So you’ve been investing in gold for a while now, and you’re always on the lookout for the latest strategies to maximize your returns. Well, have you ever considered the role of robo-advisors in automating your gold investments? It’s a fascinating concept that has gained traction in recent years, and in this blog post, we’re going to delve into the world of robo-advisors and how they can revolutionize your gold investment portfolio. Buckle up, because we’ve got a lot to cover!

This image is property of img.money.com.

The Basics of Gold Investments

Why invest in gold?

When it comes to investing, gold has always been considered a safe haven. Its value has stood the test of time, making it a reliable asset for individuals looking to diversify their investment portfolios. Gold investments provide a hedge against inflation and economic uncertainties, making it an attractive option for many investors.

Different ways of investing in gold

There are several ways to invest in gold, each with its own advantages and considerations. One common method is purchasing physical gold in the form of bullion, coins, or bars. This allows you to own and physically store the gold yourself. Another option is investing in gold Exchange Traded Funds (ETFs), which are traded on stock exchanges and provide exposure to the price of gold without the need for physical delivery.

Another way to invest in gold is through gold futures contracts, which allow investors to speculate on the future price of gold. Additionally, gold mining stocks can offer exposure to the gold industry, but it is important to note that these stocks are subject to the risks and volatility of the stock market.

Advantages of gold investments

Investing in gold has several advantages. First and foremost, gold has historically held its value and has even increased in value over time. This makes it an attractive option for long-term investors looking to preserve their wealth. Gold also serves as a hedge against inflation, as its value tends to rise when the purchasing power of fiat currencies decreases.

Furthermore, gold is a globally recognized currency and can be easily converted into cash. It is also a tangible asset, which can provide a sense of security in uncertain times. Finally, gold investments can diversify your portfolio and reduce overall risk, as gold often behaves differently from other asset classes such as stocks and bonds.

What are Robo-Advisors?

Definition of robo-advisors

Robo-advisors are automated investment platforms that use algorithms and computer algorithms to provide financial advice and investment management services. These platforms aim to streamline the investment process by using technology to automate tasks that were once performed by human financial advisors.

How robo-advisors work

Robo-advisors use sophisticated algorithms to create and manage investment portfolios based on an individual’s financial goals, risk tolerance, and investment preferences. When you sign up with a robo-advisor, you will typically be asked a series of questions to assess your risk tolerance and investment goals. Based on your responses, the robo-advisor will generate a diversified investment portfolio tailored to your needs.

Once your portfolio is established, the robo-advisor will continuously monitor and rebalance your investments to ensure they align with your desired asset allocation. Some robo-advisors also offer additional features such as tax-loss harvesting, which aims to minimize taxes on investment gains by strategically selling losing investments.

Benefits of using robo-advisors for investments

There are several benefits to using robo-advisors for your investment needs. Firstly, robo-advisors offer a low-cost alternative to traditional human financial advisors. Since robo-advisors automate many tasks, such as portfolio management and rebalancing, they can pass on cost savings to investors in the form of lower fees.

Robo-advisors also provide convenience and accessibility. Many platforms offer user-friendly interfaces and mobile apps, allowing you to manage your investments anytime, anywhere. Additionally, robo-advisors provide transparency and remove the emotional biases that can come with human advisors. Investing decisions made by robo-advisors are based on data and algorithms, rather than emotions or personal opinions.

Furthermore, robo-advisors can help eliminate the barrier to entry for novice investors. With their user-friendly platforms and automated advice, robo-advisors make investing more approachable and less intimidating for individuals who may be new to the world of finance.

This image is property of static.wixstatic.com.

Robo-Advisors in the Gold Investment Industry

Introduction to robo-advisors in gold investments

The integration of robo-advisors in the gold investment industry has provided investors with a new avenue to gain exposure to this precious metal. By harnessing the power of automation, robo-advisors are able to streamline the process of investing in gold and offer tailored investment strategies to individual investors.

How robo-advisors handle gold investments

Robo-advisors utilize algorithms and data analysis to handle gold investments. These platforms consider various factors such as market trends, historical data, and individual investor preferences to determine the optimal gold investment strategy. Robo-advisors provide a hassle-free way for investors to access and manage gold investments without the need for purchasing physical gold or closely monitoring market conditions.

