Are you interested in capitalizing on the fluctuations in the price of gold? Look no further! In this article, we will explore the golden opportunities available to investors, like yourself, who are keen on making the most out of gold price swings. As an experienced investor in gold, I have witnessed the potential gains that can be achieved by strategically navigating these fluctuations. So, whether you are a seasoned investor or just starting out, join me as we dive into the world of gold investments and discover how you can seize these lucrative opportunities.

This image is property of images.unsplash.com.

Understanding Gold Price Swings

Gold is a widely recognized and valuable precious metal that has been used as a form of currency and a store of value for centuries. As an investor, understanding the factors that influence gold price swings is crucial in order to make informed investment decisions. By analyzing historical trends and the relationship between gold and other market movements, you can gain valuable insights into the potential future direction of gold prices.

Factors Influencing Gold Price Swings

Gold price swings are influenced by a variety of factors, ranging from economic and geopolitical events to supply and demand dynamics. Understanding these factors can help you anticipate and react to changes in gold prices.

Economic factors, such as inflation, interest rates, and currency fluctuations, can have a significant impact on gold prices. For example, when inflation is high or interest rates are low, investors may turn to gold as a hedge against inflation or a safe haven asset. This increased demand can drive up gold prices.

Geopolitical events, such as political instability or conflicts, can also affect gold prices. During times of uncertainty, investors often seek the stability and security of gold, leading to increased demand and higher prices.

Supply and demand dynamics play a crucial role in gold price swings. Gold mining production, central bank policies, and global gold demand all contribute to the supply and demand of gold. Any disruption in these factors can impact gold prices.

Historical Trends in Gold Price Movements

Analyzing historical trends in gold price movements can provide valuable insights into the potential future direction of gold prices. Over the years, gold has exhibited patterns and trends that investors can use to their advantage.

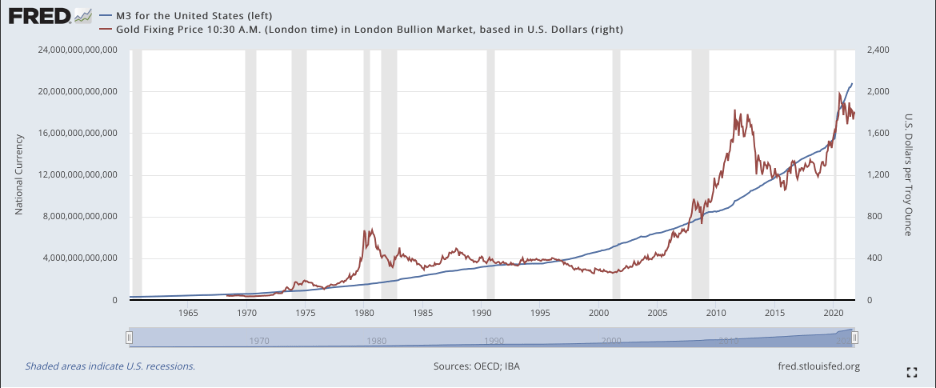

One historical trend is the inverse relationship between gold prices and the strength of the US dollar. When the US dollar weakens, gold prices tend to rise, and vice versa. This is because gold is priced in US dollars, and a weaker dollar makes gold more affordable for investors holding other currencies.

Another historical trend is the correlation between gold prices and economic indicators, such as inflation and interest rates. When inflation is low or interest rates are high, gold prices tend to be lower as investors have alternative investment options. Conversely, when inflation is high or interest rates are low, gold prices tend to rise as investors seek a store of value.

The Relationship between Gold and Other Market Movements

Gold’s relationship with other market movements is an important factor to consider when analyzing gold price swings. While gold is often seen as a safe haven asset, its relationship with other asset classes can be dynamic and complex.

During periods of economic uncertainty or market volatility, gold tends to perform well as investors seek a safe haven. However, during periods of strong economic growth, when investors have more confidence in the markets, gold prices may not perform as strongly.

The relationship between gold and other asset classes, such as stocks and bonds, can also influence gold price swings. When stock markets perform well, investors may allocate more of their portfolios to stocks, reducing the demand for gold and potentially leading to lower prices. On the other hand, during periods of market downturns, gold can act as a hedge against equity market losses.

Understanding these relationships and staying alert to market indicators can help investors anticipate and take advantage of gold price swings.

