So you’re thinking about your retirement and looking for ways to build up a nest egg that will support you in the golden years? Well, look no further because long-term gold investing might just be the answer you’re looking for. As an experienced investor in gold, I can tell you that gold has stood the test of time as a stable and reliable asset. In this blog, we’ll explore the reasons why gold can be a valuable addition to your retirement portfolio, how to invest in gold for the long term, and the potential benefits it can bring. So sit tight and get ready to unlock the secrets of building a golden nest egg for your retirement.

This image is property of pixabay.com.

Understanding Gold as an Investment

Gold has always held a special place in human history, revered for its beauty and rarity. But beyond its ornamental value, gold has also gained recognition as a viable investment option. As an investor, it is essential to understand the unique attributes of gold and how it has performed historically. Additionally, factors influencing gold prices and the importance of diversification in a well-rounded investment portfolio should also be considered.

Attributes of gold as an investment

Gold possesses several key attributes that make it an attractive investment option. Firstly, gold has intrinsic value, which means that it holds worth regardless of economic conditions. This enduring intrinsic value safeguards against the risk of depreciation that other investments may face. Secondly, gold is a highly liquid asset, meaning that it can easily be bought or sold, making it an accessible investment option. Furthermore, gold serves as a hedge against inflation and retains its value over time, providing a sense of security to investors.

