Gold Bubbles: Examining Historical Instances of Price Speculation

Hey there! So, we all know that gold is often seen as a safe haven investment, right? But have you ever wondered about those times when the price of gold skyrocketed, only to come crashing down? Well, in this article, we’re going to dive into the fascinating world of gold bubbles and take a closer look at some historical instances of price speculation. From the Dutch Tulip Mania of the 17th century to more recent examples like the Dotcom Bubble, we’ll explore the factors that contribute to the creation and ultimate bursting of these glittering bubbles. So, grab your seat and get ready to learn more about the mesmerizing world of gold bubbles!

This image is property of goldbroker.com.

1. Tulip Mania in the 17th Century

1.1 Background of Tulip Mania

Tulip Mania refers to a period in the 17th century in the Dutch Republic when the prices of tulip bulbs reached extraordinary levels before collapsing abruptly. Tulips were introduced to Europe from the Ottoman Empire in the mid-1500s and quickly gained popularity. By the early 17th century, tulips had become a status symbol and a speculative asset in the Netherlands.

1.2 Factors contributing to the bubble

Several factors contributed to the formation of the tulip bubble. Firstly, tulips were seen as a luxury item and a symbol of wealth. This created a demand for tulip bulbs, driving up their prices. Additionally, a unique feature of tulips called “breaks” added to the speculation. These breaks caused the tulips to display different patterns and colors, further increasing their value.

Another contributing factor was the emergence of futures contracts or “windhandel” in the Dutch language. These contracts allowed buyers to purchase tulip bulbs at a future date, regardless of the current price. This mechanism fueled speculation, as people started trading tulip bulbs even without physical possession.

1.3 Collapse of the tulip bubble

The tulip bubble reached its peak in February 1637 when tulip prices reached extremely high levels. However, the bubble burst quickly, leading to a sharp decline in the prices of tulip bulbs. Many traders who had purchased tulips at exorbitant prices were unable to sell them at a profit, leading to panic selling. The crash caused significant economic damage, with many people losing their fortunes.

2. Mississippi Company Bubble

2.1 The rise of the Mississippi Company

The Mississippi Company was founded by John Law, a Scottish economist, in the early 18th century to establish and develop French colonies in Louisiana and trade with them. The company became highly popular among investors due to Law’s aggressive promotion and promises of high profitability.

2.2 Speculation and the bubble formation

To attract investors, Law issued shares of the Mississippi Company and assigned a monopoly over trade in French colonies. The value of these shares skyrocketed, fueled by speculative buying. Law’s plan to create a paper currency, known as the “Banque Royale,” further fueled the bubble formation, as people believed in the value of the shares and the currency.

2.3 The burst of the Mississippi Company bubble

The Mississippi Company bubble burst in 1720 when doubts about the company’s ability to fulfill its promises arose. The value of the shares plummeted, leading to panic selling. The French government stepped in to contain the crisis, but it had a significant impact on the economy and investor confidence. The burst of the Mississippi Company bubble exposed the risks of relying on speculative investment schemes.

This image is property of goldbroker.com.

3. South Sea Bubble

3.1 Overview of the South Sea Company

The South Sea Company was established in 1711 as a British trading company with the intention of conducting trade with South America. Similar to the Mississippi Company, the South Sea Company’s shares became highly sought-after due to speculative frenzy and promises of high returns.

3.2 The growth of speculation

The South Sea Company inflated its share price through marketing and propaganda, attracting a large number of investors. Speculators, including members of Parliament and even royalty, bought shares with the expectation of substantial profits. The company also implemented a plan to take over a significant portion of the British national debt, further driving up the share prices.

3.3 Bursting of the South Sea bubble

In 1720, the South Sea bubble burst, causing immense financial losses. The company’s share price plummeted, wiping out the investments of many. The bursting of the bubble led to a financial crisis and prompted the government to pass legislation to regulate joint-stock companies. The South Sea bubble serves as a cautionary tale against excessive speculation and the dangers of unfounded optimism.

