Gold has long been touted as a safe investment during times of inflation, but does it really provide the protection that investors seek? While gold has historically held its value well during inflationary periods, it is not foolproof. Factors such as supply and demand, economic stability, and market sentiment all play a role in determining the performance of gold in relation to inflation. In this article, we will explore the concept of the inflation paradox and delve into the nuances of gold as an inflation hedge. Whether you’re a seasoned investor or just starting out, understanding the intricacies of gold and its relationship with inflation is crucial for making informed investment decisions. So, let’s dive in and unravel the mystery of gold’s protective properties in the face of inflation.

I. Understanding the Inflation Paradox

A. Introduction

Gold has long been considered a safe haven asset, particularly in times of economic uncertainty. Investors often rush to invest in gold as a way to protect their wealth against inflation. However, there is an intriguing phenomenon known as the “inflation paradox” that challenges the conventional wisdom surrounding gold’s ability to provide protection against inflation. In this article, we will explore the concept of the inflation paradox, its historical context, and evaluate the effectiveness of gold as an inflation hedge.

B. Defining the Inflation Paradox

The inflation paradox refers to the seemingly contradictory relationship between gold and inflation. Traditionally, gold has been perceived as a reliable hedge against inflation. The theory is that as inflation erodes the purchasing power of fiat currencies such as the US dollar, the value of gold, which has limited supply, increases. However, in practice, the relationship between inflation and the price of gold is not always straightforward. There have been instances where gold prices have not risen in tandem with inflation, leading to a paradoxical situation.

C. Historical Perspective

To understand the inflation paradox, it is important to examine the historical context. Throughout history, gold has served as a store of value and a medium of exchange. Its scarcity and durability have made it a desirable asset for individuals and nations alike. During times of economic instability or currency devaluation, gold has often been sought after as a form of financial security. This historical perspective provides a foundation for understanding the role of gold in relation to inflation.

II. Gold as an Inflation Hedge

A. The Traditional View

The traditional view holds that gold serves as a hedge against inflation due to its intrinsic value and limited supply. When the value of fiat currencies declines due to inflationary pressures, investors seek refuge in assets like gold, driving up its price. The belief is that gold will retain its value over time, serving as a reliable store of wealth despite inflationary pressures.

B. The Relationship with Inflation

While the traditional view suggests a strong positive correlation between gold and inflation, the reality is more complex. The relationship between gold and inflation is influenced by various factors, including market sentiment, economic conditions, and investor behavior. It is important to recognize that gold is not solely driven by inflation but also reacts to other economic and geopolitical factors.

C. Popular Perception

Gold’s reputation as an inflation hedge has made it a popular investment choice among individuals and institutions. The perception that gold will always rise in value during periods of inflation has fueled its demand. However, it is crucial to assess the accuracy of this perception and to recognize that gold’s performance as an inflation hedge can vary.

D. Gold’s Historical Performance

From a historical perspective, gold has demonstrated mixed results in terms of its performance as an inflation hedge. While there have been instances where gold prices have surged during periods of high inflation, there have also been occasions where the relationship between gold and inflation has been weak or even negative. This historical performance underscores the complexity of gold’s role as an inflation hedge and highlights the need for a comprehensive evaluation.

III. Evaluating Gold’s Effectiveness

A. Factors Influencing Gold’s Performance

Various factors can influence gold’s performance as an inflation hedge. These include supply and demand dynamics, investor sentiment, monetary policy decisions, and macroeconomic indicators. It is crucial to consider these factors in evaluating the effectiveness of gold as a hedge against inflation.

B. The Role of Other Assets

Investors often diversify their portfolios with a mix of different assets, including stocks, bonds, and commodities. The relationship between gold and other assets can impact its performance as an inflation hedge. For example, if stocks and bonds perform well during inflationary periods, investors may allocate less to gold, potentially dampening its price appreciation.