Historical performance of gold

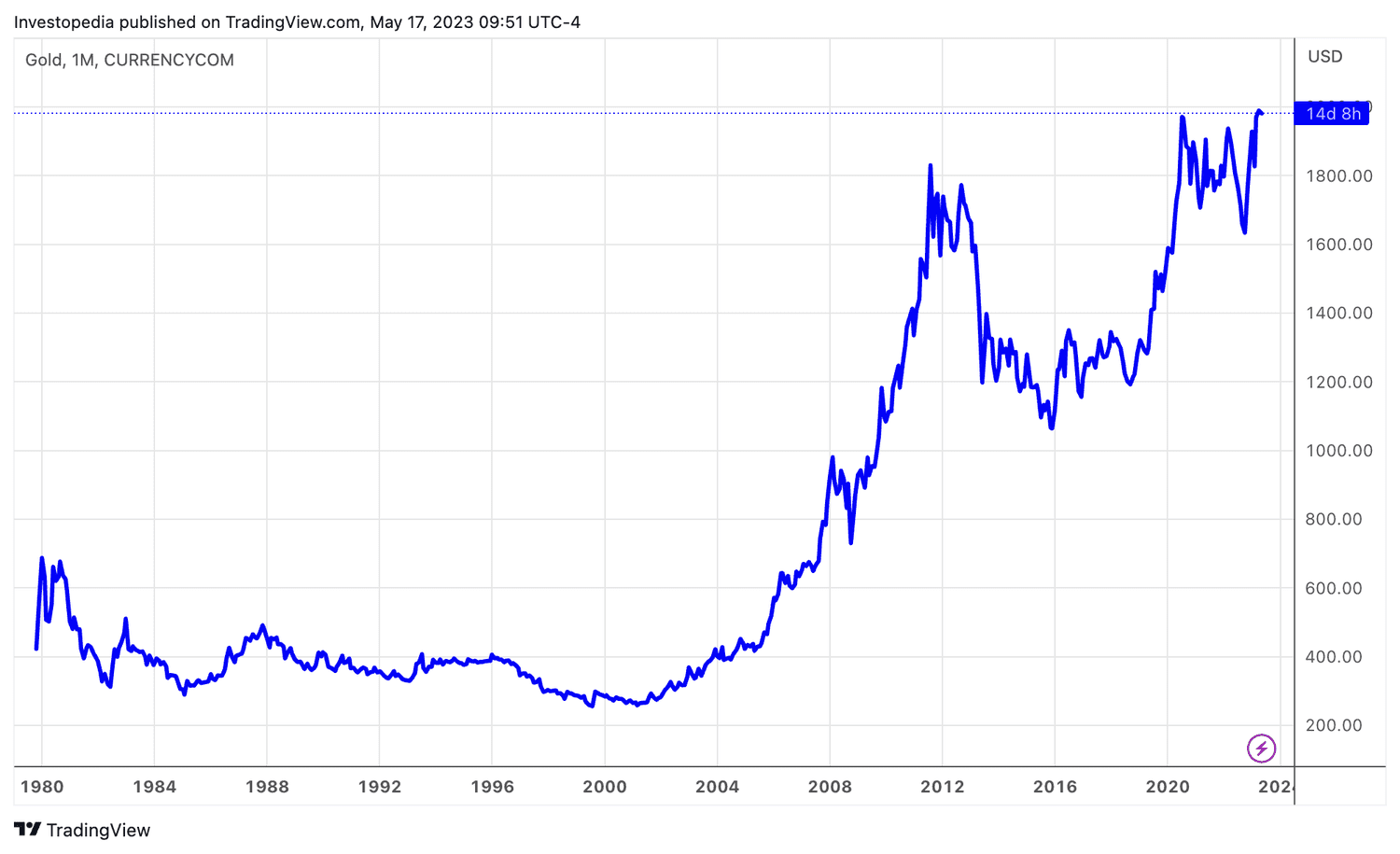

When examining gold as an investment, it is important to consider its historical performance. Throughout history, gold has consistently demonstrated its ability to maintain value and even appreciate over time. In times of economic uncertainty or market volatility, gold has often served as a safe haven for investors seeking stability and preservation of wealth. This long-term track record of gold’s performance makes it an appealing investment option for those looking to build a golden nest egg for their retirement.

Factors influencing gold prices

Gold prices are influenced by a multitude of factors, and understanding these dynamics is crucial for any investor. Some key factors include global economic conditions, geopolitical tensions, interest rates, and inflation. For example, during times of economic downturn or political instability, investors tend to flock to gold as a safe haven, driving up its price. Similarly, when interest rates are low, the opportunity cost of holding non-interest-bearing assets like gold decreases, making it more attractive.

Importance of diversification

Diversification is a fundamental principle of investment that involves spreading one’s investments across various asset classes to mitigate risk. Including gold in a well-diversified portfolio can provide several benefits. Gold’s inverse correlation to traditional securities like stocks and bonds makes it an effective diversification tool, as it tends to perform well when other assets decline. By incorporating gold into your investment strategy, you can potentially reduce overall portfolio volatility and improve long-term returns.

Benefits of Long-Term Gold Investing

Preservation of wealth

One of the primary benefits of long-term gold investing is the preservation of wealth. Unlike paper currencies and other assets that may devalue over time, gold tends to retain its value and act as a store of wealth. By holding onto gold investments for the long term, investors can safeguard their purchasing power and protect their hard-earned capital from erosion.

Protection against inflation

Inflation is the gradual increase in prices over time, leading to a decrease in the purchasing power of money. Gold has historically been an effective hedge against inflation due to its intrinsic value and limited supply. As inflation rises, the value of gold typically increases, allowing investors to maintain their wealth and keep pace with rising prices.

Hedge against economic and geopolitical risks

Gold serves as a reliable hedge against economic and geopolitical risks. During times of economic uncertainty, such as recessions or financial crises, gold often outperforms other asset classes. Additionally, geopolitical tensions can have a substantial impact on financial markets, causing volatility and instability. By including gold in your investment portfolio, you can protect yourself against these risks and ensure a more balanced approach to investing.

Potential for capital appreciation

In addition to its wealth-preserving qualities, gold also has the potential for capital appreciation. Over the long term, gold prices have shown a tendency to increase, driven by factors such as supply and demand dynamics and investor sentiment. By holding onto your gold investments for an extended period, you may benefit from its price appreciation and grow your wealth over time.

