment portfolio can offer diversification benefits, as it tends to have a low correlation with other asset classes such as stocks and bonds. This means that gold may perform differently than other investments, reducing the overall risk of your portfolio and potentially enhancing returns.

Portfolio Hedging

Gold can act as an effective hedge against market volatility and economic uncertainties. During times of heightened market volatility or crisis situations, gold prices have historically increased, providing a form of insurance for investors. By including gold in your investment portfolio, you can potentially mitigate losses during market downturns and ensure the overall stability of your portfolio.

Potential for Capital Appreciation

Aside from its role as a safe-haven asset, gold also has the potential for capital appreciation. The demand for gold can increase due to various factors such as increased industrial use, jewelry demand, or investor sentiment. By carefully analyzing market trends and understanding the factors that drive gold prices, you can identify opportunities for capital appreciation through gold investments.

3. Volatility and Price Fluctuations

Understanding Gold Price Movements

Gold prices are influenced by a multitude of factors, and understanding these movements is crucial for assessing the risk vs. reward in gold investments. Supply and demand dynamics, investor sentiment, and changes in economic conditions can all impact the price of gold. By staying abreast of these factors, you can better anticipate potential price movements and make informed investment decisions.

Factors Influencing Gold Price Volatility

Gold price volatility can be influenced by both macroeconomic factors and market-specific factors. Global economic events, changes in interest rates, and movements in major currencies can all contribute to price volatility. Market-specific factors, such as investor sentiment and trading volumes, can also impact gold price fluctuations. Evaluating these factors can help you understand the level of volatility and associated risks involved in gold investments.

Analyzing Gold Price Charts

Technical analysis of gold price charts can provide valuable insights into the potential risks and rewards of gold investments. By identifying patterns, trends, and key support and resistance levels, you can make more informed decisions about when to buy or sell gold. Additionally, analyzing price charts can help you identify potential entry and exit points, optimizing your risk vs. reward profile.

Impact of Global Events on Gold Prices

Gold prices can be influenced by major global events such as geopolitical conflicts, economic crises, or significant policy changes. When such events occur, investors often turn to gold as a safe-haven asset, driving up its price. Analyzing the potential impact of global events on gold prices is crucial for assessing the risks and rewards of gold investments.

Long-Term vs. Short-Term Price Fluctuations

It is important to distinguish between short-term price fluctuations and long-term trends when analyzing gold investments. Short-term volatility may present opportunities for traders or speculators, but long-term investors should focus on the overall trend and the fundamental factors that drive the price of gold. By understanding the distinction between short-term and long-term price movements, you can make more informed investment decisions that align with your investment objectives.

This image is property of a.c-dn.net.

4. Geopolitical Risks and Economic Factors

Political Instability and Gold Investments

Geopolitical risks, such as political instability, conflicts, or trade disputes, can have a direct impact on gold prices. During times of heightened geopolitical tensions, investors often seek out safe-haven assets like gold, leading to an increase in its price. By evaluating geopolitical risks and their potential impact on gold prices, you can better assess the risk vs. reward profile of gold investments.

Geo-economic Factors Affecting Gold

In addition to geopolitical risks, geo-economic factors also play a significant role in gold investments. Economic conditions, such as interest rates, inflation rates, and GDP growth, can influence investor sentiment and, subsequently, gold prices. Understanding how geo-economic factors can impact the demand and supply dynamics of gold is crucial for an accurate risk vs. reward analysis.

Impact of Interest Rates and Central Bank Policies

Interest rates and central bank policies can have a profound impact on gold prices. When interest rates are low or when central banks engage in expansionary monetary policies, the opportunity cost of holding gold decreases, leading to increased demand and potentially higher prices. Conversely, higher interest rates or restrictive monetary policies can dampen the demand for gold. Assessing the potential impact of interest rates and central bank policies on gold prices is vital for understanding the risks and rewards associated with gold investments.

Currency Depreciation and Gold Prices

Currency depreciation can significantly influence gold prices. When the value of a currency decreases, investors may turn to gold as a safe-haven asset, driving up its price. Gold is often seen as a hedge against currency depreciation and can potentially preserve the purchasing power of investors in times of currency devaluation. Analyzing the relationship between currency depreciation and gold prices is crucial for evaluating the risk vs. reward profile of gold investments.