Comparison of robo-advisors to traditional methods

Compared to traditional methods of investing in gold, such as purchasing physical gold or investing in ETFs, robo-advisors offer several advantages. One key advantage is the ability to automate the investment process. With a robo-advisor, you no longer need to manually buy and sell gold or worry about storage and security. The entire investment process is handled by the robo-advisor, saving you time and effort.

Robo-advisors also provide a more diversified approach to gold investments. They analyze market data and make informed decisions based on algorithms, which can help reduce the risk associated with putting all your eggs in one basket. Traditional methods of investing in gold may be more limited in terms of diversification options.

Lastly, robo-advisors often offer lower fees compared to traditional investment methods. This can be especially beneficial for individuals looking to invest in gold without incurring high transaction costs or management fees.

Choosing the Right Robo-Advisor for Gold Investments

Factors to consider when selecting a robo-advisor

When choosing a robo-advisor for gold investments, there are several factors to consider. First and foremost, consider the platform’s reputation and track record. Look for established robo-advisors with a strong track record of performance and positive user reviews.

It is also important to consider the fees and fee structure of the robo-advisor. Look for a platform that offers transparent and competitive pricing. Some robo-advisors charge a percentage of assets under management, while others charge a flat fee.

Another factor to consider is the level of customization and personalization offered by the robo-advisor. Some platforms provide more options for tailoring your investment strategy to your individual needs and preferences. Consider whether you prefer a hands-on or hands-off approach to investing and choose a robo-advisor that aligns with your preferences.

Reviews and ratings of popular robo-advisors

To help you make an informed decision, it can be helpful to research and read reviews of popular robo-advisors. Platforms like Betterment, Wealthfront, and Robinhood are among the well-known robo-advisors in the industry. Look for reviews from reputable sources and consider the experiences of other investors.

Features to look for in a robo-advisor for gold investments

When selecting a robo-advisor for gold investments, it can be beneficial to look for certain features. Firstly, consider whether the platform offers the option to invest in physical gold or gold ETFs. This will allow you to choose the investment method that aligns with your preferences.

Additionally, consider whether the robo-advisor offers features such as tax-loss harvesting or rebalancing. These features can help optimize your portfolio and minimize taxes on investment gains. Look for platforms that provide a user-friendly interface and offer educational resources to help you make informed investment decisions.

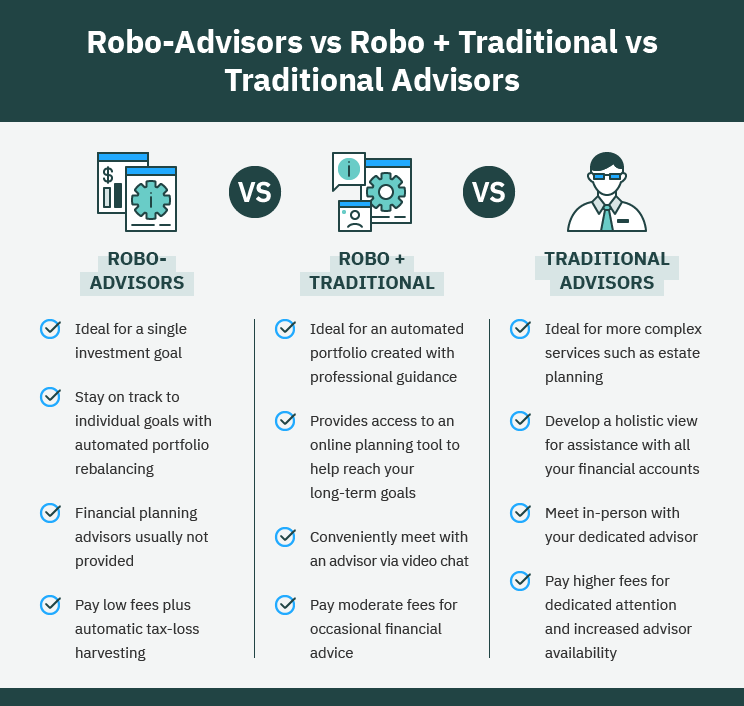

This image is property of tokenist.com.

Understanding the Automation Process

How automation works in gold investments

The automation process in gold investments involves the use of algorithms and computer programs to execute investment decisions. Robo-advisors analyze data and market trends to make investment choices on behalf of investors. Automation allows for efficient and timely execution of trades, eliminating the need for manual intervention.

