Imagine a world where your hard-earned money loses value over time, eroded by the unyielding force of inflation. Sounds like a nightmare, right? Well, fear not, because there is a time-tested solution that has been preserving purchasing power for centuries: gold. As an experienced investor, I can assure you that gold is not just shiny trinkets or an outdated relic from the past. In fact, it has proven to be a reliable hedge against inflation, offering stability and protecting your wealth in times of economic uncertainty. So, if you’re looking to beat inflation and safeguard your purchasing power, let’s delve into the fascinating world of gold and explore its unique properties that make it an invaluable asset to have in your investment portfolio.

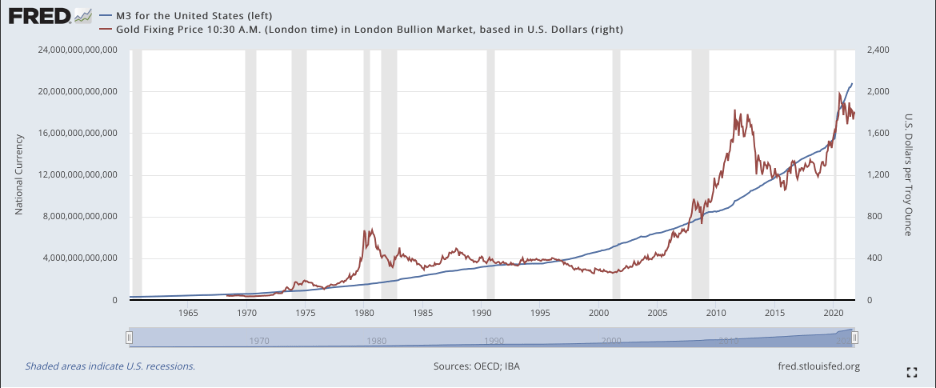

This image is property of static.seekingalpha.com.

The Importance of Beating Inflation

Inflation is a topic that always manages to catch people’s attention, especially when it comes to its impact on purchasing power. As an investor, understanding inflation and its long-term effects is crucial in order to protect and grow your wealth. In this article, we will explore the role of gold as a hedge against inflation, its historical performance, and its unique properties. We will also discuss the benefits of diversifying your investment portfolio with gold and the different ways to invest in this precious metal. Additionally, we will cover important factors to consider when investing in gold, as well as the associated risks and tax implications. Lastly, we will examine the various factors that could affect the future value of gold. So, grab a cup of coffee and get ready to delve into the world of gold investments!

Understanding Inflation and its Effects on Purchasing Power

Before diving into gold as an inflation hedge, it’s important to grasp the concept of inflation itself. Inflation refers to the continuous increase in prices of goods and services over time. When prices rise, the purchasing power of your money decreases, meaning that you can buy less than before with the same amount of money. Inflation erodes the value of your savings and investments, making it essential to stay ahead of it.

The Long-Term Effects of Inflation

The long-term effects of inflation can be significant, impacting not only individuals but also businesses and economies as a whole. Over time, inflation reduces the value of a currency, leading to higher costs for goods and services. This can have various negative effects, such as decreased consumer spending and reduced investment. Inflation also creates uncertainty in financial markets, making it more difficult for businesses to plan for the future. As an investor, it is crucial to consider the long-term effects of inflation and seek ways to mitigate its impact.

Challenges Faced by Investors in an Inflationary Environment

Investing in an inflationary environment can be challenging, as traditional investments like bonds and cash may struggle to keep up with rising prices. Inflation erodes the returns on these investments, resulting in lower real returns. Furthermore, inflation leads to higher interest rates, which can reduce the value of fixed-income investments. In an inflationary environment, it becomes essential to explore alternative investment options that can provide protection against inflation.

Gold as a Hedge Against Inflation

Now, let’s turn our attention to gold and its role as a hedge against inflation. Gold has a long history of being regarded as a store of value, especially during times of economic uncertainty. During inflationary periods, gold tends to outperform other investments due to its unique properties and historical performance.

