If you’re looking to make a solid investment that stands the test of time, consider giving gold a serious thought. Holding onto gold for the long term can provide a variety of advantages that make it a reliable choice for investors. Not only does gold act as a hedge against inflation and currency devaluation, but it also offers a tangible and portable form of wealth that can be easily stored and accessed when needed. In this blog, we’ll dive into the details of why holding onto gold for the long term can be a smart move for those looking to secure their financial future.

This image is property of imageio.forbes.com.

1. The Historical Significance of Gold

Gold has a rich and ancient history that dates back thousands of years, with its origins rooted in various ancient civilizations. As one of the first metals known to mankind, gold held a special significance and was highly valued for its rarity, beauty, and durability.

1.1 The Ancient Origins of Gold

Gold mining can be traced back to at least 4,000 B.C. in ancient Egypt, where it was used for decorative purposes and as a symbol of wealth and power. The Egyptians believed that gold was a divine metal and associated it with the gods. Gold artifacts from ancient Egypt, such as burial masks and tomb decorations, continue to captivate us today with their extraordinary craftsmanship.

Beyond Egypt, gold was also highly regarded in other ancient civilizations, including the Greeks, Romans, and Chinese. The Greeks considered gold to be a sign of power and luxury, while the Romans used it as a status symbol and for making coins. In China, gold was associated with immortality and used to craft exquisite jewelry and ceremonial objects.

1.2 Gold as a Store of Value throughout History

Throughout history, gold has proven to be a reliable store of value, preserving wealth across generations. Its intrinsic qualities of durability and scarcity have made it a desirable form of money for countless civilizations.

Gold’s role as a currency can be seen in the use of gold coins, such as the Spanish doubloon and the British sovereign, which were widely accepted and circulated. Even when currencies backed by gold were abandoned in the 20th century, gold continued to play a crucial role in the global financial system.

2. Factors Influencing Gold Prices

The price of gold is influenced by a variety of factors, ranging from global economic conditions to geopolitical uncertainty. Understanding these factors is essential for investors who want to navigate the gold market effectively.

2.1 Global Economic Conditions

Gold prices tend to rise during periods of economic uncertainty and instability. This is because investors view gold as a safe haven asset that can retain its value even when other investments are underperforming. Economic indicators such as GDP growth, interest rates, and stock market volatility can all have an impact on gold prices.

2.2 Inflation and Currency Fluctuations

Gold has historically been used as a hedge against inflation. When inflation rises, the value of fiat currencies can diminish, and investors often turn to gold as a way to protect their purchasing power. Similarly, currency fluctuations can affect the price of gold, especially when investors seek refuge from a weakening currency.

2.3 Geopolitical Uncertainty

Geopolitical events such as wars, political tensions, and trade disputes can have a significant impact on gold prices. When there is geopolitical uncertainty, investors tend to flock to safe haven assets like gold, driving up its price. This is because gold is seen as a tangible and reliable store of wealth during times of instability.

This image is property of 149664534.v2.pressablecdn.com.

3. Diversification and Risk Management

Gold plays a crucial role in portfolio diversification and risk management strategies for investors. By allocating a portion of your investment portfolio to gold, you can potentially reduce risk and enhance long-term returns.

3.1 Gold’s Role in Portfolio Diversification

Including gold in a diversified investment portfolio can help mitigate risk by providing a hedge against stock market volatility and economic downturns. Gold has historically exhibited a low correlation to other asset classes, such as stocks and bonds, meaning that it tends to move independently of them. This lack of correlation can help smooth out portfolio performance and reduce overall risk.

3.2 Hedging against Inflation and Market Volatility

Gold’s ability to hedge against inflation and market volatility is another important aspect of its role in risk management. During periods of high inflation or stock market turbulence, the value of gold has historically risen. By holding gold as part of your investment portfolio, you can potentially offset the negative impact of inflation or market downturns on your other investments.

3.3 Protecting Wealth during Financial Crises

In times of financial crises or systemic risks, gold has often proven to be a safe haven asset that holds its value. For example, during the global financial crisis of 2008, gold prices surged as investors sought refuge from the turmoil in the financial markets. By allocating a portion of your investments to gold, you can protect your wealth against the uncertainties of the financial system.

