Gold has long been regarded as a safe haven investment, a reliable hedge against inflation, and a store of value. However, like any investment, there are risks involved. As an experienced investor in gold, I have witnessed the ups and downs of this precious metal over the years. In this article, we will explore the concept of cautious optimism when it comes to investing in gold, weighing the potential rewards against the inherent risks. So, if you’re interested in navigating the world of gold investments with a balanced perspective, keep reading to uncover the intricacies of this fascinating asset class.

This image is property of zerodha.com.

Cautious Optimism: Balancing Risk and Potential Rewards in Gold

Introduction

Investing in gold can be an attractive option for those looking to diversify their portfolio and hedge against potential risks in the market. While it’s important to approach any investment with caution, gold has historically been seen as a safe-haven asset that holds its value during economic downturns. In this article, we will dive into the factors that affect the gold market, assess the risks involved, explore the potential rewards of investing in gold, analyze its historical performance, determine the right allocation for your investments, understand gold-backed investment vehicles, minimize risk through various techniques, and emphasize the importance of staying informed and seeking professional advice.

Understanding Gold as an Investment

Before delving into the specifics of investing in gold, it’s crucial to have a solid understanding of what gold truly represents. Gold is often seen as a store of value, serving as a tangible asset that can be easily traded and has a limited supply. Its scarcity and historical significance have made it a sought-after asset over the centuries. As an investor, it’s essential to recognize that gold behaves differently than other types of investments, such as stocks or bonds, due to its unique properties.

Factors Affecting the Gold Market

Global Economic Outlook

The global economic outlook plays a significant role in determining the value of gold. When the economy is performing well, investors may be more inclined to invest in riskier assets, such as stocks and bonds, which can put downward pressure on gold prices. However, during times of economic uncertainty or recession, gold tends to shine as investors seek the stability it offers.

Inflation and Currency Movements

Inflation and currency movements also impact the gold market. During periods of high inflation or currency devaluation, gold tends to hold its value better than paper currencies. This is because gold is not subject to the same level of devaluation as fiat currencies, making it an attractive option for investors.

Geopolitical Tensions

Geopolitical tensions can have a significant impact on gold prices. Political instability, conflicts, or other global events can drive investors towards safe-haven assets like gold. This surge in demand often leads to an increase in gold prices as investors seek protection against uncertain times.

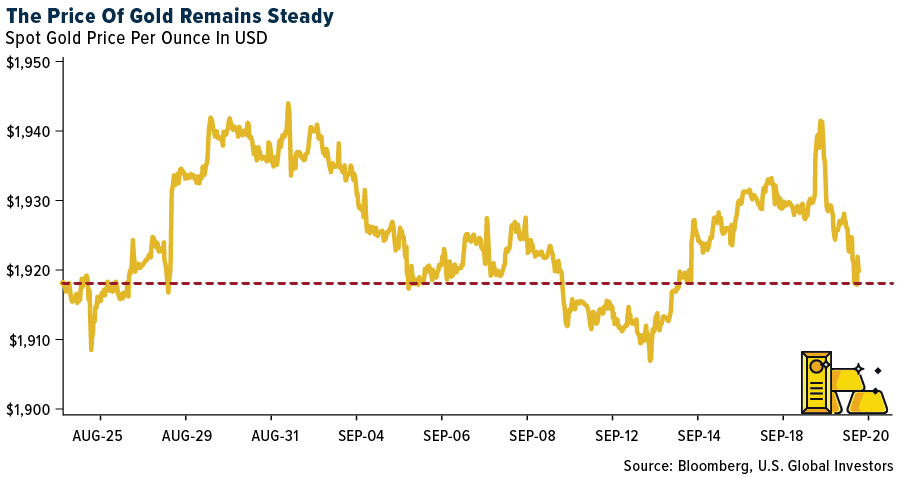

This image is property of www.usfunds.com.