Timing the Market

As an investor, timing is crucial when it comes to gold investments. Buying or selling gold at the right time can greatly impact your returns. By using technical analysis, monitoring economic and geopolitical factors, and paying attention to market timing opportunities, you can enhance your chances of capitalizing on gold price swings.

The Importance of Timing in Gold Investments

Timing is important in any investment, but it is especially crucial in the gold market. Gold prices can be volatile, and even small fluctuations can have a significant impact on returns. Buying at the right time can maximize potential gains, while selling at the right time can protect against losses.

One strategy to consider is buying gold during periods of market downturns or when prices are relatively low. This can provide an opportunity to enter the market at a lower cost and potentially benefit from future price increases. However, accurately timing these market corrections can be challenging, and it is important to conduct thorough research and analysis to make informed decisions.

Using Technical Analysis to Predict Gold Price Swings

Technical analysis is a widely used method to predict future price movements based on historical price data and market trends. By analyzing patterns, charts, and indicators, investors can identify potential buy or sell signals in the gold market.

Common technical analysis tools used in gold trading include moving averages, support and resistance levels, and chart patterns. Moving averages can help identify trends and potential reversal points, while support and resistance levels can indicate price levels where buying or selling pressure may intensify. Chart patterns, such as head and shoulders or triangles, can provide insights into potential price breakouts or reversals.

It is important to note that technical analysis is not foolproof and should be used in conjunction with other fundamental analysis methods. Market sentiment, economic indicators, and geopolitical factors should also be considered when making investment decisions.

Monitoring Economic and Geopolitical Factors for Timing Opportunities

Economic and geopolitical factors can significantly impact gold prices, making them important considerations when timing your gold investments. By monitoring these factors, you can identify potential timing opportunities and adjust your investment strategy accordingly.

Economic indicators, such as inflation rates, interest rates, and GDP growth, can provide insights into the overall health of the economy and potential future direction of gold prices. For example, if inflation rates are expected to increase, it may be a favorable time to invest in gold as a hedge against inflation.

Geopolitical events, such as political instability or conflicts, can also create timing opportunities in the gold market. These events often lead to increased uncertainty and a flight to safe haven assets like gold. By staying informed about global geopolitical developments, you can be prepared to take advantage of potential price swings.

It is important to note that timing the market perfectly is challenging and often requires a combination of research, analysis, and a bit of luck. However, by staying alert to market indicators and continuously monitoring economic and geopolitical factors, you can enhance your chances of making timely and profitable gold investments.

This image is property of images.unsplash.com.

Investing in Physical Gold

Investing in physical gold can be a tangible way to gain exposure to the precious metal. Whether you choose to invest in gold bars, coins, or jewelry, understanding the pros and cons of owning physical gold, as well as the popular forms of physical gold investments, is essential for any investor considering this option.

Pros and Cons of Owning Physical Gold

Owning physical gold has several advantages that make it an attractive investment for many investors. One of the main benefits is its tangibility. Physical gold can be held in your hand, providing a sense of security and ownership. It is a finite resource that has been valued throughout history, making it a potentially valuable long-term investment.

Physical gold is also highly liquid, meaning it can easily be bought or sold in various forms. This liquidity makes it a versatile investment that can be easily converted into cash when needed. Additionally, physical gold can act as a hedge against inflation and currency fluctuations, as its value often maintains or increases during periods of economic uncertainty.

However, there are also some drawbacks to owning physical gold. Storing and securing physical gold can be a challenge, as it needs to be protected from theft, damage, or loss. This may require additional expenses for secure storage solutions or insurance. Transaction costs, such as buying and selling fees, can also reduce the overall returns of physical gold investments.

Popular Forms of Physical Gold Investments

When investing in physical gold, there are several popular forms to consider. Gold bars, also known as gold bullion, are rectangular bars of gold that come in various weights and purities. These bars are often preferred by investors looking to make larger investments, as they tend to offer lower premiums over the spot price of gold.

Gold coins are another popular form of physical gold investment. Coins like the American Eagle, Canadian Maple Leaf, or South African Krugerrand are recognized and widely traded around the world. They come in various sizes and denominations, making them accessible to investors with different budgets.

Some investors may also choose to invest in gold jewelry. While jewelry can offer aesthetic value in addition to investment potential, it is important to consider factors such as craftsmanship, quality, and marketability when purchasing gold jewelry as an investment.