4. Dot-Com Bubble

4.1 Introduction to the dot-com era

The dot-com bubble refers to the rapid rise and subsequent collapse of stock prices of internet-based companies in the late 1990s and early 2000s. This period was characterized by excessive speculation and inflated valuations of companies that primarily operated online.

4.2 Speculative frenzy and market growth

During the dot-com era, investors poured money into internet startups without paying close attention to traditional valuation metrics, such as earnings or profitability. The rapid growth of the internet and the potential for groundbreaking innovation fueled the speculative frenzy, with companies experiencing astronomical share price increases.

4.3 Collapse of the dot-com bubble

The dot-com bubble burst when investors realized that many of the internet companies were overvalued and lacked sustainable business models. In 2000, the stock market experienced a significant decline, resulting in the loss of trillions of dollars in market value. Many dot-com companies went bankrupt, and investor sentiment turned sour. The collapse of the dot-com bubble highlighted the importance of fundamental analysis and caution in investing.

This image is property of goldbroker.com.

5. Housing Bubble in the United States

5.1 Origins of the housing bubble

The housing bubble in the United States was a period when housing prices experienced significant increases, driven by speculative investments and loose lending practices. The bubble was fueled by low-interest rates, relaxed mortgage lending standards, and a belief in ever-increasing home values.

5.2 Rise of subprime lending

One of the main contributors to the housing bubble was the rise of subprime lending. Lenders began offering mortgages to borrowers with low credit scores and little to no down payment, increasing the overall risk in the housing market. The accessibility of credit led to a surge in demand for homes, driving up prices.

5.3 Burst of the housing bubble

The housing bubble burst in 2007-2008 when the subprime mortgage market collapsed and home prices started to decline. Foreclosures increased, and the housing market faced a severe downturn. This had far-reaching implications, leading to a global financial crisis and a prolonged period of economic recession. The bursting of the housing bubble highlighted the dangers of excessive lending practices and the importance of prudent risk management.

6. Bitcoin Bubble

6.1 Introduction to Bitcoin

Bitcoin is a digital currency that was invented in 2008 and subsequently gained popularity worldwide. It operates on decentralized technology called blockchain and has experienced significant price volatility over the years.

6.2 Speculative boom in Bitcoin

Bitcoin’s price experienced a massive surge in 2017, attracting widespread media attention and speculative interest. As the price skyrocketed, more individuals and institutional investors jumped on the bandwagon, believing that Bitcoin would continue to increase in value indefinitely. This speculative boom drove the price of Bitcoin to unprecedented levels.

6.3 The crash and aftermath of the Bitcoin bubble

In early 2018, the Bitcoin bubble burst, leading to a substantial decline in its price. Many investors who had bought Bitcoin at its peak suffered significant losses. However, Bitcoin has since recovered to some extent, with ongoing debates about its long-term potential as a currency or store of value. The Bitcoin bubble serves as a reminder of the risks associated with speculative investments and the need for caution when entering volatile markets.

This image is property of goldbroker.com.

7. Gold Rush in the 19th Century

7.1 Historical context of the gold rush

The gold rush in the 19th century refers to the mass migration of people to different parts of the world in search of gold deposits. The most famous gold rushes occurred in California in 1848 and the Australian colonies in the 1850s.

7.2 Gold speculation and its impacts

The discovery of gold led to a speculative frenzy, with people abandoning their homes and livelihoods in pursuit of wealth. The popularity of gold mining contributed to economic booms, as well as social and environmental changes in the regions affected. However, the gold rushes also resulted in exploitation, environmental destruction, and economic inequality.

7.3 Implosion of the gold rush bubble

The gold rush bubbles eventually imploded as gold deposits became depleted or difficult to access. Many prospectors were left with nothing, and the economies of the affected regions suffered. The gold rush bubbles teach us about the risks of unbridled speculation and the importance of long-term sustainability in resource-based industries.