Setting Financial Goals for Retirement

Defining retirement goals

When it comes to planning for retirement, setting clear financial goals is essential. Start by envisioning the lifestyle you desire during retirement and estimate the level of income you’ll need to support that lifestyle. Consider factors such as living expenses, healthcare costs, travel plans, and any other aspirations you may have for your retirement years.

Determining required nest egg size

Once you have clarity on your retirement goals, it is crucial to determine the required size of your nest egg. In other words, how much money will you need to accumulate in order to comfortably meet your retirement goals? This calculation will typically involve analyzing your expected annual expenses during retirement, factoring in inflation, and considering any additional income sources such as Social Security or pensions.

Considering risk tolerance and time horizon

When setting financial goals for retirement, it is important to assess your risk tolerance and time horizon. Your risk tolerance is a measure of your comfort level with market fluctuations and potential investment losses. Additionally, your time horizon refers to the number of years until you plan to retire. Understanding these factors will help you determine the appropriate investment strategy and asset allocation for your retirement portfolio.

Incorporating gold into retirement planning

As you plan for retirement, it is important to consider incorporating gold into your investment strategy. Given gold’s ability to preserve wealth and act as a hedge against economic uncertainties, allocating a portion of your portfolio to gold can provide added stability and protection. Consult with a financial advisor to determine the optimal allocation of gold within your retirement plan, taking into account your individual goals, risk tolerance, and time horizon.

This image is property of pixabay.com.

Different Ways to Invest in Gold

Physical gold: Bars and coins

One of the most traditional and tangible ways to invest in gold is through the purchase of physical gold bars and coins. These physical assets offer investors the opportunity to own and hold onto gold in its physical form. When investing in physical gold, it is crucial to ensure the authenticity and purity of the gold, as well as consider storage options and costs.

Gold-backed ETFs and mutual funds

For investors seeking a more accessible and liquid form of gold investment, gold-backed exchange-traded funds (ETFs) and mutual funds can be an attractive option. These investment vehicles allow individuals to gain exposure to gold without the need for physical ownership. Gold-backed ETFs and mutual funds typically hold physical gold or derivatives representing gold, providing investors with an indirect means of investing in the precious metal.

Gold mining stocks

Another way to invest in gold is through the purchase of gold mining stocks. Investing in gold mining companies gives investors exposure to the potential profits and growth of these companies. When considering gold mining stocks, it is important to conduct thorough research on the companies and assess factors such as financial performance, production potential, and management expertise.

Gold futures and options

For more experienced investors and those comfortable with derivatives, gold futures and options provide an alternative way to invest in gold. These financial instruments allow investors to speculate on the future price of gold without owning the physical asset. However, it is essential to have a deep understanding of the complexities involved in trading futures and options, as they involve leveraging and significant risk.

Choosing the Right Gold Investment Strategy

Considering personal preferences and goals

When choosing a gold investment strategy, it is imperative to consider your personal preferences and goals. Reflect on factors such as your risk tolerance, investment timeline, and desired level of involvement. Some investors may prefer the tangibility and security of physical gold, while others may opt for the convenience and liquidity of gold-backed ETFs or mutual funds. Understanding your unique circumstances will help guide your decision-making process.

Examining liquidity and storage considerations

The liquidity and storage considerations associated with different gold investment options also play a vital role in decision-making. Physical gold, while offering tangible ownership, may require secure storage arrangements and potentially incur additional costs. Conversely, gold-backed ETFs and mutual funds provide easy liquidity, allowing investors to buy or sell shares as needed. Evaluate your investment objectives and liquidity needs to determine the most suitable gold investment vehicle.

Reviewing associated costs and fees

Investing in gold entails various costs and fees that can impact your overall investment returns. For physical gold, consider expenses associated with purchasing, storing, and potentially insuring the gold. Gold-backed ETFs and mutual funds typically charge management fees and expense ratios, which directly affect your investment’s performance. Carefully review the associated costs and fees of different investment options to ensure they align with your financial goals.

