Over the past century, gold has maintained its allure as a reliable investment, with its value often influenced by economic cycles. This article delves into the fascinating world of gold investment, sharing insights obtained from 100 years of price data and observations on economic cycles. Whether you’re a seasoned investor or new to the game, understanding the historical patterns and trends of gold can provide valuable knowledge for making informed investment decisions. From the highs and lows of gold prices to the impact of economic events, this article offers a comprehensive look at the fascinating relationship between gold and the global economy. So grab a cup of coffee, settle in, and let’s explore the century of gold together.

This image is property of www.investopedia.com.

Introduction

Hey there, fellow investor! Today, we’re going to take a deep dive into the golden world of gold. As an experienced investor, I’ve been closely following the movements and trends of this precious metal for many years. So, buckle up and get ready for an informative and comprehensive guide to gold as an investment.

Historical Overview of Gold

Gold’s role in human history

Gold has a rich history that spans thousands of years. Dating back to ancient civilizations, gold has captivated people with its beauty and rarity. Throughout history, gold has been used for various purposes, including currency, decorative arts, and jewelry. It has held a special place in human society, symbolizing wealth, power, and prestige.

Influence of gold on economies

The influence of gold on economies cannot be understated. The gold standard, where a country’s currency is directly convertible into gold, played a significant role in shaping global financial systems for much of the 19th and 20th centuries. The stability offered by gold-backed currencies provided a foundation for economic growth and international trade.

Gold’s significance as a store of value

One of the key reasons gold has retained its allure throughout history is its ability to store value. Unlike paper currency, which can be subject to inflation and depreciation, gold has proven to be a reliable store of wealth. In times of economic uncertainty, investors often turn to gold as a safe haven, hoping to preserve their purchasing power.

This image is property of www.investopedia.com.

Long-Term Trends in Gold Prices

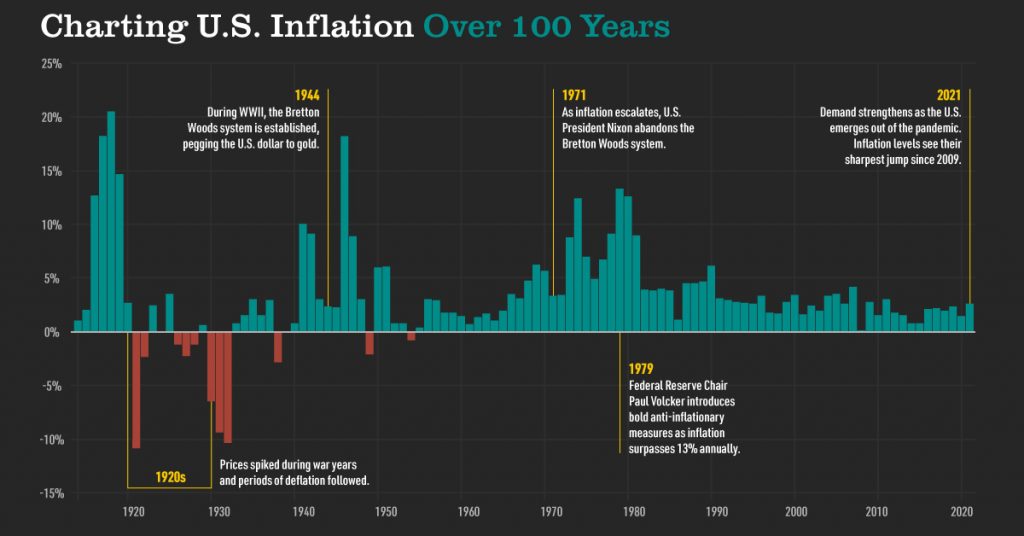

Examining gold prices over the past century

To truly understand gold as an investment, we need to analyze its long-term price trends. Looking back at the past century, we can see that gold prices have shown periods of both stability and volatility. From the early 1900s to the 1970s, gold prices remained relatively stable due to the gold standard. However, after the United States abandoned the gold standard in 1971, gold experienced significant price fluctuations.

