Have you ever wondered why gold is often regarded as a safe investment during times of economic turmoil? It’s no secret that the market can be unpredictable and volatile, leaving investors scrambling for ways to protect their hard-earned money. In this article, we will take a closer look at how gold acts as a golden hedge, offering a level of security and stability that can help navigate through uncertain times. Whether you’re a seasoned investor or just starting to dip your toes into the world of finance, understanding the power of gold as a protective asset is a valuable piece of knowledge. So, let’s dive into the fascinating world of gold and its role in safeguarding investors during economic ups and downs.

This image is property of images.unsplash.com.

What is a Golden Hedge?

A Golden Hedge refers to the practice of using gold as a form of investment to protect against economic turmoil and uncertainty. Investors turn to gold during periods of instability because it is often considered a safe haven asset. This means that it has historically held its value or even increased in value during times of financial crisis or economic downturns. Many investors view gold as a hedge against inflation, currency fluctuations, and other risks that can erode the value of traditional investments like stocks and bonds.

Definition of a Golden Hedge

A Golden Hedge is a strategy that involves allocating a portion of your investment portfolio to gold in order to safeguard against potential losses during times of economic turmoil. By including gold in your portfolio, you can potentially benefit from its ability to retain value and even appreciate during periods of market stress. This can provide a degree of stability and protection to your overall investment portfolio.

Why Investors Turn to Gold as a Hedge

Investors turn to gold as a hedge for several reasons. First and foremost, gold has a long history of retaining value, even in challenging economic times. It has been considered a store of wealth for centuries and has proven its resilience during numerous financial crises. Additionally, gold is often viewed as a hedge against inflation. When inflation rises and the value of currency declines, gold tends to maintain its purchasing power. Lastly, gold is seen as a safe haven asset because it is not directly tied to any one country’s economy or political system. This global recognition and liquidity make it an attractive option for investors seeking to diversify their holdings.

Historical Performance of Gold During Economic Turmoil

Gold’s Performance during the Great Recession

One of the most notable periods of economic turmoil in recent history is the Great Recession, which occurred from 2007 to 2009. During this time, global stock markets experienced significant declines, and many investors suffered substantial losses. However, gold performed admirably during this period. While stock prices plummeted, the price of gold increased by over 25% from 2007 to 2009. This demonstrates the ability of gold to provide a hedge against economic downturns and preserve value when other assets are faltering.

Gold’s Performance during Other Economic Crises

In addition to its performance during the Great Recession, gold has historically shown resilience during other economic crises as well. For example, during the dot-com bubble burst in the early 2000s, gold saw a steady increase in value, providing a safe haven for investors. Similarly, during the global financial crisis of 2008, gold reached record highs as investors sought refuge from the turmoil in the banking and housing sectors. These historical examples highlight the potential for gold to act as a reliable hedge during times of economic uncertainty.

This image is property of images.unsplash.com.

Why Gold is Considered a Safe Haven

Intrinsic Value of Gold

One of the reasons gold is considered a safe haven asset is its intrinsic value. Unlike paper currencies, which are backed by government promises, gold has physical properties that give it inherent worth. It is a rare and precious metal with a long history of being used as a store of value. These qualities give gold a sense of security and stability in the minds of investors, making it an attractive option when navigating uncertain economic times.

Limited Supply and Durability

Another aspect that contributes to gold’s status as a safe haven asset is its limited supply and durability. Gold is a finite resource, meaning that it cannot be easily reproduced or created at will. Its scarcity adds to its value and acts as a hedge against inflationary pressures. Additionally, gold is a highly durable metal that does not corrode or degrade over time. This physical durability further bolsters its appeal as a long-term investment and safe haven asset.

Global Recognition and Liquidity

Gold holds a unique position in the global financial system due to its universal recognition and liquidity. It is accepted as a form of payment and exchange in virtually every country around the world. This widespread acceptance means that gold can be easily converted into cash or other assets, providing investors with liquidity in times of need. The global recognition and liquidity of gold make it a highly accessible and versatile investment option, further enhancing its appeal as a safe haven asset.

Diversification Benefits of Gold

Reducing Portfolio Risk

One of the key advantages of including gold in an investment portfolio is its ability to reduce overall portfolio risk. Gold’s performance often differs from that of traditional financial assets like stocks and bonds. This difference in performance creates a diversification effect, as gold can act as a counterbalance to the volatility of other assets. When market conditions are uncertain, the inclusion of gold in a diverse portfolio can help to mitigate potential losses and stabilize overall returns.