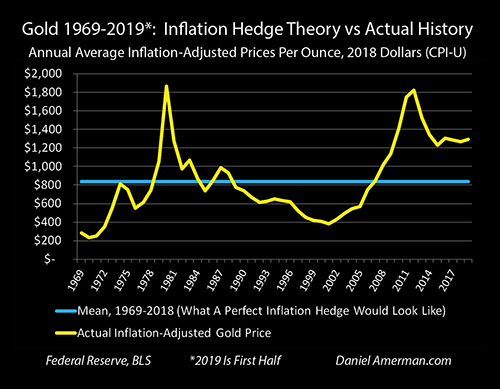

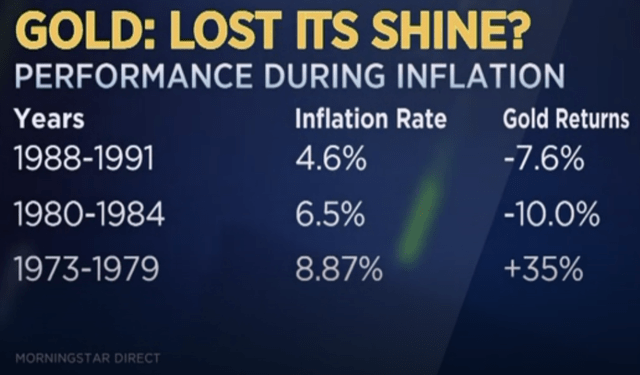

Historical Performance of Gold During Inflationary Periods

Gold has proven to be a reliable hedge against inflation throughout history. When inflation rises, the value of fiat currencies tends to decline, creating a surge in demand for gold. This increased demand drives up gold prices, offering investors a way to preserve their purchasing power. For example, during the inflationary period of the 1970s, gold prices soared, providing investors with substantial returns. This historical evidence showcases gold’s ability to protect wealth during times of inflation.

Gold’s Unique Properties as a Preserver of Wealth

Gold possesses several unique properties that make it an appealing asset for investors seeking protection against inflation. Firstly, gold is a tangible asset that holds intrinsic value and is not subject to counterparty risks like stocks or bonds. It cannot be easily created or destroyed, making it a finite resource that maintains its value over time. Secondly, gold is a globally recognized form of currency that can be easily bought, sold, and traded, providing liquidity and accessibility for investors. Lastly, gold has a timeless allure and has been considered a symbol of wealth and beauty for centuries. These properties make gold an attractive choice for hedging against inflation and preserving purchasing power.

