When it comes to diversifying your investment portfolio, gold is a shining star. It has long been revered as a safe haven for investors, providing stability and security in times of economic uncertainty. But what exactly makes gold such a valuable asset? In this blog, we’ll explore the ways in which gold enhances portfolio diversification, offering a balanced approach to your investment strategy. From its historical significance to its ability to act as a hedge against inflation, gold brings a golden balance to any well-rounded investment portfolio. So grab a cup of coffee and join me as we unlock the secrets of incorporating gold into your investment strategy.

This image is property of images.unsplash.com.

The Importance of Diversification

When it comes to investing, diversification is a key concept that every investor should understand and implement. Diversification refers to spreading your investments across different asset classes to reduce risk and enhance the potential for returns. By diversifying your portfolio, you can protect yourself from the volatility of individual investments or sectors. Gold plays a crucial role in portfolio diversification, and in this article, we will delve into the reasons why it is important to have a golden balance in your investment strategy.

Understanding Portfolio Diversification

Before we dive into the benefits of diversification, let’s first understand what it entails. Portfolio diversification is the practice of allocating your investments across different asset classes, such as stocks, bonds, real estate, and commodities. The goal is to have a mix of assets that have different risk levels and return potentials. The idea behind diversification is that if one investment underperforms, the others may compensate for it, thereby reducing the overall risk of your portfolio.

This image is property of images.unsplash.com.

Benefits of Diversification

Diversification is a risk management strategy that can offer several benefits to investors. Firstly, it helps to reduce the risk of losing a significant portion of your investments. By spreading your investments across different asset classes, you are less exposed to the risk of a single investment or sector negatively impacting your portfolio. Secondly, diversification can enhance potential returns. When you have a well-diversified portfolio, you have the opportunity to benefit from the growth of different asset classes, even if one or two assets don’t perform as well.

Role of Gold in Diversification

Gold has been considered a valuable component of diversification for centuries, and for good reason. Its unique attributes make it an excellent addition to any investment portfolio. Let’s explore the key reasons why gold plays a vital role in diversification.

Physical Tangibility

One of the primary reasons investors turn to gold for diversification is its physical tangibility. Unlike stocks or bonds, gold is a tangible asset that you can hold in your hand. This physical presence provides a sense of security and adds a layer of diversification by owning an asset that is independent of the financial markets. In times of economic uncertainty, the value of physical gold can hold steady or even increase, making it a valuable hedge against market volatility.

High Liquidity

Gold is known for its high liquidity, meaning it can be easily bought or sold on various platforms. This liquidity makes gold a highly accessible investment, allowing investors to quickly convert their holdings into cash when needed. During times of market turbulence, when other investments may experience significant price fluctuations, gold’s liquidity can provide stability and peace of mind.

Inflation Hedge

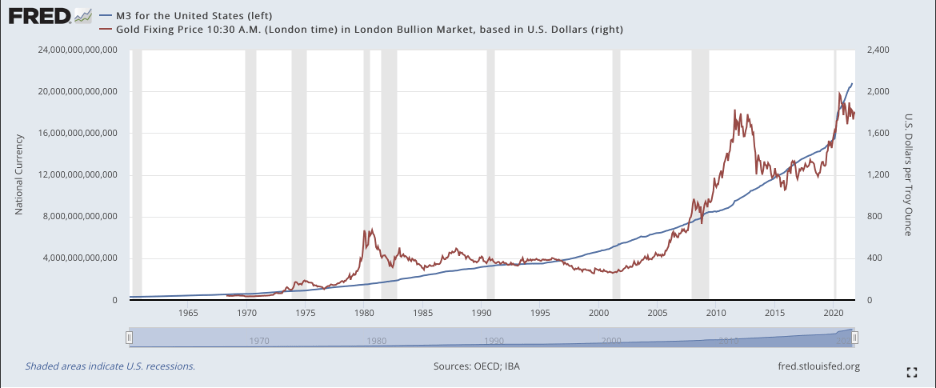

Another reason why gold is a valuable addition to a diversified portfolio is its ability to act as an inflation hedge. Inflation refers to the rise in the general price level of goods and services over time. As inflation erodes the purchasing power of traditional fiat currencies, the value of gold tends to rise. By including gold in your portfolio, you can protect your investments from the negative effects of inflation and preserve your wealth in the long run.