Inflationary Pressures and Safe-Haven Demand

Inflationary pressures can impact the demand for gold. When inflation rises, the value of fiat currencies can decrease, leading investors to seek out safe-haven assets like gold as a hedge against declining purchasing power. Analyzing how inflationary pressures may affect the demand for gold is essential for assessing the potential rewards of gold investments.

5. Inflation Protection and Wealth Preservation

Gold as an Inflation Hedge

One of the key advantages of gold investments is its ability to act as an inflation hedge. During periods of inflation, the value of fiat currencies can decrease, eroding the purchasing power of investors. Gold, on the other hand, tends to retain its value and can serve as a hedge against the effects of inflation. By including gold in your investment portfolio, you can potentially protect your wealth from the eroding effects of inflation.

Comparison with Other Inflation-Protected Assets

When evaluating the potential rewards of gold investments as an inflation hedge, it is important to compare gold with other inflation-protected assets. Treasury Inflation-Protected Securities (TIPS), real estate, and commodities are some of the options available for investors looking to safeguard their wealth from inflation. Assessing the performance and characteristics of these assets can help you make informed decisions about incorporating gold into your inflation protection strategies.

Preserving Purchasing Power with Gold

Gold can serve as a means of preserving purchasing power over the long term. Unlike fiat currencies that can be prone to devaluation, gold has maintained its value throughout history. By holding gold as part of your investment portfolio, you can potentially safeguard your purchasing power and ensure the long-term preservation of your wealth.

Wealth Preservation Strategies Using Gold

There are various wealth preservation strategies that include gold investments. These strategies can help investors protect their assets in the face of economic downturns or uncertainties. By incorporating gold into a diversified investment portfolio or utilizing gold as a hedge against inflation, investors can potentially preserve and grow their wealth over the long term. Understanding these strategies and their potential rewards is crucial for making well-informed investment decisions.

This image is property of i0.wp.com.

6. Counterparty Risk and Regulatory Considerations

Understanding Counterparty Risk in Investments

Counterparty risk refers to the potential risk that the other party in a financial transaction may default or fail to fulfill their obligations. When investing in gold, it is important to understand the counterparty risk associated with your specific investment vehicle. For example, if you invest in gold through derivatives or exchange-traded products, there may be counterparty risk involved. Assessing and minimizing counterparty risk is essential for conducting a comprehensive risk vs. reward analysis.

Minimizing Counterparty Risk with Gold

One of the advantages of investing in physical gold is the absence of counterparty risk. Unlike stocks or bonds, gold is a tangible asset that is not dependent on the performance or solvency of any specific institution. By investing in physical gold, you can potentially eliminate counterparty risk and have direct ownership of the asset.

Legal and Regulatory Considerations for Gold Investments

Legal and regulatory factors can impact gold investments. Changes in mining regulations, tax laws, or import/export restrictions can influence the supply and demand dynamics of gold, and consequently, its price. It is important to stay informed about any potential legal or regulatory changes that may impact the gold market in order to conduct a comprehensive risk vs. reward analysis.

Taxation and Reporting Requirements

Investing in gold may have tax implications and reporting requirements. Different jurisdictions may have specific tax laws and regulations surrounding gold investments. Understanding the tax implications relevant to your specific situation is essential for accurately assessing the rewards and potential returns of gold investments. Consulting with a tax professional is recommended to ensure compliance with applicable tax laws.

7. Historical Performance and Long-Term Investment Potential

Analyzing Gold’s Performance over Time

Analyzing the historical performance of gold can provide valuable insights into its long-term investment potential. Gold has demonstrated its ability to preserve wealth and act as a store of value over time. By examining its historical price trends and comparing them to other asset classes, you can better understand the potential rewards and long-term investment potential of gold.

Gold as a Long-Term Investment

Gold can be considered a long-term investment due to its historical track record of preserving wealth and acting as a safe-haven asset. While short-term price fluctuations are to be expected, holding gold as part of a long-term investment strategy can potentially provide capital appreciation and wealth preservation benefits.