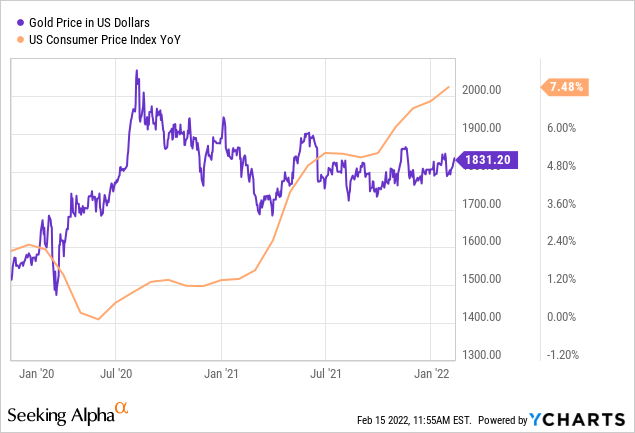

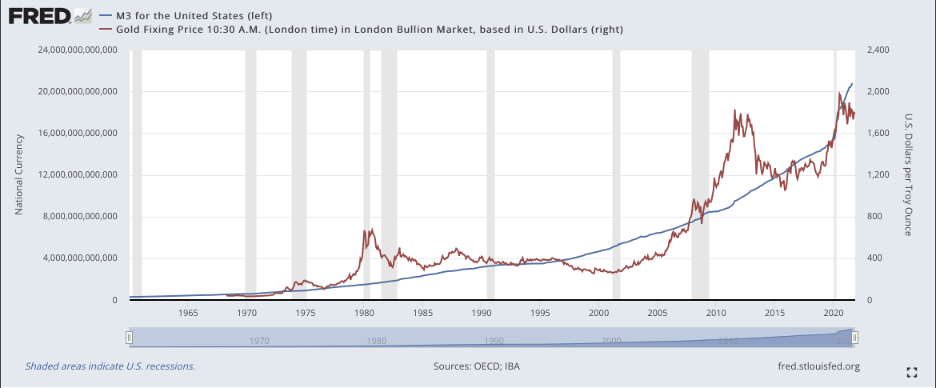

Relationship Between Inflation and Gold Prices

The relationship between inflation and gold prices is complex and influenced by various factors. Generally, as inflation expectations increase, the demand for gold as a safe-haven asset rises, leading to higher prices. Similarly, when inflation is low or well-managed, the demand for gold may decrease, putting downward pressure on prices. However, it’s important to note that gold prices are also influenced by other market factors, such as interest rates, geopolitical events, and investor sentiment. Therefore, while gold has historically been a reliable hedge against inflation, it is crucial to consider these factors when investing in gold.

This image is property of static.seekingalpha.com.

The Role of Gold in Diversification

Diversification is a key strategy in building a resilient investment portfolio. Adding gold to your investment mix can offer several benefits and reduce the overall risk of your portfolio.

Benefits of Diversification in an Investment Portfolio

Diversification involves spreading your investments across different asset classes, industries, and geographical regions. By doing so, you are not putting all your eggs in one basket and reducing the impact of any single investment’s performance on your overall portfolio. Diversification can help mitigate risk, enhance returns, and provide more stable long-term growth.

Gold’s Role as a Non-Correlated Asset

One of the primary advantages of including gold in a diversified portfolio is its low correlation with traditional assets like stocks and bonds. Gold has historically exhibited a negative or low correlation with these assets, meaning that it often moves independently from them. This non-correlation can provide a cushion during economic downturns or market volatility, as gold may perform well when other investments falter. This diversification benefit makes gold an attractive addition to an investment portfolio.

Reducing Portfolio Volatility with Gold

Volatility is an ever-present risk in financial markets. When market volatility strikes, investors often seek safe-haven assets to protect their investments. Gold has a long-standing reputation as a safe-haven asset due to its stability and store of value properties. When stocks and bonds experience significant price swings, gold has the potential to provide stability and reduce portfolio volatility. Adding a certain percentage of gold to a portfolio can help offset the downside risk during market downturns, providing a more balanced investment approach.

Investing in Physical Gold

Now that we understand the benefits of gold in a diversified portfolio, let’s explore the different forms of physical gold investments, along with their pros and cons.

Different Forms of Physical Gold Investments

When it comes to investing in physical gold, there are several options to choose from. The most common forms include gold bars, gold coins, and gold jewelry. Gold bars are typically available in various weights, making them a flexible option for investors. Gold coins, on the other hand, often carry additional numismatic value and can be more appealing to collectors. Lastly, gold jewelry allows investors to enjoy the aesthetic appeal of gold while still owning a tangible asset. Each form of physical gold has its own advantages and disadvantages, so it’s important to consider your specific investment goals and preferences.

Pros and Cons of Owning Physical Gold

Owning physical gold comes with its own set of pros and cons. On the positive side, physical gold provides tangible ownership and a sense of security. It is a physical, portable asset that you can hold in your hands, providing a peace of mind for some investors. Physical gold also allows for easy ownership verification and eliminates the reliance on third parties. However, there are also drawbacks to owning physical gold. Storing and securing physical gold can be a challenge, requiring additional costs for secure storage options. Additionally, buying and selling physical gold may involve higher transaction costs compared to other forms of gold investment. Lastly, physical gold can be subject to potential loss or theft, necessitating the need for adequate insurance coverage.

Storing and Securing Physical Gold

When it comes to storing and securing physical gold, there are several options to consider. Some investors prefer to store their gold at home in a safe or secure location. However, this option may not be suitable for everyone, as it carries the risk of theft or loss. Others may choose to store their gold in a bank safe deposit box, which offers an added level of security. However, it’s important to note that safe deposit boxes are subject to bank regulations and availability. Another popular option is storing gold in a professional vault or storage facility, which provides high levels of security and insurance coverage. Whichever storage option you choose, it’s crucial to assess the associated costs, convenience, and peace of mind that comes with knowing your gold is safe and secure.

This image is property of static.seekingalpha.com.