Safe Haven Asset

Gold has long been regarded as a safe haven asset during times of economic turmoil. When the stock market is volatile or geopolitical tensions arise, investors tend to flock to the perceived safety of gold. Its historical track record of retaining value and acting as a store of wealth has made it a go-to asset for wealth preservation. By incorporating gold into your portfolio, you can reduce risk by having an asset that is less correlated with other financial instruments.

This image is property of images.unsplash.com.

Adding Gold to Your Portfolio

Now that we understand the importance of gold in diversification, let’s explore how you can add it to your investment portfolio.

Allocating a Percentage of Gold

The percentage of gold you should allocate in your portfolio depends on various factors, such as your risk tolerance, investment goals, and time horizon. As a general rule of thumb, financial experts often recommend allocating around 5-10% of your portfolio to gold. This allocation acts as a hedge against volatility and provides diversification without overexposing your portfolio to a single asset class.

Determining the Ideal Gold Allocation

To determine the ideal gold allocation for your own portfolio, it is crucial to consider your individual circumstances. If you have a higher risk tolerance and seek greater potential returns, you may choose to allocate a higher percentage of gold in your portfolio. On the other hand, if you have a lower risk tolerance and prioritize capital preservation, a lower percentage of gold may be more suitable. It is essential to strike a balance that aligns with your investment objectives and risk appetite.

Correlation with Other Asset Classes

Understanding the correlation between gold and other asset classes is important when considering its role in diversification. Let’s explore the correlation of gold with different investment categories.

Negative Correlation with Stocks

Gold has historically shown a negative correlation with stocks, meaning that when stocks decline, the price of gold tends to rise. This inverse relationship makes gold an attractive investment during stock market downturns, as it can help offset losses and provide stability.

Positive Correlation with Inflation

Gold has a positive correlation with inflation, meaning that as inflation rises, the value of gold typically increases. This positive correlation makes gold an effective hedge against inflation, as its value tends to rise at a similar pace to or even greater than inflation rates.

Low or No Correlation with Bonds

Gold generally exhibits a low or no correlation with bonds, which are typically considered safer investments. This lack of correlation makes gold a valuable addition to a portfolio that already contains bonds, as it can further diversify the risk and potentially enhance returns.

Historical Performance of Gold

To truly appreciate the value of gold in diversification, it’s essential to examine its historical performance.

Long-Term Returns

Over the long term, gold has demonstrated the potential for attractive returns. While its short-term price fluctuations may be volatile, gold has consistently maintained its value and experienced substantial appreciation over extended periods. This long-term performance makes gold an appealing asset for investors seeking wealth preservation and capital growth.

Protection during Market Volatility

Gold’s performance during times of market volatility has been exceptional. When stock markets plunge and economic uncertainties arise, gold has often served as a safe haven asset, offering stability and even potential gains. Its ability to act as a hedge during turbulent times further emphasizes its significance in diversification.

Risks and Considerations

While gold offers numerous benefits in diversification, it is essential to understand and evaluate the potential risks and considerations.

Market Volatility

While gold can provide stability during market volatility, it is not entirely immune to price fluctuations. The price of gold can experience short-term volatility, influenced by factors such as global economic conditions, geopolitical events, and investor sentiment. It is crucial to be aware of this volatility and consider it as part of your overall investment strategy.

Storage and Insurance Costs

When investing in physical gold, it is important to consider storage and insurance costs. Physical gold needs to be securely stored and insured to protect its value. These additional costs can impact your overall investment returns, so it’s essential to factor them into your decision-making process.

