If you’ve been keeping a close eye on the economic landscape, you may have noticed a pattern: the ever-repeating cycle of boom and bust. It’s a rollercoaster ride that many investors have experienced first-hand, and it’s a wild ride that can leave you feeling dizzy and disoriented. But fear not! In this article, we’re going to explore the fascinating role that gold plays in these economic ups and downs. Gold, a timeless and precious metal, has long been considered a safe haven and a hedge against inflation, making it a go-to investment for many during uncertain times. So, buckle up, my fellow investors, and let’s take a closer look at how gold can help navigate the tumultuous seas of economic boom-bust cycles.

This image is property of images.unsplash.com.

Introduction

Economic boom-bust cycles are a recurring feature of modern economies, characterized by periods of rapid expansion followed by sharp contractions. These cycles can have significant impacts on individuals, businesses, and governments alike. In such times of economic turbulence, the role of gold becomes crucial. Gold has long been considered a safe haven, a store of value, and a diversification tool for investors. In this article, we will delve into the understanding of economic boom-bust cycles, explore the historical significance of gold, and examine its behavior during both boom and bust periods.

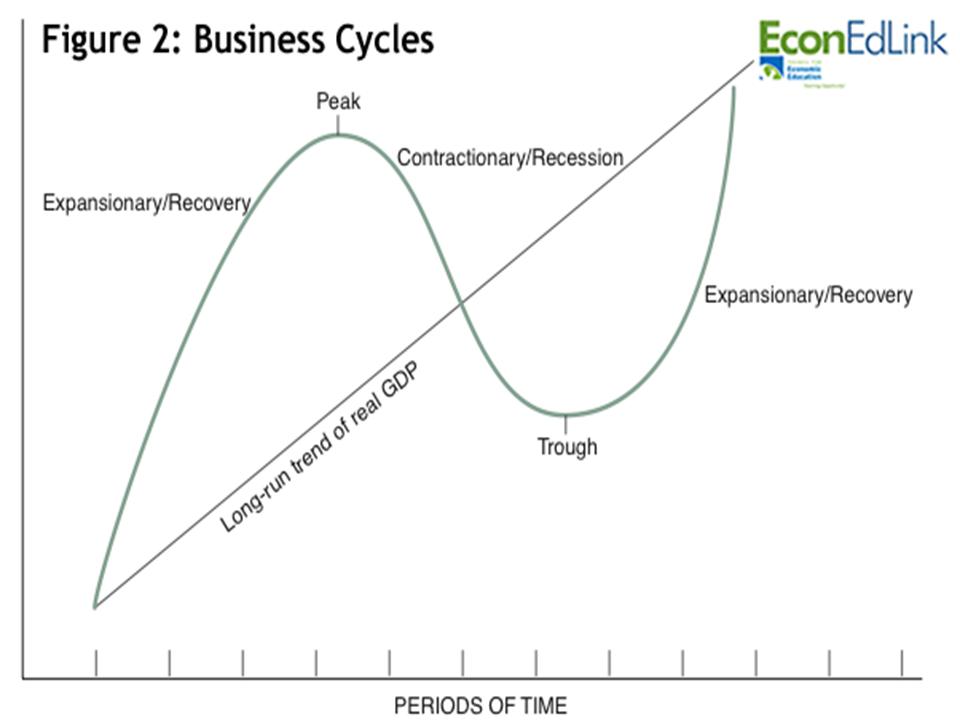

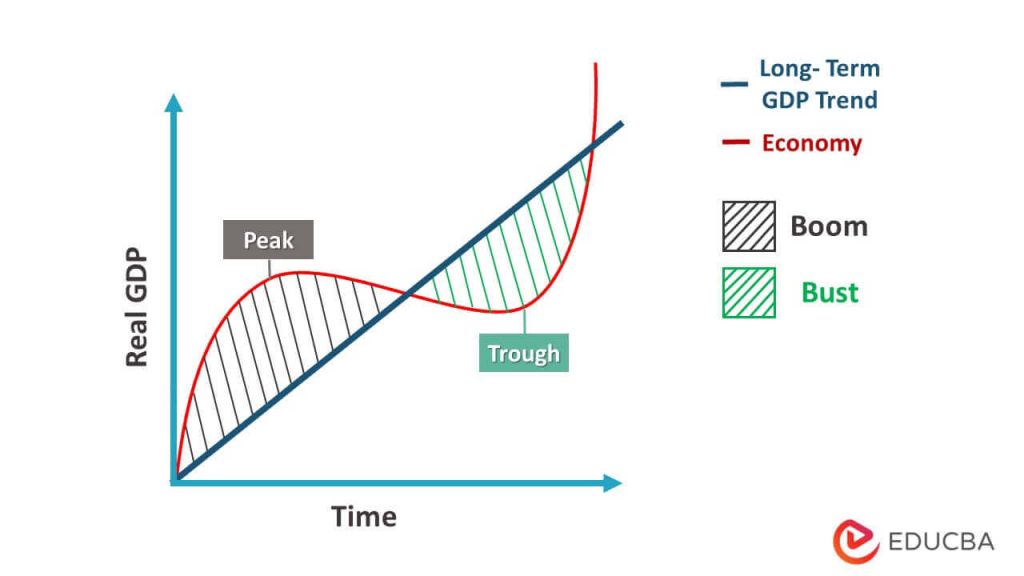

Understanding Economic Boom-Bust Cycles

Definition of Economic Boom

An economic boom refers to a period of high economic growth characterized by increased production, employment rates, and consumer spending. During a boom, businesses thrive, stock markets soar, and optimism pervades the overall economic sentiment. It is marked by rising asset prices, expanding credit, and an abundance of investment opportunities.

Causes of Economic Booms

Economic booms are often fueled by a combination of factors, including technological advancements, increased consumer confidence, expansionary monetary policies, and favorable government regulations. These factors can stimulate economic activity, leading to increased production, investment, and consumption.

Characteristics of Economic Booms

During a boom, various economic indicators soar. GDP growth rates tend to be high, unemployment rates drop, and consumer spending increases. Additionally, stock markets experience significant gains, and real estate markets witness rising property prices. Both businesses and individuals often find themselves in a favorable financial position during this period.