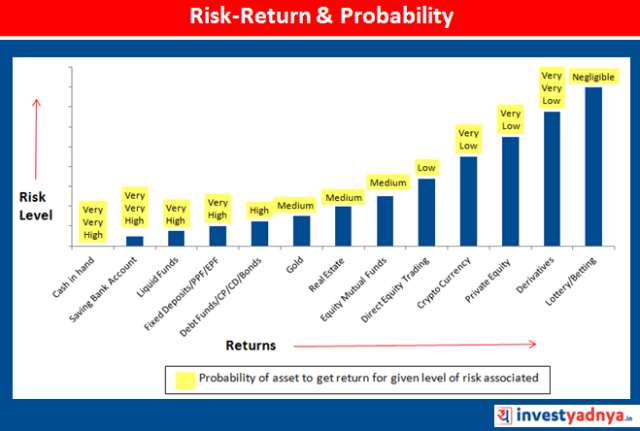

Comparing Gold’s Returns to Other Asset Classes

When evaluating the potential rewards of gold investments, it is important to compare its returns to other asset classes. Stocks, bonds, real estate, and other commodities all have the potential to generate returns over time. By assessing the historical performance and risk-adjusted returns of gold compared to these asset classes, you can make more informed investment decisions and allocate your investment capital effectively.

Investing in Gold for Retirement

Many individuals consider gold as part of their retirement investment strategy. Gold can provide diversification benefits and act as a hedge against inflation, making it an attractive option for long-term wealth preservation. However, it is important to assess the potential risks and rewards of gold investments within the context of your retirement goals and risk tolerance. Consulting with a financial advisor can help you determine the most appropriate allocation for gold in your retirement portfolio.

