Have you ever felt overwhelmed when it comes to setting your financial goals? It can be a daunting task, but aligning your vision with your personal financial goals is crucial for long-term success. Whether you’re looking to save for retirement, buy a new home, or start your own business, defining your goals is the first step towards turning them into a reality. In this article, we will explore some strategies to help you clarify and prioritize your financial goals, so you can create a roadmap to financial freedom. So, grab a cup of coffee and get ready to dive into the world of personal finance!

This image is property of vwaplanning.com.

Understanding the Importance of Personal Financial Goals

Setting personal financial goals is a crucial step towards achieving financial success and security. Without clear goals, it becomes difficult to make informed decisions about your money and to create a plan to reach your desired financial state. By establishing personal financial goals, you can have a roadmap that guides your financial choices and helps you prioritize your spending and saving. These goals can provide motivation, focus, and a sense of direction in your financial journey. Whether you are looking to buy a house, save for retirement, or pay off debt, it is essential to understand the importance of setting and working towards personal financial goals.

Assessing Your Current Financial Situation

Before you can start setting personal financial goals, it is important to assess your current financial situation. This involves taking a close look at your income, expenses, assets, and debts. Understanding these factors will give you a clear picture of where you currently stand financially and will help you make more informed decisions about your goals. Some questions to consider during this assessment include:

- How much do you earn each month?

- What are your monthly expenses and how much do they amount to?

- Do you have any outstanding debts? If so, what are they and how much do you owe?

- What are your assets, such as savings accounts, investments, or property?

By answering these questions, you can identify any financial challenges or areas of improvement and gain a better understanding of your financial goals.

This image is property of miro.medium.com.

Determining Your Short-Term Financial Goals

Short-term financial goals typically cover a period of one year or less. These goals focus on immediate needs or wants that require financial planning and saving. Examples of short-term financial goals may include building an emergency fund, saving for a vacation, or paying off a credit card balance. When determining your short-term financial goals, it is essential to consider the following factors:

Priority:

Evaluate the urgency and importance of each goal to determine which should be prioritized over others. Consider any upcoming expenses or financial obligations that require immediate attention.

Affordability:

Assess your current financial situation to determine how much you can realistically allocate towards your short-term goals. It is crucial to strike a balance between saving for your goals and maintaining your daily financial needs.

Timeframe:

Set a specific timeline for achieving each short-term goal. Having a predetermined timeframe will help you stay motivated and focused on reaching your goals within a specified period.

Determining and prioritizing your short-term financial goals will allow you to allocate resources and make informed financial decisions that align with your aspirations.

Setting Long-Term Financial Goals

Long-term financial goals typically involve planning for the future and require more extended timeframes to achieve. These goals may include saving for retirement, purchasing a home, or funding your children’s education. Setting long-term financial goals requires careful consideration due to their significance and the time it takes to achieve them. Here are some factors to consider when setting long-term financial goals:

Clarity and Specificity:

Define your long-term goals in clear and specific terms. For example, if your goal is to save for retirement, determine the exact amount you want to have saved and the age at which you want to retire.

Realistic and Attainable:

Ensure that your long-term financial goals are realistic and attainable based on your current financial situation, income potential, and lifestyle. Make sure they are challenging enough to provide motivation but not so overwhelming that they become unachievable.

Time Horizon:

Consider the time needed to accomplish your long-term goals. Understand that these goals may take several years or even decades to achieve, and adjust your savings and investment strategies accordingly.

By setting long-term goals, you can establish a clear vision of your financial future and take the necessary steps to achieve financial security and success in the long run.