Definition of Economic Bust

An economic bust, also known as a recession or economic downturn, is a period of contraction following an economic boom. It is typically characterized by a decline in economic activity, a slowdown in production, and a decrease in employment rates. Asset prices often experience a significant decline, and confidence in the economy wanes.

Causes of Economic Busts

Economic busts are often triggered by a range of factors, such as financial crises, bursting asset bubbles, or changes in government policies. These factors can lead to decreased consumer and investor confidence, resulting in a decline in spending and investment. As a consequence, businesses may face reduced demand, causing layoffs and reduced production.

Characteristics of Economic Busts

During an economic bust, several key indicators exhibit negative trends. GDP growth rates decline, unemployment rates rise, and consumer spending decreases. Stock markets experience considerable losses, and real estate markets witness falling property prices. The overall economic sentiment becomes pessimistic, with businesses and individuals facing financial challenges.

This image is property of images.unsplash.com.

The Role of Gold in Economic Boom-Bust Cycles

Historical Significance of Gold

Gold has held significant value throughout history and has been used as a medium of exchange and a store of wealth for centuries. Its scarcity and timeless appeal have made it a coveted asset across civilizations. From ancient Egypt to modern times, gold has represented wealth, power, and stability.

Gold as a Safe Haven

One of the primary roles of gold in economic boom-bust cycles is its status as a safe haven asset. During times of economic uncertainty and market volatility, investors flock to the safety and stability of gold. Gold’s limited supply, tangible nature, and universal acceptance make it a sought-after asset in times of crises.

Gold as a Store of Value

Gold’s ability to preserve value over time sets it apart from fiat currencies, which can be subject to inflation and devaluation. While the value of paper currency can fluctuate with economic conditions, gold has historically maintained its purchasing power. It serves as a reliable store of wealth, protecting investors’ purchasing power over the long term.