8. Oil Price Bubble of 2008

8.1 Causes and events leading to the bubble

The oil price bubble of 2008 was characterized by a rapid increase in oil prices, soaring to unprecedented levels. Several factors contributed to this bubble, including geopolitical tensions, increased demand from developing countries, and speculation in the futures market. The fear of oil shortages and uncertainty about future supply also added to the price volatility.

8.2 Speculation and soaring oil prices

Speculators played a significant role in driving up oil prices during this period. Investors, including hedge funds and institutional traders, entered the oil futures market, betting on rising prices. This increased demand for oil futures contracts, exerting upward pressure on prices.

8.3 Collapse of the oil price bubble

The oil price bubble burst in the second half of 2008 as the global financial crisis and economic recession unfolded. The sharp decline in demand, coupled with concerns about oversupply, led to a sudden drop in oil prices. The collapse had significant consequences for oil-producing countries and the global economy, emphasizing the interconnectedness of financial markets and commodity prices.

This image is property of goldbroker.com.

9. Uranium Market Bubble

9.1 Emergence of the uranium market bubble

The uranium market bubble emerged in the mid-2000s as a result of increased global demand for nuclear energy and a limited supply of uranium. Speculators anticipated a surge in uranium prices, leading to a speculative frenzy in the market.

9.2 Investment mania and inflated prices

Investors flocked to uranium mining companies and uranium-exposed assets, driving up their share prices. The scarcity of available uranium resources and the potential for future demand growth fueled the investment mania. As a result, uranium prices reached record levels during this period.

9.3 Deflation and the bursting of the uranium bubble

The uranium bubble eventually deflated due to a combination of factors. The Fukushima nuclear disaster in 2011 led to a decline in nuclear energy demand and a shift in global sentiment towards alternative energy sources. Additionally, the availability of alternative sources of uranium supply dampened the market. The bursting of the uranium bubble serves as a reminder of the risks associated with commodity markets and the importance of thorough research and analysis.