Economic Factors

Gold’s value is influenced by various economic factors, such as interest rates, currency fluctuations, and global supply and demand dynamics. While gold has historically proven its resilience in adverse economic conditions, it is important to keep an eye on these factors and their potential impact on the price of gold.

Investing in Gold

Now that you are familiar with the benefits and considerations of gold, let’s explore different ways to invest in this precious metal.

Physical Gold

Investing in physical gold involves purchasing gold coins, bars, or other physical forms. This provides an investor with the tangible asset that can be held and stored. Physical gold ownership offers the potential for a direct exposure to the price movements of gold, but also comes with the responsibility of storage and security.

Gold ETFs

Gold exchange-traded funds (ETFs) allow investors to gain exposure to the price movements of gold without physically owning the metal. These funds hold physical gold or futures contracts, and their shares can be traded on stock exchanges. Investing in gold ETFs offers convenience and liquidity, as well as the ability to buy and sell at market prices throughout the trading day.

Gold Mutual Funds

Gold mutual funds invest in a portfolio of gold mining stocks and, in some cases, physical gold. By investing in a gold mutual fund, you gain exposure to the performance of a diversified portfolio of gold-related assets. This investment option is suitable for investors who prefer a more hands-off approach and want professional management of their gold investments.

Gold Mining Stocks

Investing in gold mining stocks allows you to indirectly participate in the performance of the gold industry. These stocks are shares of companies engaged in gold mining and exploration. While they offer the potential for significant returns, they also come with higher risks due to factors such as operational challenges, geopolitical risks, and commodity price fluctuations.

Diversify, Diversify, Diversify

As the saying goes, diversification is the key to success. Adding gold to your investment portfolio is just one piece of the puzzle. It is important to combine gold with other diversification strategies to truly reap the benefits.

Combining Gold with Other Diversification Strategies

To build a well-diversified portfolio, consider incorporating other asset classes alongside gold. This can include stocks, bonds, real estate, and other commodities. By spreading your investments across different asset classes, you enhance the potential for returns and reduce overall portfolio risk.

Importance of Regular Rebalancing

Once you have created a diversified portfolio that includes gold, it is crucial to regularly review and rebalance your holdings. Market conditions and individual investment performances can cause your portfolio to deviate from your original asset allocation. Rebalancing ensures that your portfolio remains aligned with your investment objectives and risk tolerance.

Potential Drawbacks

While gold offers numerous benefits, it is important to be aware of potential drawbacks when considering it as an investment option.

Possible Underperformance

Like any other investment, gold can underperform compared to other asset classes. There may be periods when gold prices decline or remain stagnant while other investments experience significant growth. It is essential to have realistic expectations and understand that gold’s performance can vary over different market cycles.

Lack of Income Generation

Gold does not generate income in the form of interest or dividends. Unlike bonds or dividend-paying stocks, gold’s value is primarily driven by changes in supply, demand, and market sentiment. This lack of income generation may not suit investors seeking regular cash flow from their investments.

Psychological Factors

Investing in gold requires a certain psychological mindset. Gold prices can be influenced by investor sentiment and market speculation, leading to periods of high volatility. It is essential for investors to have the emotional resilience to withstand price fluctuations and focus on the long-term benefits of owning gold.

Conclusion

In conclusion, incorporating gold into your investment portfolio is a wise move when seeking to diversify and reduce risk. Its unique attributes, such as physical tangibility, high liquidity, inflation hedge, and safe haven status, make it an invaluable component of diversification. By allocating an appropriate percentage of gold in your portfolio and considering its correlation with other asset classes, you can enhance your potential returns and protect your investments during market volatility. While there are risks and considerations to be mindful of, gold’s historical performance and long-term benefits make it a compelling choice for investors interested in strengthening their portfolios. Remember, diversify, diversify, diversify, and may your golden balance lead you to greater financial success.