Alternative Ways to Invest in Gold

While physical gold offers tangible ownership, there are alternative ways to invest in gold without the need for physical possession. Let’s explore some of these options:

Gold Exchange-Traded Funds (ETFs)

Gold ETFs are investment funds that aim to track the performance of gold prices. They allow investors to gain exposure to the price movements of gold without actually owning physical gold. Gold ETFs can be bought and sold like stocks on a stock exchange, providing liquidity and ease of transaction. They also offer the advantage of diversification, as the value of the ETF is typically based on a basket of gold holdings. However, it’s important to research the specific ETF and its associated fees before investing, as fees can vary among different funds.

Gold Mining Stocks and Mutual Funds

Investing in gold mining stocks or mutual funds allows you to indirectly participate in the gold industry. Gold mining stocks represent shares of companies involved in gold exploration and production. These stocks can offer potential capital appreciation and dividends, but they are also subject to the performance of the underlying company and other market factors. Mutual funds focused on gold mining companies provide diversification by investing in a portfolio of mining stocks. However, investing in mining stocks and mutual funds carries additional risks compared to physical gold or gold ETFs, such as operational risks and management performance.

Gold Futures and Options

For more experienced investors looking for additional leverage and risk, gold futures and options can be considered. Futures contracts allow investors to buy or sell gold at a predetermined price on a future date. Options provide the right, but not the obligation, to buy or sell gold at a specified price within a certain timeframe. Both futures and options can be highly volatile and require a good understanding of market dynamics. These investment vehicles are typically more suitable for sophisticated investors who actively trade in the futures and options markets.

Factors to Consider When Investing in Gold

When investing in gold, there are several factors to consider to make informed investment decisions. Let’s explore some of these factors:

Market Conditions and Timing

The timing of your gold investment can significantly impact your returns. Gold prices can be influenced by market conditions, such as supply and demand dynamics, economic indicators, and investor sentiment. Monitoring market conditions and timing your gold purchases when prices are relatively low can potentially lead to better returns.

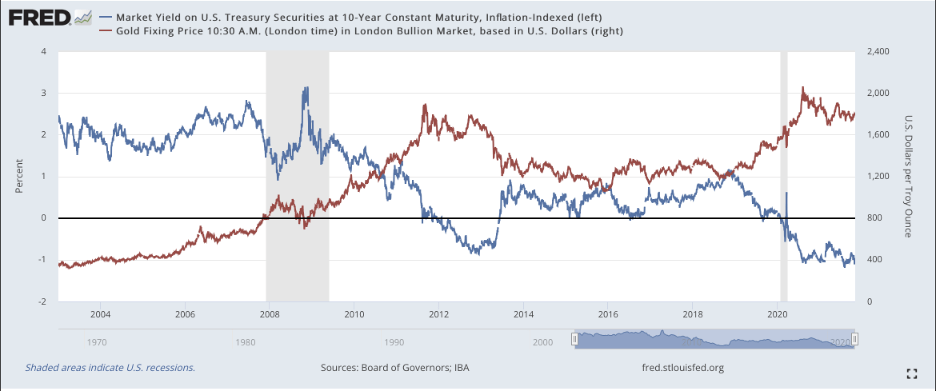

Gold’s Sensitivity to Interest Rates

Interest rates play a crucial role in determining the attractiveness of gold as an investment. Generally, when interest rates are low, gold becomes more appealing as it offers a more competitive alternative to low-yielding fixed-income investments. Conversely, when interest rates rise, the opportunity cost of holding gold increases, potentially leading to lower demand and lower gold prices. It’s important to stay informed about changes in interest rates and their potential impact on the gold market.

Impact of Geopolitical Events on Gold Prices

Gold is often viewed as a safe-haven asset during times of geopolitical uncertainty. Geopolitical events, such as wars, political instability, and trade disputes, can create volatility in financial markets and increase the demand for safe-haven assets like gold. Keeping an eye on global events and their potential impact on the gold market can help you navigate these market conditions and make more informed investment decisions.

This image is property of danielamerman.com.

Understanding the Risks of Investing in Gold

As with any investment, investing in gold carries its own set of risks that need to be considered. Understanding and managing these risks is crucial in order to protect your investment. Let’s explore some of the risks associated with gold investments:

Volatility and Price Fluctuations

While gold has historically been considered a store of value, it is not immune to price fluctuations. Gold prices can be influenced by various factors, including market sentiment, economic conditions, and investor behavior. These price fluctuations can lead to volatility in the gold market, potentially affecting the value of your investment. It’s important to be prepared for short-term price swings and take a long-term perspective when investing in gold.