Assessing the Risks

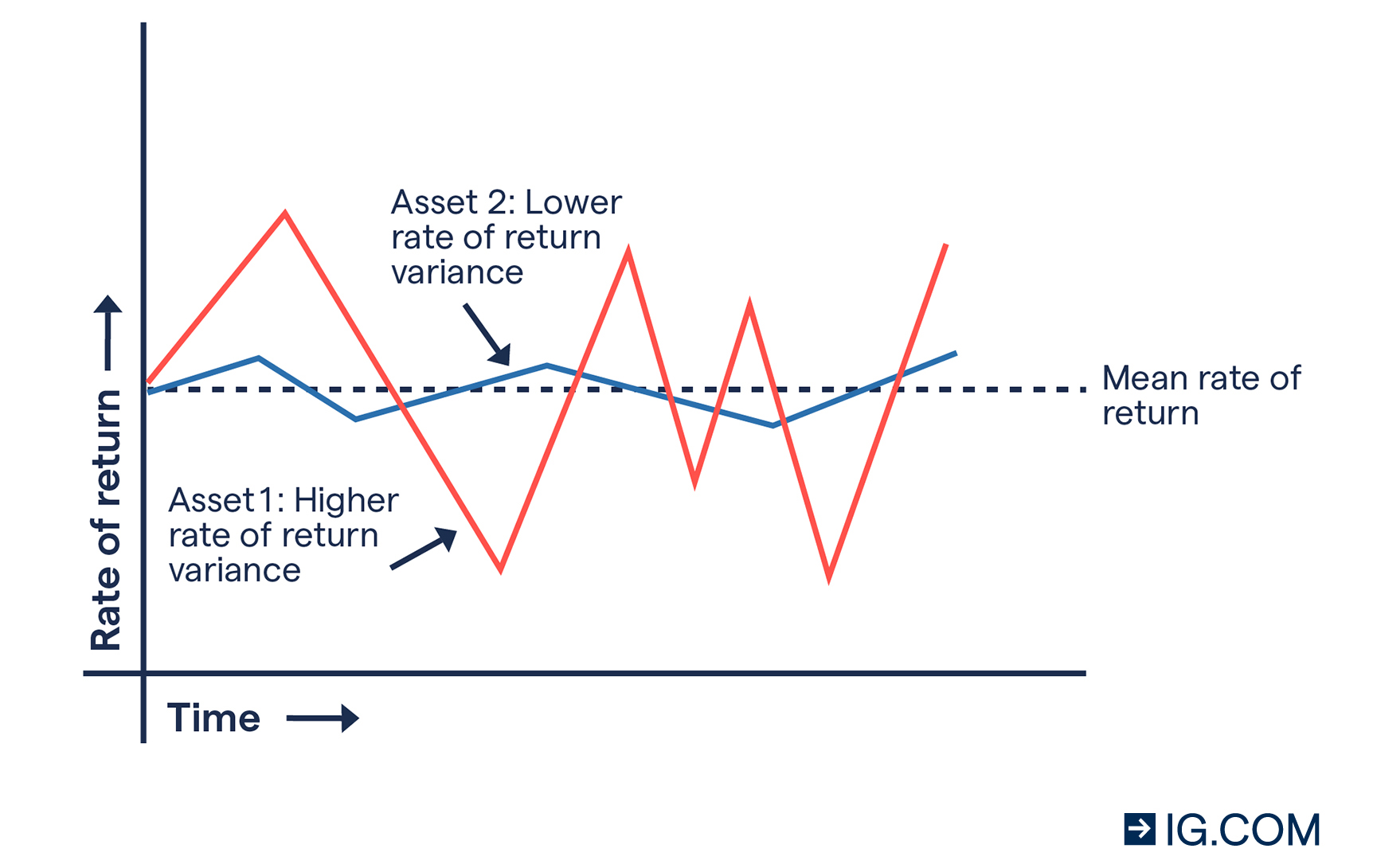

Market Volatility

While gold can offer stability during economic downturns, it’s important to note that market volatility can still affect its price. Investors should be aware that short-term fluctuations in the gold market are expected, and it may not always perform as anticipated. Understanding and accepting the inherent volatility of the market is crucial for gold investors.

Liquidity and Accessibility

One potential risk of investing in gold is its liquidity and accessibility. While physical gold may be highly liquid, meaning it can be easily bought and sold, other gold-backed investment vehicles, such as exchange-traded funds (ETFs), may have limitations. It’s essential to consider the accessibility of your investment and ensure that you can easily convert it back to cash when needed.

Risk of Underperformance

Whenever you invest, there is a risk of underperformance. Gold is no exception to this. While it has historically held its value and acted as a hedge against economic downturns, there is no guarantee that it will continue to do so in the future. It’s vital to assess your risk tolerance and diversify your investment portfolio to mitigate any potential underperformance.

Potential Rewards of Investing in Gold

Portfolio Diversification

One of the significant advantages of including gold in your investment portfolio is diversification. Gold often moves independently of other assets, such as stocks and bonds, which can help reduce overall portfolio volatility. By diversifying your investments, you can potentially increase your chances of achieving long-term financial success.