C. Diversification Benefits

One of the key arguments in favor of gold as an investment is its diversification benefits. Gold has shown a low correlation with traditional financial assets, providing potential portfolio protection against market downturns. While its effectiveness as an inflation hedge may fluctuate, maintaining a diversified portfolio that includes gold can help mitigate risks and enhance overall performance.

IV. Exceptions to the Rule

A. High Inflation Environments

While gold’s relationship with inflation may not always be consistent, there are instances where it has proven to be an effective hedge. During periods of high inflation, such as the 1970s, gold experienced significant price increases, providing investors with a store of value. In such environments, the scarcity and intrinsic value of gold can drive its price upwards, aligning with the traditional view of gold as an inflation hedge.

B. Deflationary Pressures

While gold is often associated with protecting against inflation, it can also serve as a hedge against deflationary pressures. In times of deflation, where the general price level declines, gold’s value as a tangible asset can provide stability and mitigate losses. The historical performance of gold during deflationary periods highlights its versatility as an investment option.

C. Central Bank Policies

Central bank policies, such as quantitative easing or tightening, can significantly impact the relationship between gold and inflation. Unconventional monetary measures, like quantitative easing, can create inflationary concerns, leading investors to seek gold as a hedge. On the other hand, if central banks implement restrictive policies to combat inflation, the demand for gold as a hedge may be diminished. Therefore, understanding and monitoring central bank policies is crucial in assessing gold’s effectiveness as an inflation hedge.

V. Current Economic Landscape

A. Quantitative Easing and Stimulus Measures

In response to recent economic challenges, central banks around the world have implemented unprecedented measures such as quantitative easing and stimulus programs. These policies aim to stimulate economic growth but carry inflationary risks. With the potential for increased inflation, the demand for gold as a hedge may rise. However, the effectiveness of gold as an inflation hedge in this unique economic landscape remains to be seen.

B. Low-Interest Rate Environments

Low-interest rate environments, which have become prevalent in many economies, can impact the relationship between gold and inflation. When interest rates are low, the opportunity cost of holding gold decreases, making it a more attractive investment. This increased demand can potentially drive up the price of gold, even in the absence of significant inflationary pressures.

C. Inflationary Concerns

In the current economic climate, rising inflationary concerns have become a prominent theme. Factors such as increased government spending, supply chain disruptions, and rising commodity prices have fueled speculation of potential inflationary pressures. As investors seek ways to protect their wealth, the allure of gold as an inflation hedge may become more pronounced.

VI. The Role of Gold in a Diversified Portfolio

A. Portfolio Allocation Strategies

Gold can play a valuable role in a well-diversified investment portfolio. The specific allocation to gold will depend on an individual’s risk tolerance, investment goals, and market outlook. Some investors choose to allocate a small percentage of their portfolio to gold as a long-term store of value, while others may opt for a more substantial allocation to capitalize on potential price appreciation.

B. Risk-Return Trade-off

It is important to recognize that investing in gold, like any other asset, carries inherent risks. While gold has demonstrated its ability to preserve wealth over the long term, its price can fluctuate significantly in the short term. Investors must carefully consider their risk tolerance and investment horizon when evaluating the potential risk-return trade-off associated with gold investments.

C. Long-term Investment Perspective

Gold’s historical performance suggests that a long-term investment perspective is crucial. Short-term price movements driven by market sentiment or speculative activity may not accurately reflect gold’s role as an inflation hedge. By maintaining a long-term investment horizon, investors can better position themselves to take advantage of gold’s potential as a store of value and diversification tool.

VII. Other Factors to Consider

A. Transaction Costs and Liquidity

When considering investing in gold, it is essential to account for transaction costs and liquidity. Buying and selling physical gold may involve fees and premiums, while certain investment vehicles like gold ETFs or mining stocks may have additional costs. Moreover, the liquidity of gold assets can vary, impacting the ease of buying or selling.

