Let’s talk gold and geopolitics, shall we? We all know that gold is a highly sought-after commodity, valued for its beauty and as a store of wealth. But did you know that the world of geopolitical events can have a significant impact on gold prices? That’s right, the connection between gold and geopolitics runs deep, and understanding this relationship can be crucial for investors. In this article, we’ll analyze how geopolitical factors influence the price of gold, and why keeping an eye on global events is essential in the world of gold investing. So, buckle up and get ready to delve into the fascinating world of gold and geopolitics!

This image is property of www.smallcase.com.

I. Introduction

Welcome to my blog on investment! Today, we are going to dive into the fascinating world of gold and its intricate relationship with geopolitics. As an experienced investor in gold, I understand the importance of keeping a close eye on geopolitical events and their potential impact on gold prices. In this article, we will explore the definition and characteristics of gold, its historical significance, and how global geopolitics can influence its prices. We will also analyze recent geopolitical events, strategies, and their effects on gold investment. So, let’s get started!

II. Understanding Gold

A. Definition and Characteristics of Gold

Gold, the lustrous yellow metal, has captivated humanity for centuries. Its chemical symbol, Au, is derived from the Latin word “aurum,” which means shining dawn. Gold is one of the rarest elements found on Earth and possesses unique characteristics that make it highly valued. It is known for its resistance to corrosion, malleability, and its ability to conduct heat and electricity. These properties, combined with its aesthetic appeal, have made gold not only a symbol of wealth but also a reliable store of value throughout history.

B. Historical Significance of Gold

Gold has played a significant role in human civilization for thousands of years. Ancient civilizations, such as the Egyptians, Greeks, and Romans, adorned themselves with gold jewelry and used it as a form of currency. In more recent times, gold has been used to back currencies and stabilize economies. The Gold Standard, which was prevalent until the mid-20th century, tied the value of national currencies to a fixed amount of gold. Despite the abandonment of the Gold Standard, gold continues to be viewed as a safe-haven asset during times of economic uncertainty.

This image is property of www.spglobal.com.

III. Geopolitics and its Impact on Gold Prices

A. Definition and Explanation of Geopolitics

Geopolitics refers to the study of how geography, power, and resources influence political behavior and international relations. This field examines the interplay between nations, their alliances, conflicts, and economic activities. Geopolitical factors can encompass a wide range of aspects, including military conflicts, political stability, economic sanctions, trade disputes, and the actions of central banks. Understanding geopolitics is crucial for investors, as it provides insights into potential risks and opportunities in the global market.

B. The Role of Geopolitical Factors in Gold Prices

Geopolitics has a significant impact on gold prices due to its status as a safe-haven asset. When geopolitical tensions rise, investors tend to seek refuge in assets that are perceived as stable and reliable. Gold, with its historical track record as a store of value, becomes an attractive investment option during times of uncertainty. The demand for gold increases, thereby driving up its price. Conversely, when geopolitical relations improve and stability is restored, the demand for gold as a safe-haven asset diminishes, leading to a decrease in its price.

IV. Major Geopolitical Events and their Effects on Gold Prices

A. Global Conflicts

Global conflicts, such as wars and territorial disputes, have a profound influence on gold prices. During times of heightened tensions, investors fear the impact on global economies and seek refuge in gold. For example, the 2001 terrorist attacks in the United States and subsequent conflicts in the Middle East led to a surge in gold prices as investors sought safety. The outbreak of conflicts, political unrest, or even the threat of war can lead to increased demand for gold and subsequent price appreciation.

B. Political Instability

Political instability within a country or region can also impact gold prices. When governments undergo significant changes, whether through revolutions, coups, or political crises, the uncertainty that follows can drive investors towards safe-haven assets like gold. The fear of economic disruption or policy changes can lead to increased demand for gold as a hedge against potential losses. Consequently, gold prices tend to rise during periods of political upheaval.

C. Economic Sanctions and Trade Disputes

The imposition of economic sanctions or the emergence of trade disputes between nations can have a direct impact on gold prices. When countries engage in trade wars or impose sanctions on one another, global economic growth becomes uncertain. This uncertainty prompts investors to seek refuge in gold, driving up its demand and consequently its price. The recent trade tensions between the United States and China serve as a prime example of how geopolitical trade disputes can affect gold prices.

This image is property of lh4.googleusercontent.com.