Ensuring Safe Storage of Physical Gold

Proper storage and security are crucial when investing in physical gold. Storing the gold yourself may not be the safest option, as it can be vulnerable to theft or damage. Instead, consider utilizing secure storage options such as safe deposit boxes at banks or professional vaults provided by reputable gold storage companies.

Before storing your gold, it is important to research the reputation and security measures of the storage provider. Look for facilities that offer insurance coverage, security systems, and strict access control. Regularly monitor and review the security measures to ensure that your gold investment is in safe hands.

When purchasing physical gold, consider keeping detailed records of your transactions, including purchase receipts, certificates of authenticity, or any other relevant documentation. This can help establish the provenance and authenticity of your gold in the future.

Investing in physical gold requires careful consideration and due diligence. By understanding the pros and cons, exploring popular forms of physical gold investments, and ensuring safe storage, you can make informed decisions that align with your investment goals and risk tolerance.

Investing in Gold ETFs

Gold Exchange-Traded Funds (ETFs) provide an alternative way for investors to gain exposure to the gold market without the need for physical ownership. Understanding the basics of gold ETFs, the benefits and risks associated with investing in them, and how to choose the right gold ETF are important considerations for any investor interested in this investment vehicle.

Understanding Gold ETFs

Gold ETFs are investment funds that track the price of gold and aim to replicate its performance. They are designed to provide investors with a cost-effective and convenient way to invest in gold. Gold ETFs trade on stock exchanges, just like stocks, and their prices fluctuate throughout the trading day.

Gold ETFs are typically structured as open-ended funds, meaning they can issue and redeem shares as needed to meet investor demand. The funds generally hold physical gold or derivatives contracts to track the price of gold. This allows investors to gain exposure to the gold market without having to physically own, store, or transport the metal.

Benefits and Risks of Gold ETF Investments

Investing in gold ETFs offers several benefits that make it an attractive option for many investors. One of the main advantages is the convenience and ease of trading. Gold ETFs provide instant liquidity, allowing investors to buy or sell shares on the stock exchange at any time during trading hours.

Gold ETFs also offer diversification benefits, as they provide exposure to the performance of gold without relying solely on the fortunes of a single gold mining company or mining region. This diversification can help reduce the potential risks associated with investing in individual gold stocks or physical gold.

Another benefit of gold ETFs is the transparency they offer. The funds regularly disclose their holdings, allowing investors to track the exact amount of gold backing their shares. This transparency can help build trust and confidence among investors.

However, there are also risks associated with investing in gold ETFs that investors should be aware of. One risk is the potential for tracking error. While most gold ETFs aim to replicate the performance of gold, they may not track it perfectly due to factors such as management fees and market conditions. This can result in a discrepancy between the ETF’s performance and the actual price of gold.

Another risk is the counterparty risk associated with derivative-based gold ETFs. Some gold ETFs use futures contracts or other derivatives to replicate the price of gold. In these cases, investors are exposed to the credit risk of the counterparties involved in the derivative contracts. It is important to research and choose gold ETFs with strong counterparties and risk management practices.

Choosing the Right Gold ETF

When selecting a gold ETF, there are several factors to consider. One important factor is the expense ratio, which represents the annual fees charged by the fund. Lower expense ratios can have a positive impact on investment returns over the long term.

It is also important to consider the size and liquidity of the gold ETF. Larger funds with higher trading volumes tend to have tighter bid-ask spreads, reducing the cost of buying and selling shares. Increased liquidity also ensures that the fund can easily meet redemption requests and maintain an efficient market for investors.

Additionally, consider the fund’s tracking methodology. Some gold ETFs physically hold gold, while others use derivatives to replicate the price of gold. Understanding the methodology and the associated risks can help you make an informed decision.

Lastly, review the fund manager’s track record and expertise in managing gold ETFs. Look for managers who have a solid understanding of the gold market and a history of delivering consistent performance.

By understanding the basics, benefits, and risks of investing in gold ETFs, and by conducting thorough research and due diligence, you can choose the right gold ETF that aligns with your investment goals and risk tolerance.

This image is property of images.unsplash.com.

Diversifying with Gold Stocks

Investing in gold stocks can provide investors with exposure to the gold market through shares of companies engaged in gold mining and exploration. Diversifying your investment portfolio with gold stocks can offer potential growth opportunities and increased exposure to the performance of the gold market. Understanding the key aspects of gold mining companies, analyzing financial health and performance, and considering important factors when investing in gold stocks is crucial for any investor considering this option.