4. Long-Term Stability and Preservation of Wealth

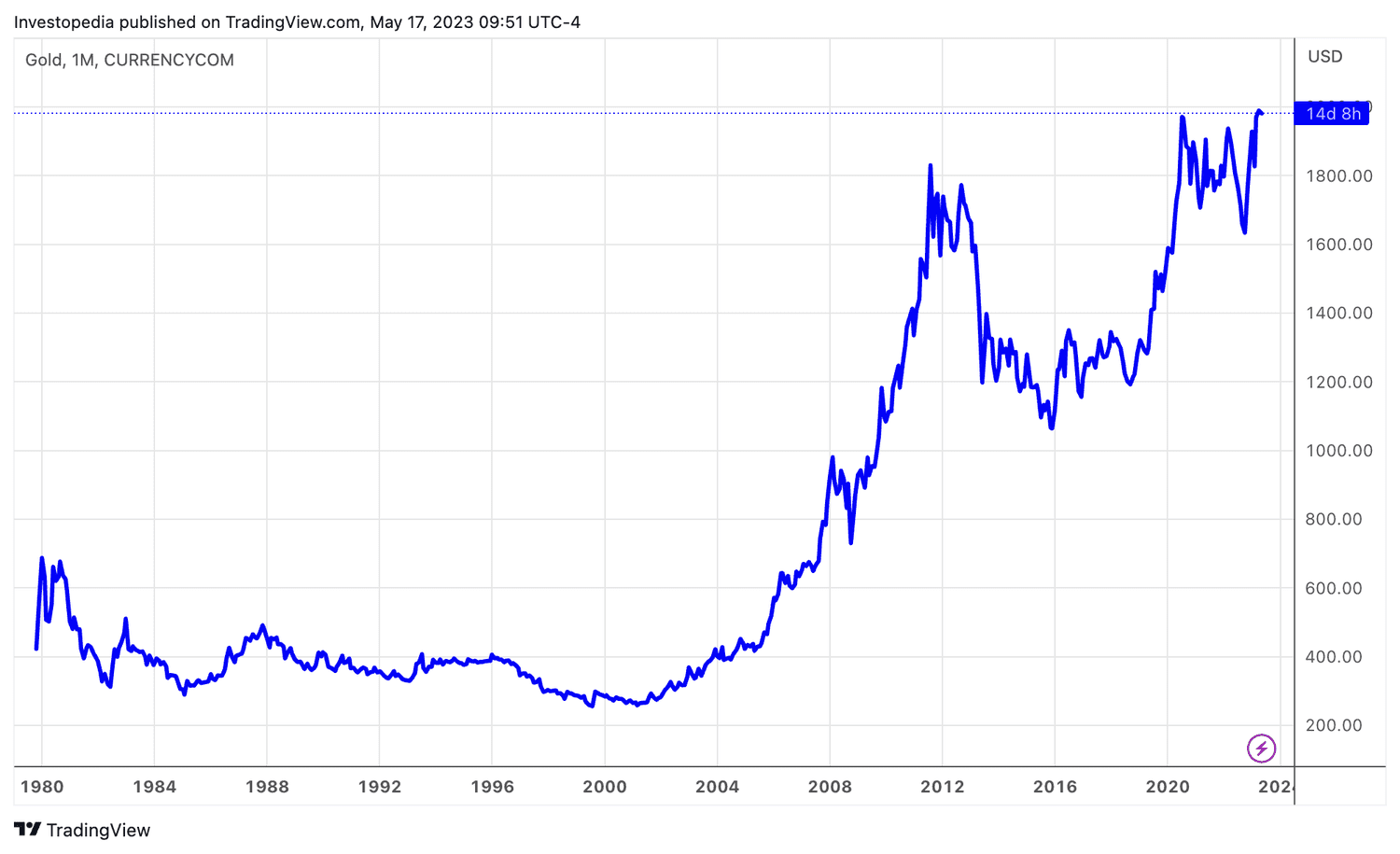

One of the key advantages of holding gold for the long term is its track record of long-term stability and preservation of wealth. Over time, gold has consistently demonstrated its ability to retain its value and provide a reliable store of wealth.

4.1 Gold’s Strong Performance over Time

When looking at historical data, gold has shown an impressive long-term performance. Over the past several decades, gold has delivered consistent returns and outperformed many other asset classes. This long-term stability makes gold an attractive option for investors looking to preserve and grow their wealth over time.

4.2 Preservation of Purchasing Power

As fiat currencies can be subject to devaluation and inflationary pressures, the purchasing power of those currencies can diminish over time. Gold, on the other hand, has maintained its purchasing power throughout history. By holding gold, you can protect your wealth and purchasing power against the erosion caused by inflation and currency devaluation.

This image is property of www.wealthandfinance-news.com.

5. Intrinsic Value and Tangibility

Gold possesses unique qualities that contribute to its intrinsic value and tangibility. These qualities make it a highly sought-after asset in the investment world.

5.1 Limited Supply and High Demand

One of the factors that contribute to gold’s value is its limited supply. Gold is a finite resource, and mining new gold is a costly and time-consuming process. As a result, the scarcity of gold contributes to its desirability and helps maintain its value over time. Additionally, gold’s high demand, both for investment purposes and for use in industries such as jewelry and technology, further supports its value.

5.2 Tangible Asset amid Digitalization

In today’s increasingly digital world, where intangible assets like cryptocurrencies dominate the investment landscape, gold stands out as a tangible and physical asset. Unlike digital assets, gold exists in physical form and can be held in your hand. This tangibility provides a sense of security for investors, knowing that they have a tangible asset that cannot be easily duplicated or hacked.