Hedge Against Inflation

Gold has long been considered a hedge against inflation. When the purchasing power of fiat currencies declines due to inflation, gold’s value tends to rise. Including gold in your portfolio can provide protection against eroding inflation and help maintain your purchasing power over time.

Safe-Haven Asset

In times of economic uncertainty or geopolitical tensions, gold has historically been seen as a safe-haven asset. Its ability to hold its value during turbulent times makes it an attractive option for risk-averse investors. By including gold in your portfolio, you can potentially reduce the overall risk exposure of your investments.

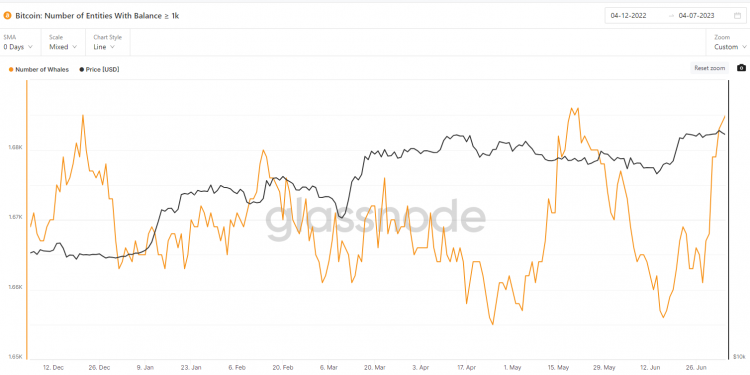

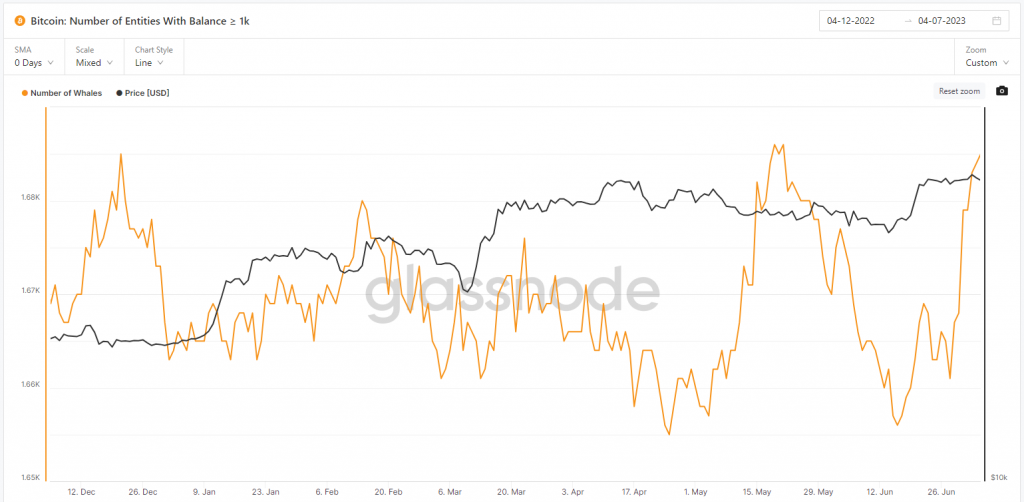

This image is property of files.ourbitcoinnews.com.

Analyzing Historical Performance

Gold’s Performance During Economic Downturns

One of the key reasons investors turn to gold is its historical performance during economic downturns. When stock markets experience significant declines, gold has often served as a safe haven, preserving, and even increasing its value. However, it’s important to note that past performance does not guarantee future results. Conduct thorough research and analysis to understand how gold has historically performed in different economic conditions.

Comparing Gold to Other Assets

When evaluating the potential returns of investing in gold, it’s essential to compare it to other investment options. While gold has offered attractive returns over the long term, it may not always outperform other asset classes, such as stocks or real estate. Consider your investment goals, risk tolerance, and time horizon to determine if gold is the right fit for your portfolio.

Determining the Right Allocation

Identifying Your Investment Goals

Before deciding on the right allocation of gold in your portfolio, it’s crucial to identify your investment goals. Are you investing for long-term growth or short-term gains? Understanding your objectives can help guide your decision-making process and determine how much weight to give to gold in your overall investment strategy.

Considering Risk Tolerance

Every investor has a different risk tolerance level. Some individuals are more comfortable with higher-risk investments, while others prefer a more conservative approach. When determining the right allocation for gold, consider your risk tolerance and select a percentage that aligns with your comfort level and overall financial objectives.