Handling investment decisions through algorithms

Robo-advisors utilize algorithms to handle investment decisions in gold investments. These algorithms consider various factors, including market conditions, historical data, and investor preferences, to determine the best investment strategy. By relying on algorithms, robo-advisors remove human biases and emotions from the investment process, leading to more objective and data-driven decisions.

Analyzing market data and making informed choices

One of the key roles of robo-advisors in gold investments is analyzing market data to make informed investment choices. These platforms continuously monitor market conditions and adjust investment portfolios accordingly. By analyzing market data, robo-advisors can identify trends and potential opportunities in the gold market, allowing investors to capitalize on potential gains.

Automation also enables robo-advisors to implement disciplined investment strategies. These platforms stick to predetermined investment rules and rebalance portfolios on a regular basis to maintain the desired asset allocation. This systematic approach helps investors stay on track with their investment goals and reduce the impact of emotional decision-making.

Risk Assessment and Diversification

Assessing risk tolerance and investment goals

Risk assessment is a crucial aspect of any investment strategy. When utilizing a robo-advisor for gold investments, it is important to assess your risk tolerance and investment goals. This will help the robo-advisor create a well-balanced investment portfolio that aligns with your preferences.

Robo-advisors often provide questionnaires or assessments to gauge an investor’s risk tolerance. These assessments consider factors such as investment horizon, financial goals, and risk aversion to determine an appropriate asset allocation.

Benefits of a diversified gold investment portfolio

Diversification is a fundamental principle of investing, and it holds true for gold investments as well. A diversified gold investment portfolio can help mitigate risk by spreading investments across different assets. By including a mix of gold-related investments, such as physical gold, gold ETFs, and gold mining stocks, investors can reduce exposure to any single investment and increase the potential for overall returns.

Gold investments can act as a hedge against various economic and market conditions. For example, during times of economic uncertainty, gold prices may rise, providing a potential offset to losses in other asset classes. By diversifying your gold investments, you can better protect your portfolio from volatility and enhance potential returns.

Robo-advisors’ role in creating a balanced investment strategy

Robo-advisors play a crucial role in helping investors create a balanced investment strategy. Through their algorithms and data analysis, robo-advisors can determine the optimal allocation of gold investments based on an investor’s risk tolerance and investment goals. They can automatically adjust the portfolio to maintain the desired asset allocation, ensuring that the investment strategy remains aligned with the investor’s objectives.

By utilizing robo-advisors, investors can benefit from the expertise and strategic decision-making of these automated platforms. Through diversification and regular portfolio rebalancing, robo-advisors can help mitigate risk and maximize potential returns in a gold investment portfolio.

This image is property of images.contentstack.io.

Customization and Personalization Features

Tailoring investment strategies to individual needs

One of the key advantages of using robo-advisors for gold investments is the ability to tailor investment strategies to individual needs. These platforms typically offer a range of investment options and allow investors to personalize their portfolios based on their preferences and goals.

Investors can customize their investment strategy by specifying factors such as risk tolerance, investment horizon, and desired asset allocation. This level of customization ensures that the investment strategy aligns with the investor’s unique circumstances and objectives.

Options for adjusting investment preferences

Robo-advisors also provide options for adjusting investment preferences as circumstances change. For example, investors may have the option to increase or decrease their exposure to gold within their portfolio. This flexibility allows investors to adapt their investment strategy based on market conditions, changing risk profiles, or evolving investment goals.

Investors can also adjust their investment preferences by specifying preferences for specific gold investment vehicles, such as physical gold or gold ETFs. This allows investors to take a more active role in shaping their investment portfolio and tailoring it to their individual preferences.

Using robo-advisors to automate periodic investments

Another customization feature offered by robo-advisors is the ability to automate periodic investments. Investors can set up recurring investments to regularly contribute to their gold investment portfolio. This automation feature ensures consistent contributions and helps investors take advantage of dollar-cost averaging, which entails buying more gold when prices are low and less when prices are high.

By automating periodic investments, investors can remove the need for manual intervention and ensure a disciplined approach to investing. This feature is especially beneficial for individuals who prefer a hands-off approach or may have limited time to actively manage their investments.

Costs and Fees of Robo-Advisors

Understanding fee structures of robo-advisors

It is important to understand the fee structures of robo-advisors when considering gold investments. Robo-advisors typically charge fees for their services, and these fees can vary depending on the platform and the amount of assets under management.