5.3 Industrial and Medical Applications

Gold also has practical uses beyond its value as an investment asset. Its unique properties make it highly sought after in various industries, including electronics, dentistry, and medicine. The demand for gold in these sectors adds another layer of value and demand to the precious metal, contributing to its long-term price stability.

6. Liquidity and Accessibility

Gold offers investors a high level of liquidity and accessibility, making it a versatile and easily tradable asset.

6.1 Readily Convertible into Cash

Gold is highly liquid and can be readily converted into cash whenever needed. Unlike other investments that may have limitations when it comes to selling, gold can be easily sold or exchanged for cash in various markets around the world. This liquidity provides investors with the flexibility to adapt to changing market conditions and capitalize on investment opportunities.

6.2 Global Accessibility and Market Integration

Another advantage of gold is its global accessibility and market integration. Gold markets exist around the world, allowing investors to buy and sell gold in different currencies and jurisdictions. This global reach ensures that there is always a robust market for gold, regardless of the location of the investor. Moreover, the integration of gold markets enables investors to benefit from price arbitrage opportunities and ensures fair pricing.

This image is property of imageio.forbes.com.

7. Protection against Devaluation of Fiat Currencies

Fiat currencies, backed solely by the trust and confidence of their respective governments, can be subject to devaluation and loss of purchasing power. Gold provides a valuable safeguard against these risks.

7.1 Gold as a Safe Haven Asset

Gold has long been considered a safe haven asset in times of economic uncertainty and currency instability. When investors lose confidence in fiat currencies, they often turn to gold as a reliable store of value. Gold’s ability to retain its purchasing power even in the face of currency devaluation makes it an attractive option for investors looking to protect their wealth.

7.2 Countering Currency Debasement

Gold serves as a hedge against the debasement of fiat currencies through inflationary monetary policies. Central banks have the ability to print more money and increase the money supply, which can lead to inflation and a decrease in the value of the currency. By holding gold, investors can protect themselves from the loss of value caused by currency debasement.

8. Tax Benefits and Advantages of Gold Investment

Investing in gold can offer various tax benefits and advantages, making it an appealing asset class for tax-conscious investors.

8.1 Tax Efficiency of Gold Investments

One of the key advantages of gold investments is their tax efficiency. Unlike certain other investments, such as stocks or real estate, gold investments may be subject to more favorable tax treatment. In many jurisdictions, gains from the sale of gold held for investment purposes may be taxed at a lower capital gains rate or be eligible for other tax benefits.

8.2 Tax-Deferred Accounts and Gold IRA

Investors looking to maximize the tax advantages of gold investment can consider holding gold within tax-deferred accounts, such as Individual Retirement Accounts (IRAs). Gold IRAs allow for the purchase of physical gold or gold-backed financial products within a tax-sheltered account, providing long-term benefits and potential tax savings.

This image is property of i.insider.com.

9. Avoidance of Default and Counterparty Risks

Gold offers protection against default and counterparty risks, which are inherent in many other types of investments.

9.1 Eliminating Third-Party Risks

One of the unique features of gold is that it is not dependent on any third party for its value. Unlike stocks or bonds, which rely on the performance and stability of the issuing company or government, gold holds its value independently. This independence from third-party risks provides investors with peace of mind and reduces the potential for losses due to default or bankruptcy.

9.2 Gold’s Independence from Financial Institutions

Gold’s independence from the banking system and financial institutions adds an extra layer of protection for investors. In times of financial crises or systemic risks, such as bank failures, gold remains unaffected and holds its value. This independence from the banking system makes gold a valuable asset for diversification and risk management.

10. Inflation Hedge and Wealth Preservation

Gold’s role as an inflation hedge and as a means of preserving wealth for future generations makes it a compelling long-term investment option.

10.1 Protection against Diminishing Purchasing Power

One of the primary advantages of holding gold is its ability to protect against the diminishing purchasing power of fiat currencies. Inflation erodes the value of paper money over time, but gold has historically retained its purchasing power. By holding gold, investors can protect their wealth and maintain their standard of living in the face of inflationary pressures.

10.2 Wealth Preservation for Future Generations

Gold’s ability to preserve wealth makes it an attractive investment option for those looking to pass on their assets to future generations. Gold is durable and retains its value over long periods, making it an ideal asset for intergenerational wealth transfer. By including gold in their portfolios, investors can ensure the preservation of their wealth for their children and grandchildren.

In conclusion, gold’s historical significance, diverse factors influencing its prices, and its unique advantages as an investment asset make it an appealing option for long-term investors. The inherent stability, diversification benefits, and protection against inflation and financial risks make gold a valuable addition to any well-rounded investment portfolio. Whether you are looking to preserve wealth, hedge against inflation, or safeguard against market volatility, gold can offer a reliable and tangible solution for your long-term investment goals.