Exploring Gold Mining Companies

Gold mining companies are involved in the exploration, development, and production of gold. These companies own and operate mines around the world to extract gold from the earth. Investing in gold mining companies allows investors to participate in the potential profits generated by the production and sale of gold.

When exploring gold mining companies for investment purposes, consider factors such as the company’s size, geographical location of its mines, and production levels. Larger companies with diversified operations may have lower risk profiles, while smaller companies focused on specific regions may offer higher growth potential.

Researching a company’s management team and their track record is also important. Experienced and competent management teams are more likely to make sound decisions and successfully navigate the challenges of the gold mining industry.

Analyzing Financial Health and Performance of Gold Stocks

Analyzing the financial health and performance of gold mining companies is essential for evaluating their investment potential. Key financial metrics to consider include revenue growth, cash flow generation, and profitability.

Revenue growth can indicate the success of a company’s mining projects and its ability to expand production. Positive and consistent revenue growth is often a favorable sign for investors.

Cash flow generation is crucial for evaluating a company’s ability to fund its operations and finance future growth. Positive cash flow can provide financial stability, while negative cash flow may indicate the need for additional financing or the potential need to reduce activities.

Profitability is an important consideration when assessing the investment potential of gold stocks. Analyze a company’s profit margins, return on equity, and cost efficiency. A company with strong profitability metrics indicates effective cost management and the ability to generate returns for its shareholders.

Considerations for Investing in Gold Stocks

When investing in gold stocks, there are important factors to consider. One consideration is the price of gold itself. While gold mining companies are connected to the gold market, their performance may not always correlate directly with changes in gold prices. Understanding the relationship between gold prices and the performance of gold stocks can help you make more informed investment decisions.

The political and regulatory environment of the countries where the gold mining companies operate is also important to consider. Political stability, mining regulations, and tax policies can influence a company’s operations and potential profitability.

Evaluating a company’s risks and liabilities is crucial. These can include environmental and social risks, legal disputes, or labor issues. Understanding these risks can help you assess the potential impact on a company’s operations and financial performance.

Lastly, diversify your portfolio by investing in multiple gold mining companies. This can help mitigate risks associated with individual stocks and provide exposure to different regions and mining strategies.

By exploring gold mining companies, analyzing financial health and performance, and considering important factors when investing in gold stocks, you can make informed investment decisions that align with your investment goals and risk tolerance.

Exploring Gold Futures and Options

Gold futures and options are derivative instruments that allow investors to speculate on the future direction of gold prices, hedge against price fluctuations, or gain leverage in the gold market. Understanding how gold futures and options work, managing risks, and leveraging trading opportunities can provide investors with additional strategies to capitalize on gold price swings.

Understanding How Gold Futures and Options Work

Gold futures and options are contracts that provide the right, but not the obligation, to buy or sell gold at a predetermined price at a specific date in the future. These contracts are traded on regulated exchanges, such as the Chicago Mercantile Exchange (CME).

Gold futures contracts represent an agreement to buy or sell a specified quantity of gold at a future date. The contracts have standardized specifications, including the quantity of gold, the quality of the gold, the contract size, and the delivery months. Futures contracts are typically settled through cash payments rather than physical delivery of gold.

Gold options contracts, on the other hand, provide the buyer with the right to buy (call option) or sell (put option) gold at a predetermined price within a specific time frame. Options allow investors to gain exposure to the gold market without the need to directly own the underlying asset.

Managing Risks and Leveraging Opportunities in Derivative Markets

Derivative markets, such as gold futures and options, carry risks that investors should be aware of. The main risk is the potential for price volatility. Gold futures and options are highly leveraged instruments, meaning that a small price movement in gold can have a significant impact on the value of the contract. This volatility can result in substantial gains or losses, depending on the direction of the price movement.

To manage risks in derivative markets, it is important to have a clear understanding of your risk tolerance and investment objectives. Set realistic profit and loss targets, and consider utilizing risk management tools such as stop-loss orders to limit potential losses.

Leveraging opportunities in derivative markets requires careful analysis and market research. Understand the fundamental and technical factors that can influence gold prices, and use this knowledge to identify potential trading opportunities. Develop a solid trading strategy and stick to it, avoiding emotional decision-making.