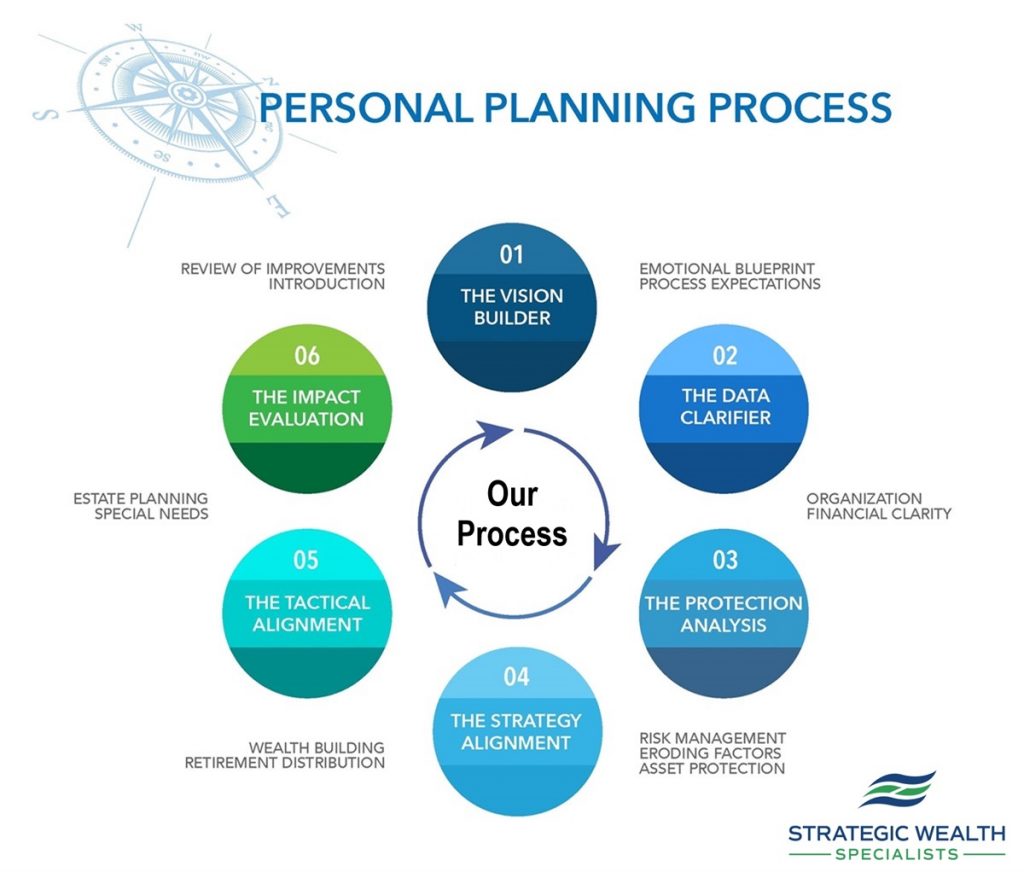

This image is property of static.fmgsuite.com.