Negative Correlation with Other Assets

Gold has historically shown a negative correlation with other financial assets, meaning that it tends to move in the opposite direction of stocks and bonds. When equity markets experience downturns, gold has often shown stability or even increased in value. This negative correlation can provide a valuable hedge against potential losses in other areas of an investment portfolio. By diversifying with gold, investors can potentially offset declines in other asset classes and protect their overall wealth.

This image is property of images.unsplash.com.

The Role of Central Banks in the Gold Market

Central Bank Gold Reserves

Central banks around the world play a significant role in the gold market. These institutions often hold gold reserves as a form of international reserve currency. The amount of gold held by central banks can impact the supply and demand dynamics of the market. For example, when central banks are net buyers of gold, it can drive up prices due to increased demand. Conversely, when central banks are net sellers of gold, it can put downward pressure on prices. Monitoring central bank actions and their impact on the gold market is a key consideration for gold investors.

Impact of Central Bank Actions on Gold Prices

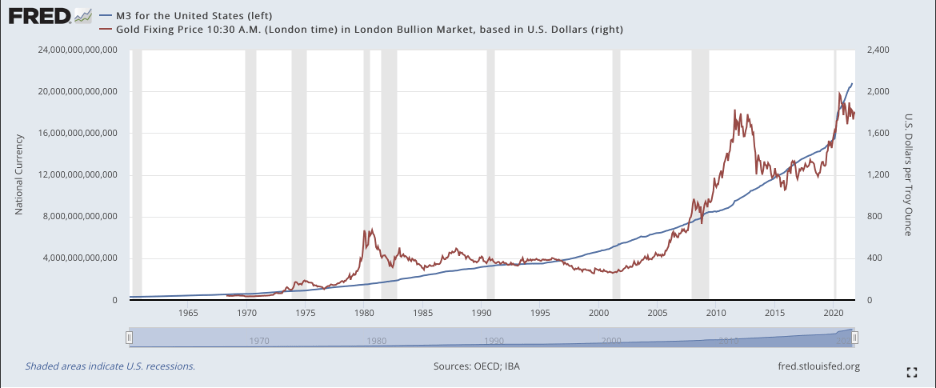

Central bank actions can have a substantial impact on the price of gold. For instance, when central banks implement policies that increase money supply or lower interest rates, it can lead to inflationary pressures and devaluation of currencies. In such situations, gold often becomes more attractive as a store of value, resulting in increased demand and upward pressure on prices. Conversely, when central banks adopt tightening monetary policies or the economy enters a period of stability, it can lead to reduced demand for gold and potential price decreases. Understanding the relationship between central bank actions and the gold market is essential for informed investment decisions.

Different Ways to Invest in Gold

Physical Gold: Bullion and Coins

One of the most traditional and tangible ways to invest in gold is through physical ownership of bullion or coins. Bullion refers to gold bars or ingots, while coins can include national currency gold coins or specialized bullion coins. Physical gold offers the advantage of direct ownership and the ability to physically possess and store the asset. However, it also comes with the responsibility of ensuring proper storage and security measures to protect against theft or loss.

Gold Exchange-Traded Funds (ETFs)

Gold Exchange-Traded Funds (ETFs) provide investors with exposure to gold without the need for physical ownership. These funds hold physical gold or gold derivatives and issue shares that represent ownership in the underlying assets. By investing in gold ETFs, investors can gain exposure to the price movements of gold without the logistical challenges of storing and securing physical gold. These funds also provide the convenience of being traded on stock exchanges, allowing for easy buying and selling.

Gold Mining Stocks and Funds

Investing in gold mining stocks and funds is another way to gain exposure to the gold market. These investments involve buying shares in companies involved in gold exploration, mining, or production. The performance of gold mining stocks is influenced by a combination of factors, including the price of gold, production costs, and company-specific factors such as management and operational efficiency. Investing in gold mining stocks and funds can offer potential upside and leverage to the price of gold but also carries additional risks associated with the specific mining operations and industry dynamics.

Gold Futures and Options

Gold futures and options contracts enable investors to speculate on the future price of gold without owning the physical metal. These derivative instruments provide exposure to gold price movements and allow for leveraging and hedging strategies. However, trading gold futures and options requires specialized knowledge and carries a higher level of risk compared to other investment options. It is important for investors to understand the mechanics of these financial instruments and the potential impact of factors such as contract expiration and margin requirements.

Considerations When Investing in Gold

Long-Term vs. Short-Term Investing

When investing in gold, it is important to determine your investment horizon and goals. Gold can be suitable for both long-term and short-term investment strategies, depending on your objectives. For long-term investors, gold can act as a reliable store of value and a hedge against inflation and currency fluctuations. In contrast, short-term investors may focus on taking advantage of price volatility and market trends to generate profits. Understanding your investment timeframe and aligning it with your overall financial goals will help guide your gold investment strategy.