It is also important to stay informed about the contract specifications, trading rules, and margin requirements of the derivative markets you are participating in. Compliance with the exchange’s regulations and ensuring proper margin coverage is essential to avoid unnecessary risks.

Educating Yourself for Successful Trading in Gold Derivatives

Before engaging in trading gold futures and options, it is crucial to educate yourself about the mechanics of these derivative instruments. Research and understand the contract specifications, margin requirements, and trading procedures of the exchanges where these instruments are traded.

Learn about technical analysis tools and chart patterns that can help identify potential entry and exit points. Develop a solid understanding of supply and demand dynamics, economic indicators, and geopolitical events that can influence gold prices.

Consider starting with a paper trading account or using a simulator to practice your trading strategies without risking real money. This allows you to gain experience and test different approaches before committing actual capital.

Stay informed about current market events and news that can impact gold prices. Regularly review financial publications, follow reputable sources, and engage in discussions with fellow traders to gain insights and perspectives.

By understanding how gold futures and options work, managing risks, leveraging trading opportunities, and continuously educating yourself, you can explore additional strategies to capitalize on gold price swings.

Investing in Gold Mining Mutual Funds

Gold mining mutual funds offer investors the opportunity to gain exposure to multiple gold mining companies through a diversified portfolio. Understanding the benefits and drawbacks of investing in gold mining mutual funds, analyzing the performance and holdings of these funds, and selecting the right gold mining mutual fund are key considerations for investors interested in this investment vehicle.

Benefits and Drawbacks of Investing in Gold Mining Mutual Funds

Investing in gold mining mutual funds offers several benefits that make it an attractive option for many investors. One of the main advantages is diversification. These funds typically hold shares of multiple gold mining companies, reducing the risk associated with investing in individual stocks. Diversification can help mitigate potential losses from underperforming companies or regions.

Gold mining mutual funds also provide investors with professional management and expertise. Fund managers conduct thorough research and analysis to identify attractive investment opportunities in the gold mining sector. This can save individual investors time and effort in researching and analyzing individual stocks.

However, there are also drawbacks to investing in gold mining mutual funds that investors should be aware of. One drawback is the fees associated with mutual fund investments. These fees can include management fees, administrative expenses, and potential sales loads. It is important to carefully review and compare these fees to understand their impact on investment returns.

Additionally, gold mining mutual funds are subject to market risks and fluctuations. The performance of these funds can be influenced by factors such as gold prices, political and regulatory risks, and operational challenges faced by individual mining companies. It is important to carefully analyze the fund’s performance track record and holdings to make informed investment decisions.

Analyzing the Performance and Holdings of Gold Mining Mutual Funds

When evaluating gold mining mutual funds, it is important to analyze their performance track record and holdings. Look for funds with consistent long-term performance and competitive returns compared to their peers and relevant benchmarks.

Review the fund’s historical performance, considering factors such as annualized returns, volatility, and risk-adjusted returns. Look for funds that have demonstrated the ability to generate consistent returns over different market cycles.

Also, analyze the fund’s holdings to understand its exposure to different regions, company sizes, and mining strategies. Consider the fund’s investment philosophy and how it aligns with your risk tolerance and investment objectives. Some funds may focus on large-cap mining companies, while others may have a bias towards smaller companies or specific regions.

Consider factors such as the fund’s expense ratio, portfolio turnover, and any potential transaction costs. Higher expense ratios and turnover can impact net returns over time.

Research the fund manager’s experience, expertise, and track record in managing gold mining mutual funds. Look for managers who have a deep understanding of the gold mining industry and a history of delivering consistent performance.

Selecting the Right Gold Mining Mutual Fund

When selecting a gold mining mutual fund, consider several factors. One important factor is your investment objectives and risk tolerance. Understand your own investment goals and match them with the fund’s strategy and portfolio composition. For example, if you are seeking capital appreciation, a fund with a focus on growth-oriented mining companies may be more suitable.

Review the fund’s historical performance and risk metrics. Look for funds that have consistently outperformed their peers and relevant benchmarks over the long term. Consider the fund’s volatility and risk-adjusted returns, and ensure they align with your risk tolerance.

Thoroughly research the fund’s holdings and assess their potential for growth and profitability. Look for holdings that are well-positioned in terms of production levels, cost efficiency, and geopolitical risks. Be mindful of concentration risks, such as heavy exposure to a specific region or company.