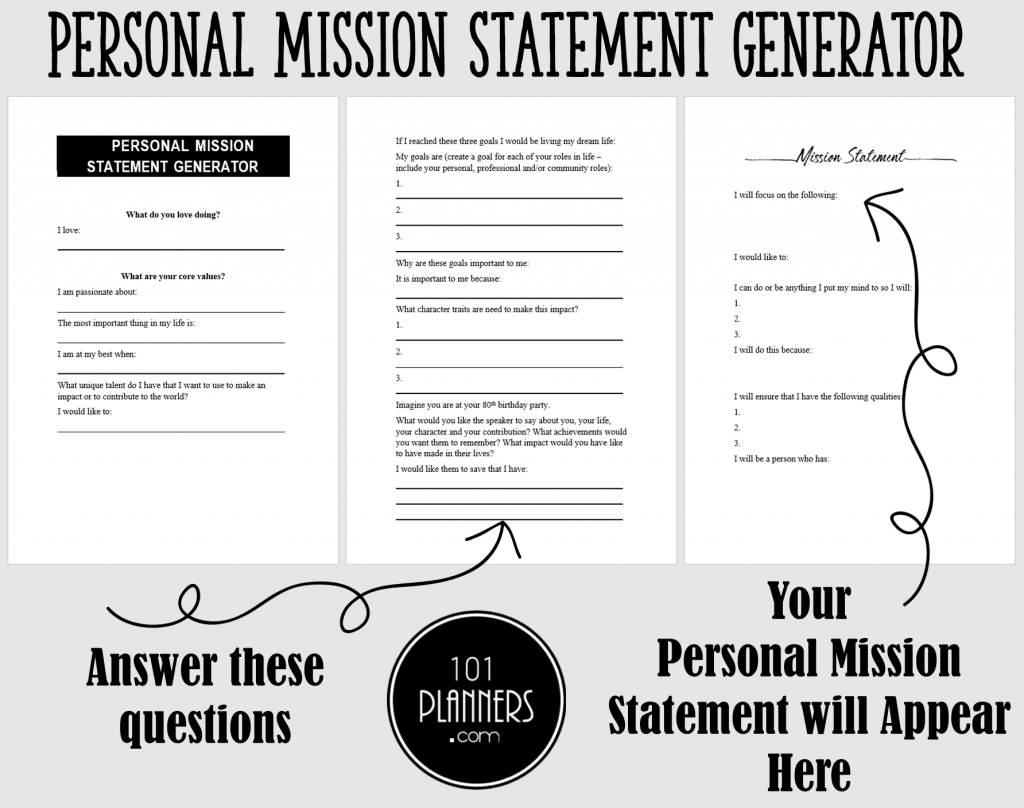

Identifying Your Values and Priorities

When setting personal financial goals, it is crucial to align them with your values and priorities. Understanding what is truly important to you in life will help you make decisions that are in line with your beliefs and bring you greater satisfaction. Take some time to reflect on your values and priorities, and consider how they align with your financial goals. For example, if giving back to your community is important to you, consider including charitable giving as part of your financial plan. By identifying your values and priorities, you can ensure that your goals are meaningful and fulfilling.

Defining Specific and Measurable Goals

To set effective financial goals, it is important to define them in specific and measurable terms. Vague goals such as “save more money” or “pay off debt” can be difficult to quantify and track progress. Instead, break down your goals into specific targets. For example, aim to save $10,000 in the next year or pay off $5,000 of debt within six months. By making your goals specific and measurable, you can easily track your progress and celebrate milestones along the way.

This image is property of www.101planners.com.

Creating a Realistic Timeline

Setting a realistic timeline for achieving your financial goals is essential to stay motivated and on track. Consider your current financial situation, income, and expenses when determining the timeframe for each goal. Avoid setting overly ambitious deadlines that may be difficult to achieve, as this can lead to frustration and burnout. Instead, be honest with yourself and set reasonable timelines that take into account potential setbacks and unexpected expenses.

Developing an Action Plan

Once you have defined your financial goals, it is important to develop a detailed action plan to achieve them. Break down each goal into smaller, manageable steps, and determine the specific actions you need to take to make progress. This may involve creating a budget, adjusting your spending habits, increasing your income, or seeking additional education or training. By creating a comprehensive action plan, you can make your goals more attainable and increase your chances of success.

This image is property of imageio.forbes.com.

Tracking Your Progress and Making Adjustments

Regularly tracking your progress is important to ensure that you stay on course towards achieving your financial goals. Keep a record of your income, expenses, savings, and investments to monitor your progress over time. Evaluate your action plan periodically and make adjustments as necessary. Life circumstances and financial situations can change, and it is important to adapt your goals and strategies accordingly. Celebrate your achievements along the way and remain flexible in your approach to reach your desired financial state.

Seeking Professional Financial Advice

While setting and working towards personal financial goals can be done independently, seeking professional financial advice can provide valuable insights and guidance. A financial advisor can help you assess your current financial situation, identify suitable strategies to achieve your goals, and provide expertise on various investment options. They can also help you navigate complex financial decisions, such as retirement planning or estate planning. Consider consulting with a certified financial planner or advisor to ensure that your goals are aligned with your financial capacity and risk tolerance.

In conclusion, personal financial goals play a significant role in shaping your financial future. By understanding the importance of setting goals, assessing your current financial situation, and defining both short-term and long-term goals, you can take control of your finances and work towards financial security and success. Aligning your goals with your values and priorities, creating specific and measurable targets, and developing a realistic action plan will help you stay focused and motivated. Regularly tracking your progress and seeking professional financial advice when needed will ensure that you make informed decisions and stay on track towards achieving your desired financial state. Remember, setting personal financial goals is not a one-time task but an ongoing process that requires dedication, adaptability, and a commitment to your financial well-being.