Seeking professional advice

Given the complexity of the gold market and the multitude of investment options available, seeking professional advice from a financial advisor is highly recommended. An experienced advisor can help evaluate your individual circumstances, assess your risk appetite, and guide you in choosing the right gold investment strategy. Their expertise and insights can contribute to a more informed decision and enhance the potential success of your gold investments.

Investing in Physical Gold

Types of gold bullion available

When investing in physical gold, investors can choose from various types of gold bullion. Common options include gold bars and coins. Gold bars can range in size from small, more affordable increments to larger, high-value bars. Gold coins, on the other hand, are typically issued by governments or reputable mints and often hold numismatic value in addition to their intrinsic gold value.

Ensuring authenticity and purity

One of the most critical considerations when investing in physical gold is ensuring the authenticity and purity of the gold. Counterfeit gold is a real concern in the market, and investors must take necessary measures to verify the legitimacy of their gold purchases. Working with reputable dealers or purchasing from trusted sources is crucial to minimize the risk of acquiring counterfeit or impure gold.

Storage options and considerations

Storing physical gold securely is an important aspect of investing in physical gold. Investors have several storage options to choose from, including home storage in safes or secure vaults. Alternatively, utilizing professional third-party storage services, such as managed vaults or safety deposit boxes, offers an added layer of security. When considering storage options, factor in accessibility, insurance, and associated costs.

Selling physical gold

When you decide to sell your physical gold, several avenues are available to facilitate the process. Trusted dealers, online platforms, and auction houses are common options for selling physical gold. It is important to research and compare prices from different buyers to ensure you receive a fair value for your gold. Retaining documentation of your gold’s authenticity and provenance can also be beneficial when selling.

Investing in Gold ETFs and Mutual Funds

Understanding how ETFs and mutual funds work

Gold-backed exchange-traded funds (ETFs) and mutual funds provide investors with exposure to gold through indirect ownership. ETFs and mutual funds pool money from multiple investors to invest in gold-related assets, such as physical gold or derivatives. The shares of these funds are then traded on exchanges, allowing investors to buy or sell them easily.

Evaluating expense ratios and fees

When considering gold ETFs and mutual funds, it is crucial to evaluate the expense ratios and fees associated with these investment vehicles. Expense ratios represent the ongoing management fees and operating expenses, while other fees may include sales loads or brokerage commissions. These costs can vary among different funds and directly impact your investment returns, so it is essential to compare and choose funds with competitive fees.

Examining diversification within the fund

Another key factor to consider when investing in gold ETFs and mutual funds is the diversification within the fund. Different funds may hold varying proportions of physical gold, gold futures contracts, or gold mining stocks. Assessing the fund’s holdings and understanding the degree of diversification will give you a better understanding of the risks and potential returns associated with your investment.

Selling ETFs and mutual funds

Selling gold ETFs and mutual funds is relatively straightforward, as they are traded on exchanges. You can sell your shares at any time during market hours by placing an order through your brokerage account. The proceeds from the sale will be deposited into your brokerage account, providing you with liquidity and the ability to reinvest or utilize the funds as needed.

Investing in Gold Mining Stocks

Researching gold mining companies

Investing in gold mining stocks requires thorough research and analysis of different companies in the industry. Begin by identifying mining companies that align with your investment goals and risk tolerance. Evaluate their financial statements, production potential, growth prospects, and exploration projects. Researching the management team’s expertise and track record is also crucial in assessing a company’s long-term viability.

Analyzing financial performance and production potential

When analyzing gold mining stocks, assessing their financial performance and production potential is vital. Evaluate key indicators such as revenue, profitability, and cash flow to gauge a company’s financial health. Additionally, analyze production figures, reserves, and resource estimates to understand the potential for future growth. Understanding the financial and production aspects of gold mining companies will help you make informed investment decisions.