Review the fund’s expense ratio and other applicable fees. Consider the impact of these fees on your investment returns and compare them to similar funds in the market.

Lastly, assess the fund manager’s expertise and track record. Look for managers who have a deep understanding of the gold mining industry and a history of delivering consistent performance.

By analyzing the benefits and drawbacks of investing in gold mining mutual funds, evaluating the performance and holdings of these funds, and selecting the right fund that aligns with your investment goals, you can make informed investment decisions in the gold mining sector.

Considering Gold IRA Investments

A Gold IRA, or Individual Retirement Account, allows investors to hold physical gold, such as gold bars or coins, within a tax-advantaged retirement account. Understanding what a Gold IRA is, the advantages and disadvantages of Gold IRA investments, and choosing a trustworthy Gold IRA custodian are important considerations for investors interested in this investment option.

What is a Gold IRA?

A Gold IRA is a self-directed Individual Retirement Account that allows investors to hold physical gold as part of their retirement savings. Traditional IRAs typically allow investment in stocks, bonds, and mutual funds, but a Gold IRA provides the opportunity to diversify retirement assets with physical gold.

Gold IRAs are subject to the same contribution limits and administrative rules as traditional IRAs. Investors can contribute up to the annual limits set by the IRS, and the investments grow tax-deferred until withdrawals are made during retirement.

Advantages and Disadvantages of Gold IRA Investments

Investing in a Gold IRA offers several advantages that make it an attractive option for retirement savings. One advantage is the potential for portfolio diversification. Holding physical gold within a retirement account can provide a hedge against inflation and currency fluctuations, as gold has historically maintained its value or increased during economic downturns.

Gold IRAs also offer tax advantages. Similar to traditional IRAs, contributions to a Gold IRA are generally tax-deductible, meaning investors can reduce their taxable income in the year of contribution. Additionally, the growth of investments within the Gold IRA is tax-deferred, allowing for potential compounding growth over time.

However, there are also some disadvantages to consider when investing in a Gold IRA. One disadvantage is the lack of liquidity. Unlike traditional IRAs invested in stocks or bonds, physical gold held within a Gold IRA cannot be easily sold or converted into cash. This lack of liquidity may limit an investor’s ability to access funds during retirement.

Gold IRAs also come with storage and maintenance costs. Physical gold needs to be securely stored, which can require additional expenses for safe deposit boxes or professional storage solutions. It is important to consider these costs when evaluating the overall returns of a Gold IRA investment.

Choosing a Trustworthy Gold IRA Custodian

Selecting a trustworthy Gold IRA custodian is crucial when investing in a Gold IRA. The custodian is responsible for maintaining and safeguarding the physical gold held within the IRA. Research and due diligence are essential to ensure that the custodian is reputable and trustworthy.

When choosing a Gold IRA custodian, consider factors such as the company’s reputation, experience, and customer reviews. Look for custodians that meet regulatory requirements and adhere to industry best practices. The custodian should be well-established and have a proven track record of providing secure storage solutions.

It is also important to review the custodian’s storage facilities and security measures. Look for custodians that offer insured storage, advanced security systems, and strict access control. Regularly monitor and review the custodian’s practices to ensure that your gold investment is being stored and protected properly.

Lastly, compare the fees and costs associated with different custodians. Consider the custodian’s annual storage fees, transaction fees, and any other administrative costs. Ensure that the overall fees are reasonable and competitive compared to other custodians in the market.

By understanding what a Gold IRA is, considering the advantages and disadvantages of Gold IRA investments, and selecting a trustworthy custodian, investors can make informed decisions regarding their retirement savings and potentially benefit from the diversification and tax advantages offered by a Gold IRA.

Staying Alert to Market Indicators

Staying alert to market indicators is crucial for investors looking to capitalize on gold price swings. By monitoring central bank policies and actions, tracking global gold demand and supply, and keeping an eye on inflation and interest rates, investors can stay informed and make strategic decisions.

Monitoring Central Bank Policies and Actions

Central banks play a significant role in shaping the global economy and influencing gold prices. Monetary policies, interest rate decisions, and large-scale asset purchases by central banks can have a direct impact on gold prices.