Determining Time Horizon

Your time horizon is another important factor to consider when deciding on the right allocation for gold. If you have a longer investment horizon, the potential benefits of holding gold for the long term may outweigh short-term fluctuations. However, if you have a shorter time horizon, you may need to adjust your allocation accordingly to ensure liquidity when needed.

This image is property of files.ourbitcoinnews.com.

Understanding Gold-Backed Investment Vehicles

Physical Gold: Bars and Coins

Investing in physical gold, such as bars and coins, is a common choice for many investors. Owning physical gold provides a tactile and tangible investment that can be easily stored and accessed. However, it’s important to consider storage and security costs, as well as potential premiums when purchasing physical gold.

Gold ETFs

Gold exchange-traded funds (ETFs) offer investors a convenient way to gain exposure to the gold market without owning physical gold. These funds typically track the price of gold and can be bought and sold on major stock exchanges. Gold ETFs provide liquidity and accessibility, making them a popular choice for many investors.

Gold Mining Stocks

Investing in gold mining stocks is another option for those looking to gain exposure to the gold market. By investing in these stocks, you are investing in the companies involved in the exploration, production, and sale of gold. This option provides indirect exposure to the gold market and can be influenced by both gold prices and company-specific factors.

Techniques for Minimizing Risk

Dollar-Cost Averaging

Dollar-cost averaging is a strategy that involves investing a fixed amount of money in regular intervals, regardless of the market price. This technique can help mitigate the risk of investing a large sum at an unfavorable time. By consistently investing over time, you can potentially reduce the impact of short-term market fluctuations.

Setting Stop-Loss Orders

Setting stop-loss orders can be a useful risk management tool when investing in gold. By setting a predetermined price at which you would sell your gold investment, you can protect yourself from significant losses if prices decline. However, it’s important to reassess your stop-loss levels periodically to ensure they align with your investment objectives.

Active Portfolio Management

Active portfolio management involves regularly reviewing and adjusting your investment portfolio based on market conditions and your financial goals. By actively managing your investments, you can potentially reduce risk and maximize returns. Regularly reassessing your allocation to gold and other assets is crucial to ensure your investments align with your changing circumstances and financial objectives.

This image is property of www.usfunds.com.

Staying Informed and Adapting

Monitoring Market News and Trends

Staying informed about market news and trends is essential for any investor, including those interested in gold. By keeping an eye on economic indicators, geopolitical developments, and gold-specific news, you can make more informed investment decisions. Regularly reading financial news, following reputable sources, and staying updated on market trends can help you navigate the gold market with greater confidence.

Regular Portfolio Reviews

Regular portfolio reviews are vital in assessing the performance of your investments and ensuring they align with your goals. Analyze the performance of your gold investments in relation to other assets and evaluate if any adjustments are necessary. By regularly reviewing your portfolio, you can identify any potential risks or opportunities and make informed decisions accordingly.

Evaluating Long-Term Performance

Evaluating the long-term performance of your gold investments is crucial for assessing their effectiveness in your portfolio. While short-term fluctuations are expected, it’s important to focus on the overall trend and whether gold has helped achieve your investment objectives over time. Be patient and maintain a long-term perspective when evaluating the performance of your gold investments.

Seeking Professional Advice

Consulting with Financial Advisors

Seeking professional advice from a financial advisor can provide valuable insights and guidance when it comes to investing in gold. Financial advisors have expertise in understanding market dynamics, risk management strategies, and individual financial goals. They can help tailor an investment plan that aligns with your specific needs and objectives.

Joining Investment Communities

Joining investment communities, whether online or in-person, can provide opportunities to learn from and engage with fellow investors. Sharing experiences, discussing investment strategies, and staying updated on industry trends can help you make more informed decisions when it comes to gold investments. However, always exercise caution and verify information before making any investment decisions based on community discussions.

Attending Investment Seminars

Attending investment seminars can be an effective way to enhance your knowledge and gain insights from industry experts. These seminars often cover a wide range of investment topics, including gold investments. By participating in such events, you can learn from experienced professionals, ask questions, and network with fellow investors who share similar interests.

Investing in gold requires careful consideration, research, and a balanced approach. By understanding the factors that affect the gold market, evaluating the risks and potential rewards, analyzing historical performance, determining the right allocation, utilizing strategies to minimize risk, staying informed, and seeking professional advice, you can navigate the gold market with cautious optimism. Remember, investing is a journey, and it’s essential to adapt and refine your approach as you gain more experience and knowledge.