The most common fee structure is a percentage fee based on the assets under management. This fee is often calculated as a percentage of the total assets in the investment portfolio and is typically charged on an annual basis. Some robo-advisors may also charge additional fees for specific services, such as tax-loss harvesting or premium features.

Comparing costs with traditional investment services

When comparing the costs of robo-advisors with traditional investment services, robo-advisors often come out as a more cost-effective option. Traditional human financial advisors typically charge higher fees, often based on a percentage of assets under management or through commission-based models. These fees can be significantly higher than the fees charged by robo-advisors.

Robo-advisors, on the other hand, benefit from automation and scale, allowing them to offer lower fees to investors. This cost advantage is particularly attractive for individuals looking to invest in gold without incurring high management fees or transaction costs.

Evaluating the value and affordability of robo-advisors

When evaluating the value and affordability of robo-advisors, it is important to consider the services provided and the fees charged. While robo-advisors offer lower fees compared to traditional investment services, the value they provide goes beyond just cost savings.

Robo-advisors provide convenience, accessibility, and personalized investment strategies tailored to individual needs. They offer a user-friendly experience, access to market data and trends, and the ability to automate investments. When considering the value and affordability of robo-advisors, it is important to weigh the fees against the benefits and features provided by the platform.

This image is property of www.xpheno.com.

The Human Element: Robo-Advisor vs. Personal Financial Advisor

Discussing the advantages of human financial advisors

While robo-advisors offer a range of benefits, it is important to acknowledge the advantages of human financial advisors. Human advisors bring a personal touch and a level of expertise that algorithms cannot replicate. They can provide personalized advice, take into account individual circumstances, and communicate complex investment concepts in a way that is easily understandable.

Human advisors also offer a level of emotional support and guidance that can be valuable during uncertain times. They can help investors navigate market fluctuations and make informed decisions based on their experience and understanding of the investment landscape.

Comparing the expertise and experience of humans and algorithms

When comparing the expertise and experience of humans and algorithms, it is important to recognize that both have their strengths. Humans bring years of experience, market knowledge, and intuition to the table. They can adapt their advice based on changing market conditions and provide personalized strategies tailored to each investor’s unique situation.

On the other hand, algorithms utilized by robo-advisors have the ability to analyze vast amounts of data, identify patterns, and make objective decisions based on historical data. They remove human biases and emotions, which can sometimes cloud judgment and lead to suboptimal investment decisions.

Finding the right balance between automation and human advice

Finding the right balance between automation and human advice is key. Many investors find that a combination of both can yield the best results. By leveraging the strengths of both robo-advisors and human financial advisors, investors can benefit from the efficiency and objectivity of algorithms while also accessing the personalized insights and support of human advisors.

Some robo-advisors are incorporating a hybrid model that combines automated investment management with access to human advisors for specific needs or complex financial situations. This allows investors to have the best of both worlds and ensures that they receive the level of support and expertise they need.

The Future of Robo-Advisors in Gold Investments

Exploring the potential growth of robo-advisors

The future of robo-advisors in gold investments looks promising. As technology continues to advance and investors seek more cost-effective and efficient investment solutions, the demand for robo-advisors is expected to grow. These platforms offer a convenient and accessible way to invest in gold, making it more accessible to a wider range of investors.

Predictions and trends in the gold investment industry

In the gold investment industry, several trends and predictions are shaping the landscape. Increased market volatility and economic uncertainties are driving investors to seek safe-haven assets such as gold. The rise of digital platforms and automation is also transforming the way people invest.

Furthermore, the increasing popularity of environmental, social, and governance (ESG) investing is likely to impact the gold investment industry. Investors are becoming more conscious of the environmental and social impact of their investments, and gold mining practices are under scrutiny. Robo-advisors specializing in ESG investments may emerge to cater to this growing demand.

Adapting to technological advancements for better automation

As technology continues to advance, robo-advisors will likely adapt and incorporate new features and capabilities to enhance automation in gold investments. This could include leveraging artificial intelligence and machine learning to improve data analysis and investment decision-making. Robo-advisors may also integrate with other technologies, such as blockchain, to provide more secure and transparent investment processes.

Additionally, robo-advisors may expand their offerings beyond traditional gold investments. They may incorporate other precious metals or alternative assets to provide investors with a more diverse range of options. As technology continues to evolve, robo-advisors will play a pivotal role in the gold investment industry, providing investors with efficient, cost-effective, and accessible avenues to invest in this valuable asset.