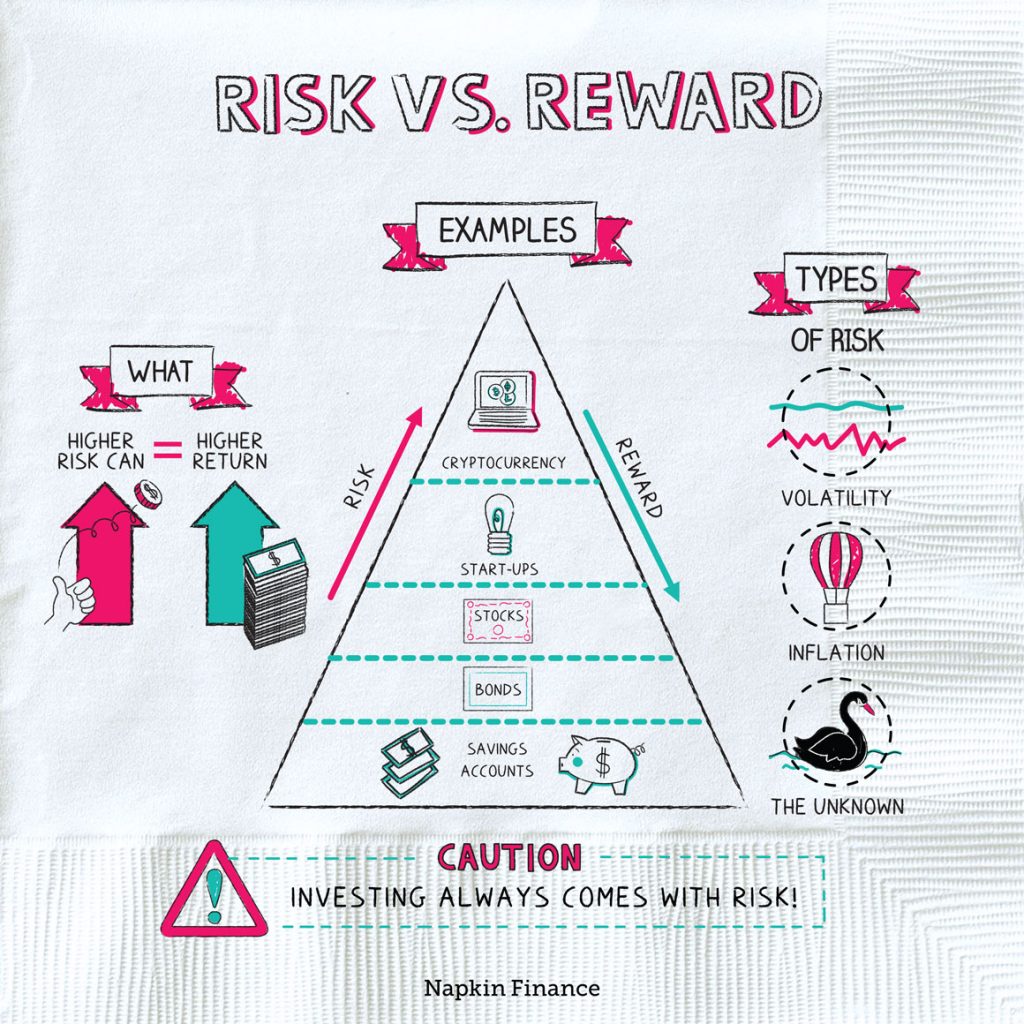

This image is property of napkinfinance.com.

8. Diversification Benefits and Portfolio Hedging

Reducing Portfolio Volatility with Gold

Diversification is a key strategy for reducing portfolio volatility. By incorporating different asset classes with low correlation, such as gold, into your investment portfolio, you can potentially reduce overall volatility and enhance risk-adjusted returns. Gold’s historical performance during times of market uncertainty makes it an attractive option for diversifying your investment portfolio.

Correlation Analysis with Other Asset Classes

Analyzing the correlation between gold and other asset classes is crucial for effective portfolio diversification. Low or negative correlation with stocks, bonds, and other investments ensures that gold can provide diversification benefits and potentially mitigate losses during market downturns. Conducting correlation analysis can help you identify the right investment mix and optimize the risk vs. reward profile of your portfolio.

Strategies for Gold Allocation in a Portfolio

When considering gold investments, it is important to determine the optimal allocation within your investment portfolio. The appropriate percentage of gold allocation will depend on your investment goals, risk tolerance, and the overall composition of your portfolio. A balanced approach that considers diversification and risk management is recommended when incorporating gold into your portfolio.

Using Gold as a Hedge Against Stock Market Crashes

Gold has historically been perceived as a hedge against stock market crashes and economic crises. During times of market turmoil, gold prices have often spiked as investors seek safe-haven assets. Incorporating gold into your investment portfolio can act as a buffer against stock market declines and potentially limit losses during turbulent times.

10. Psychological Factors and Emotional Investing

The Role of Psychology in Investment Decisions

Psychological factors play a significant role in investment decisions, including those related to gold investments. Investor sentiment, fear, and greed can influence market movements and individual investment choices. Understanding the psychological factors at play can help you manage emotions and make rational investment decisions.

Managing Emotional Biases in Gold Investments

Investing in gold can evoke strong emotions, particularly during periods of market volatility or economic uncertainty. Emotional biases, such as fear of missing out or fear of loss, can cloud judgment and lead to irrational investment decisions. Managing emotional biases through disciplined decision-making and adhering to a well-thought-out investment plan is essential for long-term success in gold investments.

Long-Term Perspective vs. Short-Term Market Sentiment

When evaluating the risk vs. reward profile of gold investments, it is important to maintain a long-term perspective. Short-term market sentiment and price fluctuations can be driven by various factors, including investor sentiment and speculator activity, which may not be indicative of the long-term fundamentals. Focusing on the long-term potential of gold investments and avoiding reactionary decision-making based on short-term market sentiment is crucial for achieving investment objectives.

Maintaining a Rational Approach to Gold Investing

Maintaining a rational approach to gold investing involves conducting thorough research, analyzing historical data, and making informed investment decisions based on your risk tolerance and financial goals. It is important to filter out noise and maintain discipline even during times of market volatility. By staying true to your investment strategy and considering the comprehensive risk vs. reward analysis, you can navigate the gold market with confidence.

In conclusion, conducting a risk vs. reward analysis is crucial when making investment decisions in gold. Understanding the potential risks associated with market volatility, geopolitical factors, economic conditions, inflation, counterparty risk, and regulatory considerations allows investors to gauge the rewards and potential returns of gold investments. By evaluating historical performance, diversification benefits, portfolio hedging potential, and the psychological factors that can influence investment decisions, investors can make informed choices that align with their financial goals and risk tolerance. Remember, a comprehensive risk vs. reward analysis is an essential tool for successful gold investments.