Gold as a Diversification Tool

Gold also plays a crucial role as a diversification tool in investment portfolios. By adding gold to a diversified portfolio, investors can potentially reduce overall risk. Gold has historically had a low correlation with other asset classes such as stocks and bonds, meaning it may perform differently during economic cycles. This diversification can help offset losses in one asset class with gains in another, providing stability and potentially enhancing overall returns.

Gold Price Behavior during Economic Booms

During economic booms, the price of gold can exhibit mixed behavior. Initially, optimism and increased economic activity may lead investors to shift their focus away from gold and towards riskier assets such as stocks. However, as the boom progresses and risks become more apparent, gold’s appeal as a safe haven asset may resurface, driving its price higher.

Gold Price Behavior during Economic Busts

During economic busts, the price of gold tends to experience more consistent upward trends. As economic conditions deteriorate, investors seek refuge in the stability of gold, driving up demand and prices. The negative sentiment surrounding the broader economy often reinforces gold’s status as a safe haven, amplifying its price appreciation.

Gold as a Safe Haven

Why Investors Turn to Gold during Uncertain Times

Investors turn to gold during uncertain times because of its qualities as a safe haven asset. It offers protection against market volatility, currency devaluation, geopolitical tensions, and financial turmoil. Gold provides a sense of security and acts as a hedge against economic uncertainties.

Factors Influencing Gold’s Safe Haven Status

Several factors contribute to gold’s safe haven status. These include its scarcity, durability, limited supply, and consistent global demand. Additionally, concerns over inflation, currency fluctuations, and market instability enhance gold’s attractiveness as a safe haven asset.

Examples of Gold’s Performance as a Safe Haven Asset

Throughout history, gold has demonstrated its safe haven qualities in crises and economic downturns. During the 2008 financial crisis, when stock markets plummeted and financial institutions faltered, the price of gold surged as investors sought shelter from the storm. Similarly, during the COVID-19 pandemic, gold reached record highs as the global economy faced uncertainty and central banks implemented expansive monetary policies.

This image is property of images.unsplash.com.

Gold as a Store of Value

Gold’s Intrinsic Value vs. Fiat Currency

Gold’s intrinsic value lies in its scarcity, aesthetic appeal, and industrial uses. Unlike fiat currencies, which are backed by trust in central banks, gold possesses inherent value that is not subject to manipulation or devaluation. This makes gold an attractive option for long-term wealth preservation.

Historical Examples of Gold’s Value Preservation

Gold’s value preservation can be observed throughout history. Over centuries, gold has maintained its purchasing power, even as currencies have experienced significant fluctuations and devaluations. From the Roman Empire to the present day, gold has stood the test of time as a reliable store of value.

Inflation and Gold’s Store of Value

Inflation erodes the purchasing power of fiat currencies over time. However, gold has historically acted as a hedge against inflation, preserving its value when paper currencies lose theirs. As the general price level rises, the value of gold often rises in tandem, mitigating the impacts of inflation on investors.

Gold as a Diversification Tool

Benefits of Diversification

Diversification is a risk management strategy aimed at reducing the overall volatility of an investment portfolio. By diversifying across different asset classes, including gold, investors can potentially lower the impact of any single investment on their overall portfolio performance. Diversification allows for a smoother ride during economic fluctuations and increases the potential for long-term gains.

Correlation between Gold and Other Assets

Gold’s low correlation with traditional financial assets, such as stocks and bonds, makes it an attractive diversification tool. When stocks and other assets experience declines, gold often moves independently, or even counter-cyclically, providing a potential buffer against losses. This lack of correlation can enhance portfolio stability and potentially improve risk-adjusted returns.

Portfolio Allocation Strategies

The allocation of gold in a portfolio is subjective and depends on an individual’s investment goals, risk tolerance, and time horizon. Some investors allocate a small percentage of their portfolio to gold, while others may choose a more significant allocation. Regardless of the allocation, gold can provide diversification benefits and serve as a long-term wealth preservation tool.