10. Gold Bubbles in Recent History

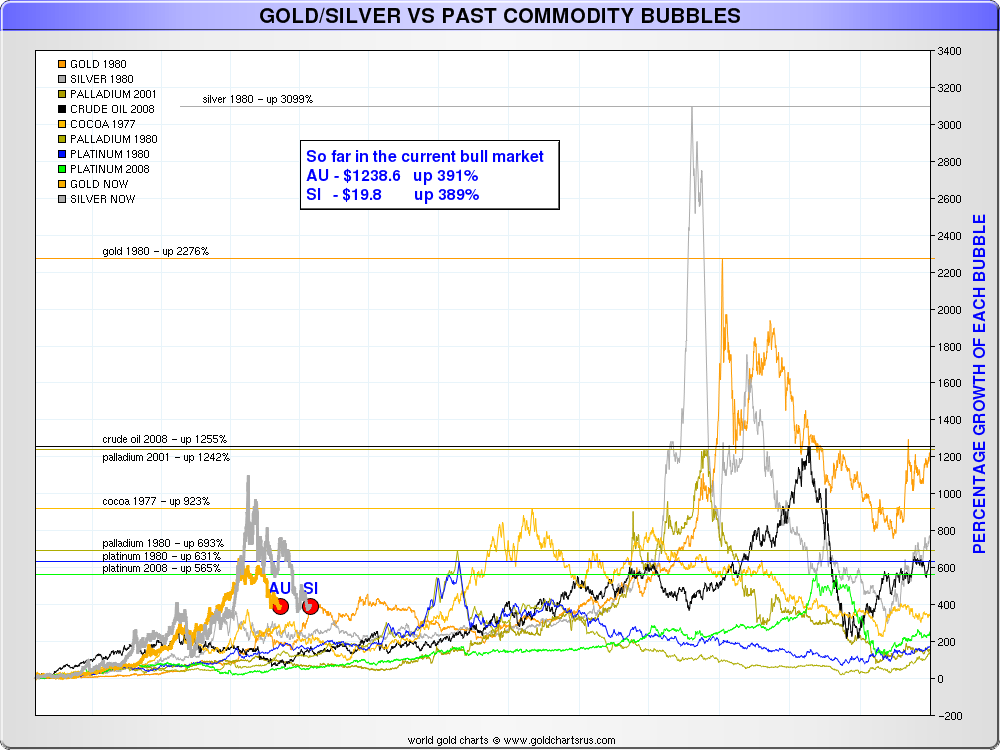

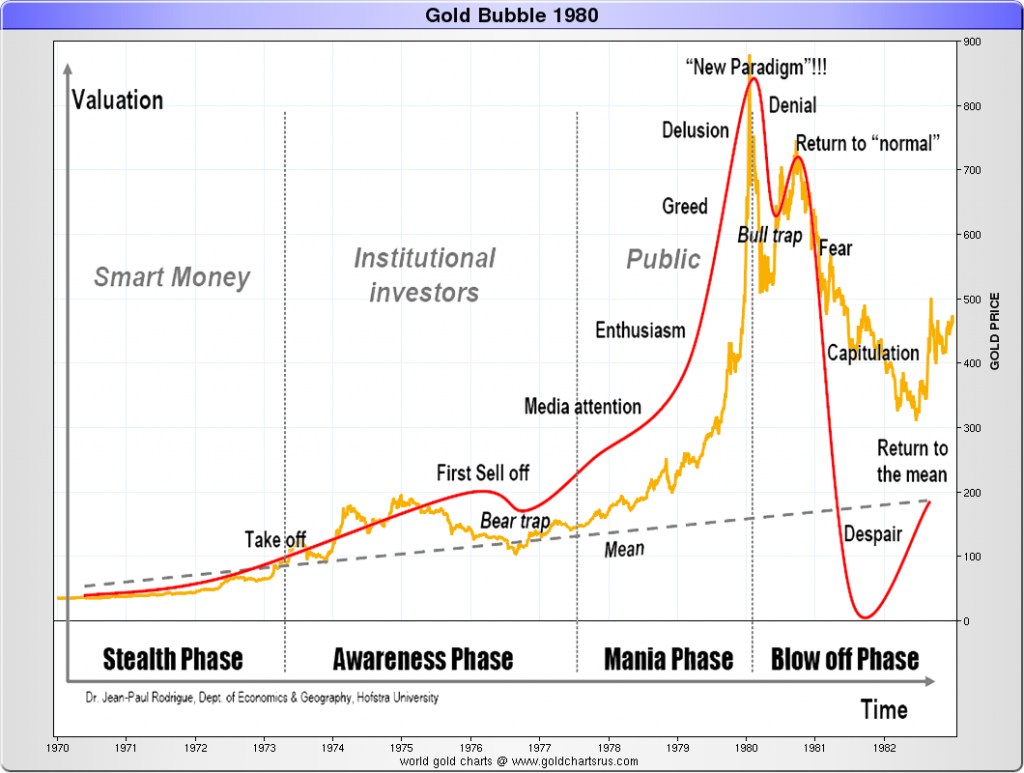

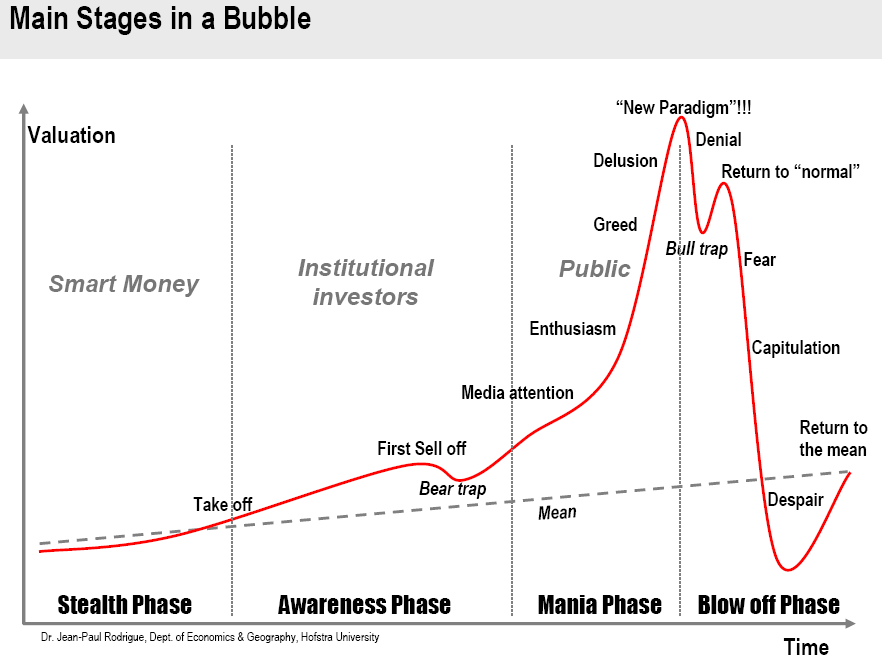

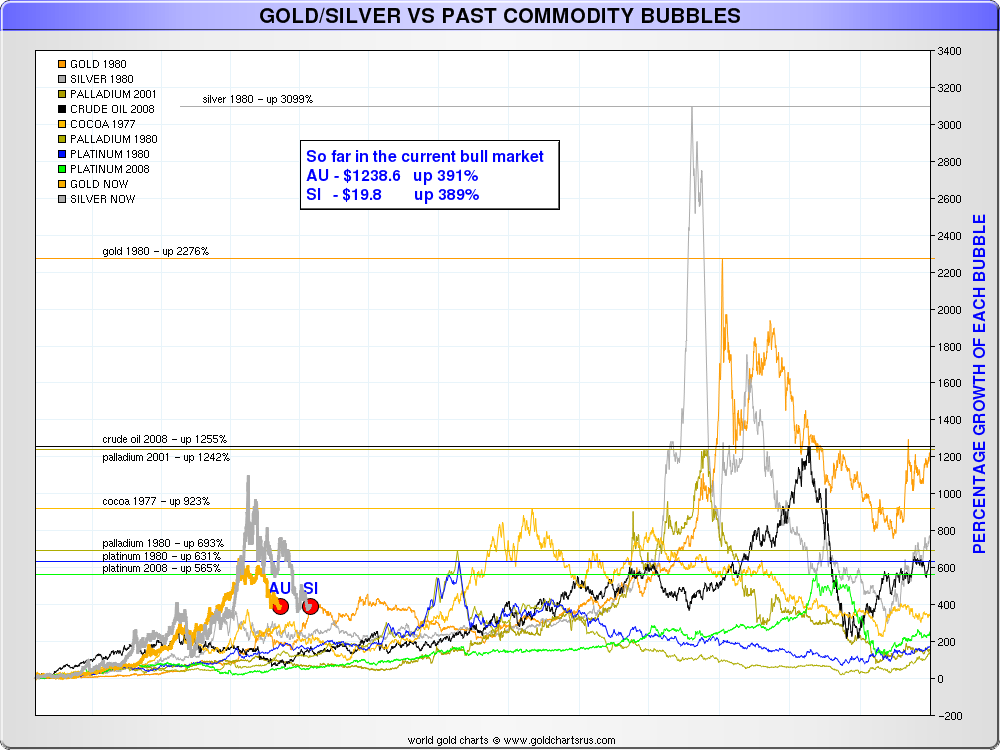

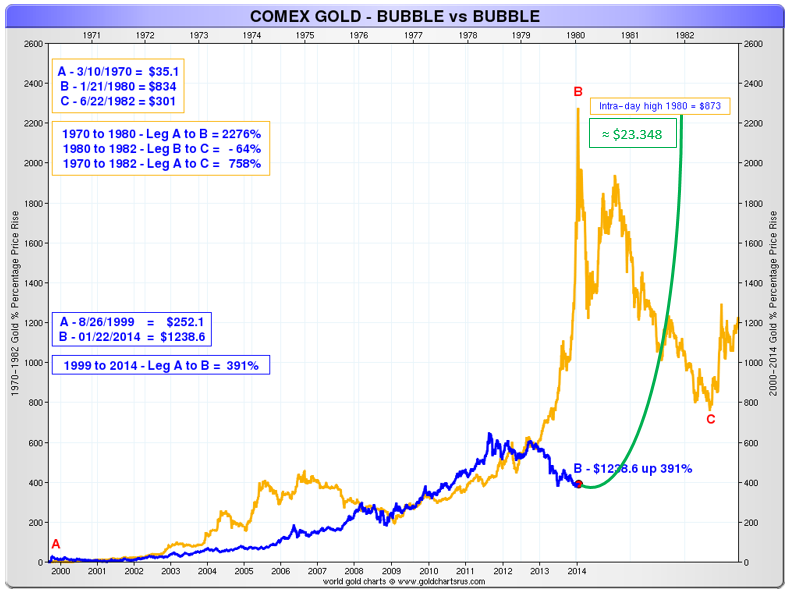

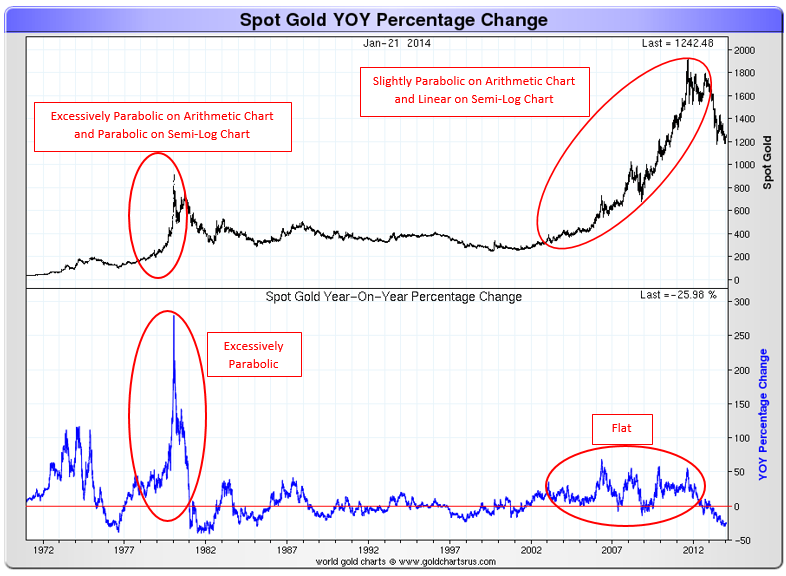

10.1 Historical volatility of gold prices

Gold has experienced several periods of volatility throughout history, with its price subject to various economic, geopolitical, and market factors. Gold prices can be influenced by inflation, currency fluctuations, interest rates, and investor sentiment.

10.2 Factors leading to gold bubbles

Gold bubbles have often been fueled by economic uncertainties, market speculation, and a flight to safety during times of crisis. Investors seek the perceived stability and long-term store of value that gold offers, leading to increased demand and price inflation.

10.3 Current state of gold investments

As of the present, gold continues to be a popular investment asset, particularly during times of economic uncertainty. Its price is influenced by a range of factors, including global macroeconomic conditions, political developments, and monetary policies. Investors interested in gold should carefully evaluate these factors and consider diversifying their portfolios to mitigate risks.

In conclusion, historical instances of price speculation, whether in tulips, company shares, internet stocks, housing, cryptocurrencies, or commodities, highlight the risks and dynamics of speculative bubbles. Examining these historical cases can provide valuable insights for investors, emphasizing the importance of prudent risk management, thorough research, and a long-term investment approach.