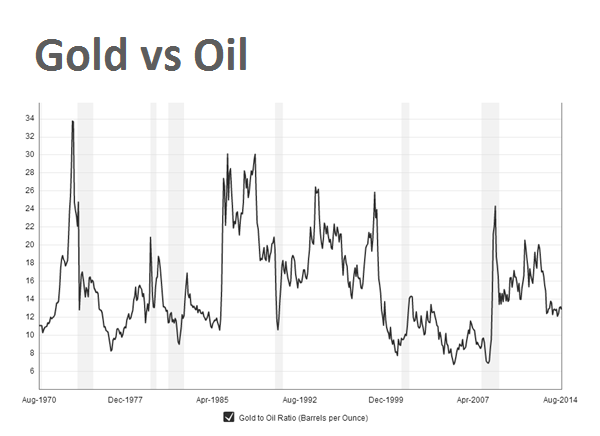

Factors impacting long-term trends in gold prices

Several factors influence the long-term trends in gold prices. Inflation, interest rates, geopolitical tensions, and global economic conditions all play a role in shaping the value of gold. For example, during times of high inflation and economic uncertainty, gold tends to perform well as investors seek a safe haven. On the other hand, when interest rates rise, gold may become less attractive compared to other investment options.

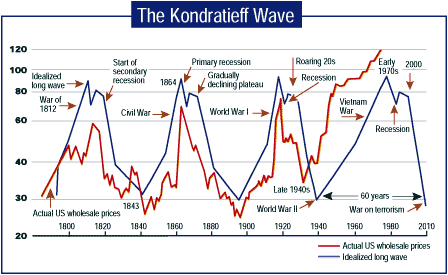

Comparing gold price movements to economic cycles

Gold price movements often reflect the ups and downs of economic cycles. During periods of economic expansion, when stock markets are booming, gold prices may exhibit slower growth or even decline. However, during economic downturns or recessions, gold tends to shine as investors flock to its stability. It is important to consider economic cycles when evaluating the potential of gold as an investment.

Short-Term Fluctuations in Gold Prices

Understanding short-term volatility in gold prices

In addition to long-term trends, short-term volatility is another aspect of gold investment to consider. Day-to-day or even month-to-month fluctuations in gold prices can be influenced by a range of factors, including market speculation, investor sentiment, and even technical trading patterns. It’s important to recognize that short-term fluctuations in gold prices are often driven by short-term market dynamics and may not necessarily reflect the long-term value of the metal.

Influence of geopolitical events on gold prices

Geopolitical events can have a strong impact on the price of gold. Political tensions, conflicts, and uncertainty in global markets tend to drive investors towards safe haven assets like gold. When there is political upheaval or the threat of war, gold prices may soar as investors seek to safeguard their investments. It is crucial to stay informed about geopolitical events to understand their potential influence on gold prices.

Role of supply and demand in gold price fluctuations

Like any other commodity, supply and demand dynamics play a significant role in gold price fluctuations. Changes in gold production levels, mining output, and global demand for jewelry and industrial uses can impact the value of gold. Additionally, fluctuations in central bank policies, particularly regarding their buying or selling of gold reserves, can also influence supply and demand dynamics and subsequently affect gold prices.

This image is property of advisor.visualcapitalist.com.

Gold as a Safe Haven Asset

Why investors flock to gold during times of uncertainty

Gold has long been regarded as a safe haven asset, attracting investors during periods of economic and geopolitical uncertainty. During times of crisis, such as financial market crashes or political instability, gold often proves to be a reliable hedge against market volatility. Its intrinsic value and historical track record make it an appealing choice for those seeking stability and a store of value.

Gold’s performance during economic downturns

When economic downturns hit, gold has historically performed well. During recessions or financial crises, gold prices tend to rise as investors seek shelter from the storm. The metal’s ability to retain value and act as a hedge against inflation makes it an attractive investment option when economies are struggling. Its performance during economic downturns has solidified its reputation as a safe haven asset.

Comparing gold to other safe haven assets

While gold holds a prominent position as a safe haven asset, it’s worth considering how it compares to other similar options. Assets like government bonds, the Swiss franc, and even cryptocurrencies like Bitcoin have also proven to be safe havens during times of crisis. Each asset class has its own strengths and weaknesses, and investors should carefully evaluate their investment goals and risk tolerance when choosing between them.

Gold as a Diversification Tool

The benefits of including gold in an investment portfolio

Diversification is a key principle of investment portfolio management, and gold can play a valuable role in achieving that diversification. Gold’s low correlation with other asset classes, such as stocks and bonds, makes it an effective hedge against volatility in traditional markets. Including gold in a portfolio can help reduce overall risk and increase the potential for long-term returns.

Correlation between gold and other asset classes

Understanding the correlation between gold and other asset classes is crucial when considering its role in diversification. Historically, gold has exhibited a low or negative correlation with stocks and bonds. This means that when stocks or bonds are experiencing declines, gold prices may rise, providing a counterbalance to potential losses in other areas of the portfolio.