This image is property of tradeproacademy.com.

Gold Price Behavior during Economic Booms

Factors Influencing Gold Prices during Booms

Several factors can influence gold prices during economic booms. Optimism, increased risk appetite, and higher interest rates may divert investment flows away from gold, leading to price declines. However, as economic boom periods progress and risks emerge, factors such as geopolitical tensions, stock market volatility, and concerns about inflation can drive investors back to gold, pushing prices higher.

Demand and Supply Dynamics

The demand for gold during economic booms is influenced by various factors. Jewelry demand, which accounts for a significant portion of gold consumption, tends to rise as incomes increase. Additionally, industrial demand for gold in sectors such as electronics and technology can also increase during economic expansions. On the supply side, gold production may increase as mining companies ramp up operations to meet growing demand.

Impact of Economic Indicators on Gold Prices

Gold prices can be influenced by a range of economic indicators during booms. For example, rising inflation expectations may drive up gold prices, as investors view gold as a hedge against the erosion of purchasing power. Monetary policy decisions, such as interest rate changes, can also impact gold prices, as shifts in interest rates can affect the cost of holding gold and the relative attractiveness of other investments.

Gold Price Behavior during Economic Busts

What Happens to Gold Prices during Economic Busts

During economic busts, gold prices tend to experience upward movements. As investors seek safe haven assets amidst economic uncertainty, the demand for gold increases, driving prices higher. The negative sentiment surrounding the broader economy further reinforces gold’s position as a store of value and leads to appreciation in its price.

Role of Investor Sentiment

Investor sentiment plays a crucial role in determining gold prices during economic busts. Negative market sentiment, fear of economic turmoil, and a lack of confidence in traditional financial assets all contribute to the increased demand for gold. The sentimental shift towards safer assets drives investors to purchase and hold gold, exerting upward pressure on its price.

Central Bank Policies and Gold Prices

Central bank policies also impact gold prices during economic busts. Expansive monetary policies, such as quantitative easing, can increase inflationary concerns and drive investors towards gold as a hedge. Similarly, if central banks implement policies aimed at stabilizing the financial system or devaluing their currencies, it can bolster the appeal of gold as a safe haven asset.

This image is property of cdn.educba.com.

Practical Considerations for Investing in Gold

Different Ways to Invest in Gold

Investors have various options for investing in gold, each with its own considerations. These include purchasing physical gold in the form of bars or coins, investing in gold exchange-traded funds (ETFs), buying shares of gold mining companies, or trading gold futures contracts. Each approach carries its own advantages and risks, depending on factors such as liquidity, storage costs, and market accessibility.

Factors to Consider before Investing

Before investing in gold, several factors should be taken into account. These include an investor’s risk tolerance, investment horizon, and overall financial goals. Additionally, considering the current economic climate, gold market trends, and the potential impact of geopolitical events on gold prices is important. Conducting thorough research and consulting with a financial advisor can help navigate the complexities of gold investing.

Risk Management Strategies

As with any investment, managing risks is crucial. Diversification, as mentioned earlier, can help mitigate risks associated with gold investments. Setting clear investment objectives, establishing a risk tolerance level, and regularly monitoring and adjusting the investment portfolio are also essential risk management practices. Additionally, understanding the costs and logistics of owning physical gold, such as storage and insurance options, is necessary for prudent risk management.

Conclusion

In conclusion, gold plays a significant role in economic boom-bust cycles. Its historical significance, safe haven status, ability to store value, and diversification benefits make it a valuable asset for investors. During economic booms, gold prices can exhibit mixed behavior, while during busts, prices tend to rise as investors seek refuge from economic uncertainties. Understanding the various factors that influence gold prices, the impact of economic indicators, and practical considerations for investing in gold can help investors navigate through economic cycles and make informed decisions. As an investor, recognizing the role of gold in economic boom-bust cycles can enhance your investment strategy and potentially protect and grow your wealth.