Evaluating management expertise

The management team of a gold mining company plays a crucial role in its success. Evaluate the experience, track record, and expertise of the management team when considering investments in gold mining stocks. Strong leadership and effective management practices are often indicative of a well-run company and can contribute to potential long-term returns on your investment.

Selling gold mining stocks

Similar to selling other stocks, selling gold mining stocks involves placing sell orders through your brokerage account. Monitor the performance of your gold mining stocks and assess when it may be the right time to sell. Consider factors such as changes in the industry, company-specific developments, and overall market conditions to make informed decisions regarding the sale of your gold mining stocks.

Understanding Gold Futures and Options

Basics of futures and options contracts

Gold futures and options contracts are financial derivatives that allow investors to speculate on the future price of gold without owning the physical asset. A futures contract obligates the buyer to purchase or the seller to sell a specified amount of gold at a predetermined price and date in the future. Options contracts, on the other hand, give the holder the right, but not the obligation, to buy or sell gold at a specified price within a predetermined timeframe.

Calculating leverage and margin requirements

One of the unique aspects of trading gold futures and options is the ability to amplify your exposure to the asset through leverage. Leverage allows investors to control a larger position in gold using a smaller amount of capital. However, it is essential to understand the margin requirements associated with futures and options trading, as they determine the initial funds needed and potential risk exposure.

Risk management with gold derivatives

Trading gold futures and options involves inherent risks due to their leverage and speculative nature. To effectively manage these risks, it is crucial to establish a risk management strategy. This may involve setting stop-loss orders to limit potential losses, diversifying your investment portfolio, and implementing proper position sizing techniques. Always conduct thorough research, seek professional advice if needed, and carefully evaluate risk-reward dynamics before engaging in gold derivatives trading.

Exiting futures and options positions

Exiting gold futures and options positions can be done by either letting the contracts expire or actively closing them before their expiration date. If you hold a long position, meaning you expect the price of gold to rise, you would sell the futures contract or exercise the options contract to realize a profit. Alternatively, if you hold a short position, anticipating a decline in gold prices, you would buy back the futures contract or let the options contract expire to close your position.

The Importance of Monitoring Your Gold Investments

Tracking gold prices and market trends

Continuous monitoring of gold prices and market trends is essential when investing in gold. Stay informed about the factors that influence gold prices, such as economic indicators, geopolitical developments, and central bank policies. Utilize reliable sources, including financial news outlets, industry reports, and market analysis, to track gold prices and identify potential opportunities or risks in the market.

Rebalancing your portfolio

Regularly reassess and rebalance your investment portfolio, including your gold investments. Over time, the performance of different assets may deviate from your original target allocation, leading to an imbalance in your portfolio. Rebalancing involves adjusting your holdings to maintain your desired asset allocation. By rebalancing, you ensure that your investment strategy remains aligned with your long-term goals and risk tolerance.

Reassessing your investment strategy periodically

Periodically reassessing your investment strategy is crucial for long-term success. As market conditions and personal circumstances change, it is important to review your investment goals, risk appetite, and time horizon. Consider consulting with a financial advisor to conduct a comprehensive review of your investment strategy and make any necessary adjustments to optimize your portfolio.

Staying informed about the gold market

Lastly, staying informed about the gold market is essential to make well-informed investment decisions. Keep up with industry news, market trends, and economic developments that can impact the price of gold. Engage with reputable sources, attend conferences or webinars, and actively participate in investment communities or forums to expand your knowledge and gain valuable insights into the gold market.

In conclusion, understanding gold as an investment, its historical performance, and the factors that influence its price is essential for every investor. Long-term gold investing for retirement offers benefits such as wealth preservation, protection against inflation, and a hedge against economic and geopolitical risks. Different ways to invest in gold include physical gold, gold-backed ETFs and mutual funds, gold mining stocks, and gold futures and options. The right gold investment strategy depends on individual preferences, goals, liquidity and storage considerations, and associated costs. Monitoring gold investments, tracking market trends, and periodically reassessing one’s investment strategy are crucial for long-term success in gold investing.