Gold’s role in reducing portfolio risk

Gold’s ability to reduce portfolio risk stems from its low correlation with other asset classes. By including an asset with a different risk profile, investors can potentially offset losses in one area with gains in another. This diversification can help smooth out overall portfolio performance and reduce the potential impact of market turbulence. It’s worth noting, however, that diversification does not guarantee profits or protect against losses.

This image is property of static.seekingalpha.com.

The Role of Central Banks and Gold

Central banks’ gold reserves and their impact on prices

Central banks around the world hold significant gold reserves, and their actions regarding these reserves can influence gold prices. When central banks increase their purchases of gold, it can create upward pressure on prices. Conversely, if central banks decide to sell off their gold reserves, it can put downward pressure on prices. Monitoring central bank actions can provide valuable insights into the direction of gold prices.

The significance of central banks as buyers/sellers of gold

Central banks have been both buyers and sellers of gold throughout history, and their decisions can have profound implications for the market. During times of economic uncertainty, central banks may increase their gold purchases as a means of diversifying their reserves and protecting against currency fluctuations. Conversely, if central banks face economic pressures or need to support their currencies, they may opt to sell gold reserves.

The relationship between central bank policies and gold prices

Central bank policies, including interest rate decisions and monetary stimulus measures, can indirectly impact gold prices. When central banks adopt accommodative policies like lowering interest rates or implementing quantitative easing, it can lead to inflationary pressures and weaken the value of paper currencies. In such cases, gold often serves as a hedge against the potential erosion of purchasing power, driving up demand and prices.

Investing in Gold: Strategies and Considerations

Different ways to invest in gold (physical, ETFs, mining stocks)

Investors have various options when it comes to investing in gold. Some may choose to buy physical gold in the form of bars or coins, while others prefer the convenience of exchange-traded funds (ETFs) that track gold prices. Furthermore, investing in gold mining stocks provides exposure to the industry as a whole, with the potential for higher returns but also increased volatility.

The pros and cons of each investment option

Each investment option has its own set of pros and cons. Physical gold provides a tangible asset that can be owned and held directly, but it also requires storage and may involve additional costs. ETFs offer easy access to gold without the need for physical ownership, but they carry some counterparty risk. Investing in gold mining stocks can offer leverage to rising gold prices, but it is inherently riskier and subject to factors beyond the price of gold.

Factors to consider when investing in gold

Before diving into gold investment, it’s important to consider several factors. First and foremost, understanding your investment goals and risk tolerance is crucial. Additionally, analyzing the current economic and geopolitical landscape, as well as market trends and gold price forecasts, can provide valuable insights. Consideration of costs, liquidity, and tax implications is also necessary when choosing the most suitable investment option.

This image is property of mining.com.

Gold Mining and Production

Overview of the gold mining industry

Gold mining plays a crucial role in the global economy. It involves the exploration, extraction, and processing of gold ore to produce the precious metal. Gold mines are scattered across the world, with some countries, including China, Russia, and Australia, being key producers. The industry encompasses both large-scale mining operations and small-scale artisanal mining, each with its own set of economic and environmental implications.

Factors impacting gold production and supply

Several factors impact gold production and supply. Exploration and new discoveries of gold deposits determine the future supply of the metal. Technological advancements in mining techniques also play a role in increasing efficiency and productivity. Additionally, environmental regulations, labor conditions, and geopolitical factors can affect the stability and accessibility of gold mines.

Economic and environmental implications of gold mining

Gold mining has both economic and environmental implications. On the economic side, it contributes to job creation and revenue generation for countries and local communities. It also drives infrastructure development in mining regions. However, gold mining can also result in negative environmental impacts, including deforestation, ecosystem disruption, and water pollution. Responsible mining practices and environmental regulations are crucial for mitigating these risks.

Conclusion

There you have it, folks! A comprehensive journey through the world of gold as an investment. We’ve explored its historical significance, analyzed its long-term trends and short-term fluctuations, discussed its role as a safe haven asset and diversification tool, delved into the influence of central banks, and considered various strategies for investing in gold. Keep in mind that investing in gold, like any investment, requires careful consideration and knowledge of the risks involved. So, whether you’re a seasoned investor or just starting out on your investment journey, make sure to arm yourself with the right information and stay informed to make wise decisions in the exciting world of investing in gold. Happy investing!