Liquidity and Market Accessibility

Gold is a highly liquid asset that can be easily bought and sold. However, in times of extreme market stress or disruption, liquidity can become limited. This can make it more difficult to buy or sell gold at desired prices. Additionally, accessibility to the gold market can vary depending on your location and the investment option you choose. It’s crucial to consider these factors when investing in gold and ensure that you have the necessary means to access your investment when needed.

Counterparty Risks and Potential Scams

Investing in certain forms of gold, such as gold futures or options, involves counterparty risks. These risks arise when dealing with financial institutions, brokers, or other parties involved in the transaction. It’s important to research and choose reputable and trustworthy counterparties to minimize the risk of fraud or default. Additionally, the gold market has seen instances of scams and fraudulent schemes targeting unsuspecting investors. Being vigilant and conducting thorough due diligence when considering gold investments will help protect you from potential scams.

Tax Implications of Gold Investments

When investing in gold, it’s important to consider the tax implications to ensure compliance with tax regulations. Here are some important considerations:

Capital Gains Tax on Gold Profits

In many jurisdictions, profits from the sale of gold are subject to capital gains tax. Capital gains tax is typically applied to the increase in value of your gold investment from the time of purchase to the time of sale. The tax rate and exemptions can vary depending on your country of residence, so it’s crucial to consult with a tax professional or research the specific tax regulations in your jurisdiction.

Tax Considerations for Different Forms of Gold

Different forms of gold may have different tax treatments. For example, gold coins may be subject to different tax rates or exemptions compared to gold bars or jewelry. Understanding the tax considerations for the specific form of gold you own or are considering can help you better manage your tax obligations.

Tax Reporting Requirements for Gold Investments

In addition to capital gains tax, some jurisdictions may have specific reporting requirements for gold investments. These requirements may include reporting the purchase or sale of gold above a certain threshold or reporting foreign gold holdings. It’s important to stay informed about the tax reporting obligations in your jurisdiction to ensure compliance.

This image is property of static.seekingalpha.com.

Factors That Could Affect the Future Value of Gold

Looking into the future, several factors could influence the value of gold. It’s important to stay informed about these factors to make informed investment decisions.

Emerging Technologies and Industrial Demand

Gold has a wide range of industrial applications, including electronics, dentistry, and aerospace. Emerging technologies and advancements in these industries can significantly impact the demand for gold. For example, the increasing demand for electronic devices and renewable energy technologies could drive up the need for gold in the future. Monitoring these technological advancements and their impact on the demand for gold can provide insights into the future value of the precious metal.

Government Policies and Regulations

Government policies and regulations can have a profound impact on the gold market. Changes in import or export regulations, mining policies, or taxation can affect the supply and demand dynamics of gold. Additionally, central bank policies, such as interest rate decisions or currency interventions, can influence the attractiveness of gold as an investment. Staying informed about government actions and their potential impact on the gold market can help you anticipate market trends.

Market Sentiments and Investor Demand

Investor sentiment and demand for gold can heavily influence its price movements. Market sentiment can be impacted by a wide range of factors, including economic indicators, geopolitical events, and financial market conditions. When uncertainty or fear pervades, investors often seek the safety of gold, driving up demand and prices. Understanding investor sentiment and monitoring market demand for gold can help you gauge the future value of the precious metal.

Conclusion

Gold has long been considered a timeless and reliable hedge against inflation, making it a popular choice for investors looking to preserve their purchasing power. Its historical performance, unique properties, and ability to diversify investment portfolios make it an appealing asset for investors with a long-term perspective. However, investing in gold comes with its own set of risks and considerations, including market volatility, storage and security, and tax implications. It’s crucial to thoroughly research and understand these factors before making any gold investment decisions. Seeking professional advice from financial advisors or precious metal experts can further enhance your knowledge and help you make informed investment choices. By considering gold as part of a balanced investment strategy and staying informed about the factors that could affect its future value, you can position yourself for potential wealth preservation and growth in the ever-changing investment landscape.