V. Geopolitical Strategies and their Impact on Gold Prices

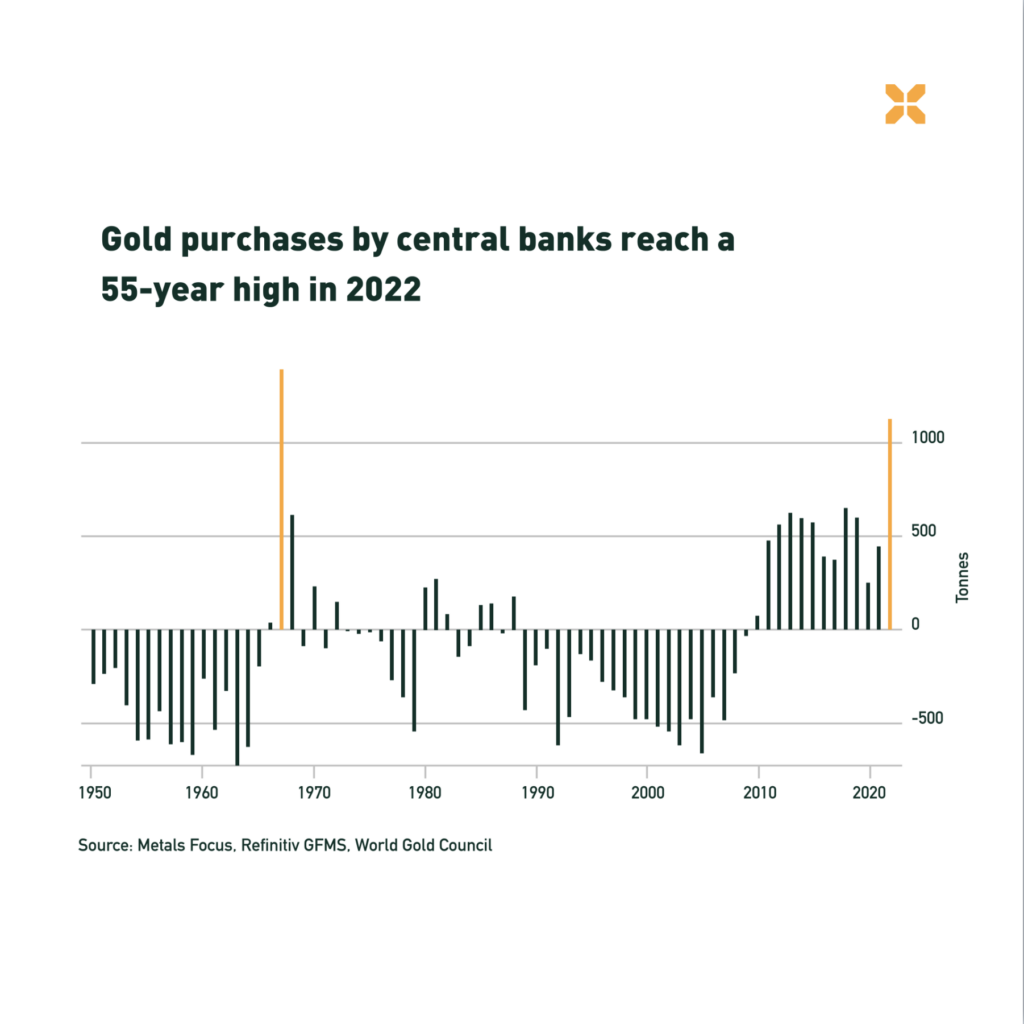

A. Central Bank Actions

The actions and policies of central banks have a significant impact on gold prices. Central banks holding large gold reserves can influence the market by buying or selling gold. For instance, central banks may reduce interest rates or implement quantitative easing measures during economic downturns. These actions weaken currencies and increase the demand for safe-haven assets like gold. Similarly, when central banks buy gold, it signals confidence in the metal, leading to an increase in prices.

B. Market Speculation

Market speculation, driven by geopolitical events, can cause fluctuations in gold prices. Investors closely monitor geopolitical developments and analyze their potential impact on the market. Speculators take positions in gold based on their predictions of future events. For instance, if tensions between countries escalate, speculators may anticipate a surge in gold prices and buy gold contracts accordingly. This speculation can lead to short-term spikes or drops in gold prices, depending on market sentiment.

C. Investor Sentiments

Investor sentiments play a crucial role in determining gold prices. During times of uncertainty, when geopolitical events dominate headlines, investor confidence in traditional assets may waver. In such situations, gold appears as a safe-haven option, attracting investors seeking to safeguard their wealth. Conversely, periods of relative geopolitical stability can shift investor sentiments away from gold, leading to a decline in its demand and price.