Storage and Security of Physical Gold

If you choose to invest in physical gold, it is crucial to consider proper storage and security measures. Physical gold, such as bullion or coins, must be stored in a secure location that is protected against theft, damage, and natural disasters. Options for storage include secure vaults, safety deposit boxes, or professional custodial services. It is important to weigh the costs of storage against the convenience and peace of mind provided by professional storage solutions.

Understanding Gold Taxes and Regulations

Investors should also familiarize themselves with the tax implications and regulations surrounding gold investments. Different jurisdictions may have varying tax laws related to buying, selling, and holding gold. It is important to consult with a qualified tax professional or financial advisor to ensure compliance with applicable regulations and to understand the tax consequences of your gold investments. By having a clear understanding of tax implications, investors can make informed decisions and optimize their gold investment strategy.

Risks and Challenges of Investing in Gold

Volatility and Price Fluctuations

While gold is often considered a safe haven asset, it is not immune to volatility and price fluctuations. The price of gold can be influenced by various factors, including economic indicators, geopolitical events, and investor sentiment. These factors can cause significant price swings in the short term, potentially leading to potential losses for investors who do not carefully monitor and manage their gold investments. It is important to have a realistic understanding of the risks associated with gold investments and to diversify your portfolio accordingly.

Counterparty and Fraud Risks

Investors should be aware of counterparty and fraud risks when investing in gold, especially when dealing with third-party entities. If you choose to invest in physical gold through a dealer or custodian, it is crucial to conduct thorough due diligence and choose reputable and trustworthy providers. It is also important to be mindful of the risk of counterfeit gold products on the market. Verifying the authenticity and purity of gold is essential to protect yourself from potential fraud and to ensure the value and integrity of your investment.

Psychological Factors and Market Sentiment

Psychological factors and market sentiment can also influence the price of gold. Investor sentiment, fear, and market speculation can create short-term price movements that may not necessarily align with the fundamental value of gold. It is important to remain focused on the long-term outlook for gold and avoid making impulsive investment decisions based on short-term market fluctuations. Emotional discipline and a rational assessment of market conditions are crucial when investing in gold or any other asset class.

Gold as a Long-Term Store of Value

Historical Retention of Purchasing Power

Gold’s status as a long-term store of value can be observed through its historical retention of purchasing power. Over centuries, the purchasing power of gold has remained relatively stable compared to other forms of currency or goods. While paper currencies can lose value due to inflation or economic instability, gold has demonstrated the ability to retain its purchasing power over time. This characteristic makes it an appealing option for investors seeking to preserve wealth and protect against long-term erosion of value.

Gold’s Role in Preserving Wealth over Generations

Gold has also played a key role in preserving wealth over generations. Throughout history, families and individuals have passed down gold from one generation to another as a means of maintaining and transferring wealth. This ability to withstand the test of time and retain value makes gold an attractive option for long-term financial planning and intergenerational wealth preservation. By including gold in an investment strategy, investors can potentially lay the foundation for financial security for themselves and future generations.

Gold as a Hedge Against Inflation

Relationship between Gold and Inflation

Gold is often viewed as a hedge against inflation due to its historical performance during periods of rising prices. When inflation occurs, the value of currencies can decline, eroding the purchasing power of individuals. In contrast, gold has historically retained its value or even appreciated during inflationary periods. This is because gold is not tied to any one currency or government, and its limited supply and intrinsic value provide a degree of protection against the erosion of wealth caused by inflation.

Gold’s Performance during Inflationary Periods

Historical data supports gold’s role as a hedge against inflation. For example, during the 1970s, the United States experienced high inflation, with annual rates reaching double digits. During this time, the price of gold surged and reached record highs. Similarly, during periods of economic uncertainty and inflationary pressures in other countries, gold has often performed well. By including gold in your investment portfolio, you can potentially offset the negative effects of inflation and maintain the purchasing power of your wealth.

In conclusion, gold has a long history of serving as a hedge for investors during economic turmoil. Its intrinsic value, limited supply, global recognition, and liquidity contribute to its appeal as a safe haven asset. Gold’s performance during previous economic crises, its diversification benefits, and its correlation with other assets make it an attractive addition to an investment portfolio. However, investors should also consider the risks and challenges associated with gold investments, such as price volatility, counterparty risks, and psychological factors. Ultimately, gold’s long-term retention of purchasing power and ability to preserve wealth over generations make it a valuable asset for investors looking to navigate uncertain economic times and protect their financial future.