Stay informed about the policies and actions of major central banks, such as the Federal Reserve, the European Central Bank, and the Bank of Japan. Monitor announcements and statements from central bank officials regarding interest rate changes, quantitative easing programs, or other monetary policy adjustments.

Changes in monetary policies or expectations of such changes can cause significant fluctuations in gold prices. For example, if a central bank announces a decrease in interest rates or additional quantitative easing measures, it may increase the attractiveness of gold as an alternative investment and potentially drive up gold prices.

Tracking Global Gold Demand and Supply

Global gold demand and supply dynamics can have a significant influence on gold prices. Monitor trends in jewelry demand, industrial demand, and investment demand from institutions and individuals.

Changes in consumer behaviors, such as shifts in jewelry buying patterns in emerging economies, can impact gold prices. Rising middle-class populations in countries like China and India may lead to increased demand for gold jewelry, potentially driving up prices.

Additionally, changes in investment demand, such as inflows or outflows from gold-backed exchange-traded funds (ETFs), can affect gold prices. Tracking these changes can provide insights into investor sentiment and potential price movements.

Supply dynamics, such as changes in gold mining production or central bank gold sales, can also impact gold prices. Any disruption to the supply side of the market, such as labor strikes or regulatory changes, can lead to supply shortages and potentially impact prices.

Keeping an Eye on Inflation and Interest Rates

Inflation and interest rates are key macroeconomic indicators that can influence gold prices. Gold is often seen as a hedge against inflation and a safe haven asset during periods of low or negative real interest rates.

Monitor inflation rates and expectations to assess the potential impact on gold prices. Rising inflation or expectations of higher inflation can increase the demand for gold as a store of value, potentially driving up prices.

Interest rates, especially real interest rates (adjusted for inflation), can also impact gold prices. When real interest rates are low or negative, the opportunity cost of holding gold decreases, making gold more attractive as an investment. This increased demand can drive up prices.

Stay informed about central bank decisions regarding interest rates and market expectations of future rate changes. These decisions can have a direct impact on the direction of gold prices.

By staying alert to market indicators such as central bank policies and actions, global gold demand and supply trends, and inflation and interest rates, investors can stay ahead of market trends and make informed decisions regarding their gold investments.

Seeking Expert Guidance

Seeking expert guidance is a valuable resource for investors looking to navigate the intricacies of the gold market. Consulting financial advisors with gold expertise, accessing research and analysis from reputable sources, and utilizing online communities for insights and discussions can enhance your investment knowledge and decision-making.

Consulting Financial Advisors with Gold Expertise

Financial advisors with expertise in the gold market can provide valuable insights and guidance to investors. Working with an advisor who understands the intricacies of gold price swings, historical trends, and market dynamics can help you make more informed investment decisions.

When seeking a financial advisor, look for professionals with relevant experience and a solid track record in the gold market. Consider their knowledge and understanding of gold price movements, their ability to analyze market trends, and their expertise in portfolio management.

Be prepared to discuss your investment goals, risk tolerance, and time horizon with the advisor. This will enable them to tailor their recommendations and strategies to your specific needs.

Accessing Research and Analysis from Reputable Sources

Accessing research and analysis from reputable sources is essential for staying informed about the gold market. Reputable financial institutions, investment firms, and government agencies often provide valuable insights, reports, and market analysis on gold prices and trends.

Subscribe to newsletters or publications that cover the gold market to receive regular updates and analysis. Pay attention to market research reports, economic indicators, and geopolitical analysis that can impact gold prices.

It is important to verify the credibility and reliability of the sources you rely on for research and analysis. Look for sources with a strong reputation, a history of accurate forecasts, and a transparent methodology.

Utilizing Online Communities for Insights and Discussions

Online communities can provide additional insights and perspectives on the gold market. Participating in forums, discussion boards, or social media groups focused on investments or precious metals can offer a platform to engage with like-minded individuals and share ideas.

Be cautious when relying on information from online communities. While these platforms can provide valuable insights, they can also contain misinformation or biased opinions. Do your own research and critically evaluate the information you receive from online sources.

Engaging in discussions and exchanging ideas with other investors can be beneficial, but it is important to keep an open mind and consider different viewpoints. Learn from the experiences and perspectives of others, but ultimately make your investment decisions based on thorough research and analysis.

By seeking expert guidance, accessing research and analysis from reputable sources, and utilizing online communities for insights and discussions, investors can enhance their understanding of the gold market and make more informed investment decisions.