VI. Recent Geopolitical Influences on Gold Prices

A. Impact of US-China Trade War

The US-China trade war, which began in 2018, had a significant impact on gold prices. As the two largest economies in the world engaged in tit-for-tat tariffs, global economic growth became uncertain. Investors turned to gold as a hedge against the potential fallout from the trade war. Consequently, gold prices experienced upward momentum during the escalation of tensions, reflecting the market’s perception of gold as a safe-haven asset.

B. Brexit and its Effects on Gold Prices

The prolonged uncertainty surrounding Brexit, the withdrawal of the United Kingdom from the European Union, has also influenced gold prices. The negotiations and political turmoil surrounding Brexit have created economic uncertainty, leading investors to seek refuge in gold. Whenever significant developments occur in the Brexit process, such as deadlines or trade agreements, gold prices often experience fluctuations as a response to changing market sentiments.

This image is property of s21309.pcdn.co.

VII. Analyzing Geopolitics and Gold Investment

A. Factors to Consider in Gold Investment

When analyzing gold investment, it is essential to consider multiple factors influenced by geopolitical events. These factors include geopolitical tensions, global economic stability, central bank policies, and investor sentiments. By assessing these elements, investors can gain a comprehensive understanding of gold’s potential performance and make informed investment decisions.

B. Diversification and Risk Management

Gold, as a safe-haven asset, plays a crucial role in diversifying investment portfolios and managing risks. Adding gold to a diversified portfolio can offset potential losses in other asset classes during times of economic turmoil. Geopolitical events can introduce significant volatility to financial markets, making risk management a critical consideration for investors. Incorporating gold into a well-balanced portfolio can provide stability and act as a hedge against potential market downturns.

C. Long-term vs. Short-term Investing

Geopolitical events can influence gold prices in both the short and long term. Short-term fluctuations are often driven by market sentiments and speculations. In contrast, long-term trends are shaped by broader geopolitical factors and macroeconomic conditions. Investors interested in gold should be prepared for short-term volatility while focusing on the long-term potential of gold as a wealth preservation asset.

VIII. Forecasting Gold Prices with Geopolitical Analysis

A. Tools and Techniques for Analysis

Forecasting gold prices using geopolitical analysis requires a combination of fundamental and technical analysis. Fundamental analysis involves examining geopolitical events, economic indicators, and central bank policies to assess potential impacts on gold prices. Technical analysis, on the other hand, uses historical price data and charts to identify trends and patterns. By combining these analytical approaches, investors can make more accurate forecasts regarding gold prices.

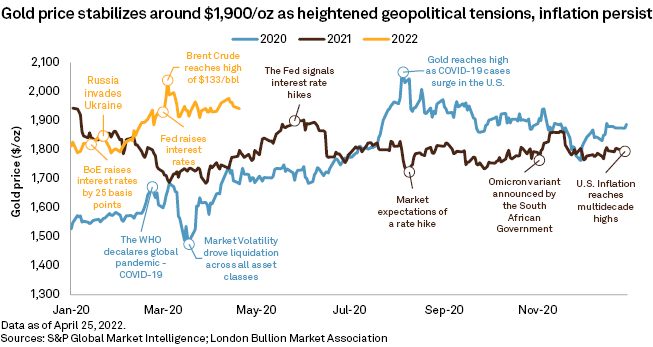

B. Case Studies and Examples

Case studies and historical examples can provide valuable insights into how geopolitical events influenced gold prices in the past. Analyzing the impact of events like the 2008 global financial crisis, geopolitical conflicts in the Middle East, or the financial implications of the COVID-19 pandemic can help investors better understand the relationship between geopolitics and gold prices. By studying these cases, investors can learn from past trends and enhance their ability to forecast future gold price movements.

This image is property of whitegold.money.

IX. Conclusion

As we conclude this in-depth exploration of the connection between gold and geopolitics, we can see that geopolitical events have a profound impact on gold prices. Gold’s historical significance as a safe-haven asset makes it highly responsive to global geopolitical developments. Understanding the dynamics of geopolitics and its influence on gold prices is essential for investors aiming to make informed decisions in the ever-changing investment landscape. By analyzing past cases, monitoring ongoing events, and using appropriate analytical tools, investors can navigate the intricacies of the gold market and potentially capitalize on its price movements. Remember, investing in gold requires careful consideration, diversification, and a long-term perspective. Stay informed, stay patient, and happy investing!