B. Storage and Security

If you choose to invest in physical gold, storage and security become important considerations. Gold bullion or coins need to be stored safely, ideally in a secure vault or safe deposit box. The cost and accessibility of secure storage should be weighed against the benefits of physical ownership.

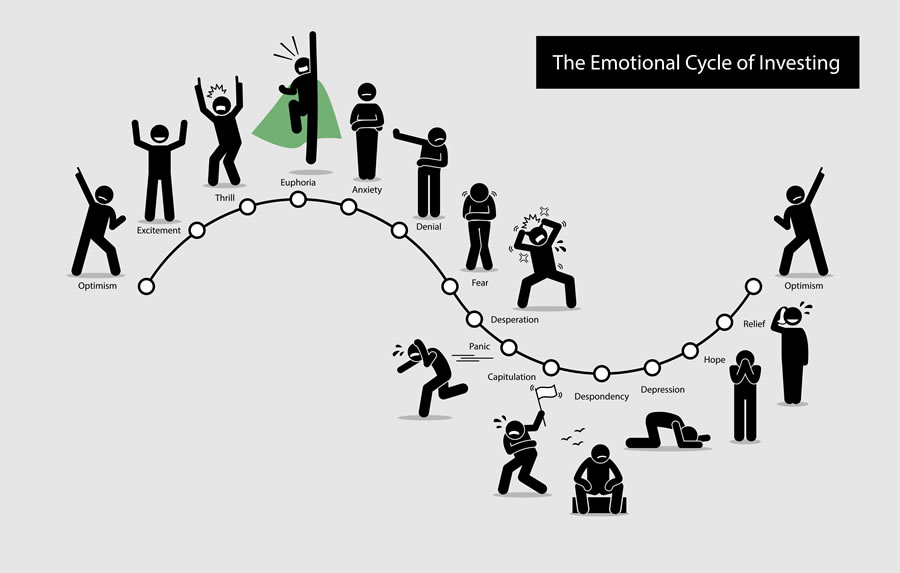

C. Psychological Bias

Investing in gold is not immune to psychological biases that can affect investment decision-making. Fears of inflation or economic instability can drive emotional responses, leading to impulsive actions. It is essential to acknowledge and manage these biases to make rational investment choices.

VIII. Investing in Gold

A. Different Investment Vehicles

There are multiple ways to invest in gold, each with its own advantages and considerations. Physical ownership of gold in the form of bullion or coins provides direct exposure to the metal but comes with storage and security requirements. Investing in gold ETFs offers the convenience of trading on exchanges while tracking the price of gold. Additionally, investing in gold mining stocks provides exposure to the industry as a whole but carries specific risks associated with the mining sector.

B. Due Diligence and Research

Before investing in gold, conducting due diligence and research is of utmost importance. Understanding the fundamentals of gold, monitoring market trends, and evaluating the performance of various investment vehicles can help inform investment decisions. Seeking reputable sources of information and consulting financial professionals can contribute to a well-informed investment strategy.

C. Seeking Professional Advice

Investing in gold, like any other investment, requires careful consideration and evaluation of individual circumstances. While this article provides a comprehensive overview of gold’s role as an inflation hedge, seeking professional financial advice tailored to your specific needs is recommended. Financial advisors can offer personalized guidance and help navigate the complexities of the gold market.

IX. Conclusion

Gold’s reputation as an inflation hedge has made it a popular choice among investors seeking protection against inflationary pressures. However, the concept of the inflation paradox challenges the assumption that gold always provides reliable protection. While gold has shown historically mixed results, its diversification benefits and potential as a store of value cannot be dismissed. Understanding the dynamics of gold’s relationship with inflation, along with considering other factors such as central bank policies and market conditions, can help investors make informed decisions when incorporating gold into their investment portfolios. As with any investment, conducting thorough research, assessing risk tolerance, and seeking professional guidance are essential in navigating the complexities of investing in gold.