So you’re looking to make some investments, huh? Well, I’ve got just the thing for you – a little comparison between two popular options: gold and high-yield investments. Now, you might be wondering, what’s the difference? Isn’t gold stable and high-yield investments all about growth? Well, my friend, that’s exactly what we’re going to dive into today. We’ll explore the pros and cons of each, discuss their performance over time, and give you all the information you need to make an informed decision. So, grab yourself a cup of coffee, and let’s weigh the options together.

This image is property of www.policystreet.com.

Introduction

Welcome to our blog on investment strategies and considerations. In this article, we will explore the topic of growth versus stability in investment decisions. Specifically, we will delve into the concept of gold as a safe haven investment and high-yield investments, examining their pros and cons, performance factors, and how they can be balanced within a portfolio. By the end of this article, you will have a comprehensive understanding of these investment options and be better equipped to make informed decisions.

Understanding Growth and Stability

Before we dive into specific investment options, it’s important to define what we mean by growth and stability. In the investment world, growth refers to the increase in value or profit over time, while stability refers to the ability to maintain steady and consistent returns. These two factors often go hand in hand, as achieving substantial growth typically requires a certain level of stability.

Factors Influencing Growth and Stability

Several factors can influence the growth and stability of investments. Economic conditions, market trends, and industry-specific factors all play a role. Additionally, political events, technological advancements, and consumer behavior can also impact investment performance. It’s essential for investors to stay informed about these variables and consider them when making investment decisions.

This image is property of i0.wp.com.

Investment Styles and Goals

Different investors have varying investment styles and goals. Some investors prefer long-term investments, while others focus on short-term gains. Understanding these different approaches can help determine which investment options align with your goals.

Long-term Investments

Long-term investments are typically held for extended periods, often exceeding five years. They are characterized by a buy-and-hold strategy, aiming to achieve substantial growth over time. Examples of long-term investments include stocks, bonds, real estate, and certain commodities.

Short-term Investments

Short-term investments, on the other hand, are held for shorter durations, ranging from a few days to a few months. These investments often aim to capitalize on quick market fluctuations and generate immediate gains. Day trading, swing trading, and options trading are examples of short-term investment strategies.

Considerations for Different Investment Goals

When deciding between long-term and short-term investments, it’s crucial to consider your investment goals, risk tolerance, and financial circumstances. Long-term investments are typically more stable and less prone to short-term market volatility. In contrast, short-term investments can be more volatile and require active monitoring and quick decision-making. Assessing your personal circumstances and objectives will help guide you towards the most appropriate investment style.

Gold as a Safe Haven Investment

Gold has long been regarded as a safe haven investment, particularly during times of economic uncertainty and market turbulence. Let’s explore the reasons why gold is considered a reliable investment option.

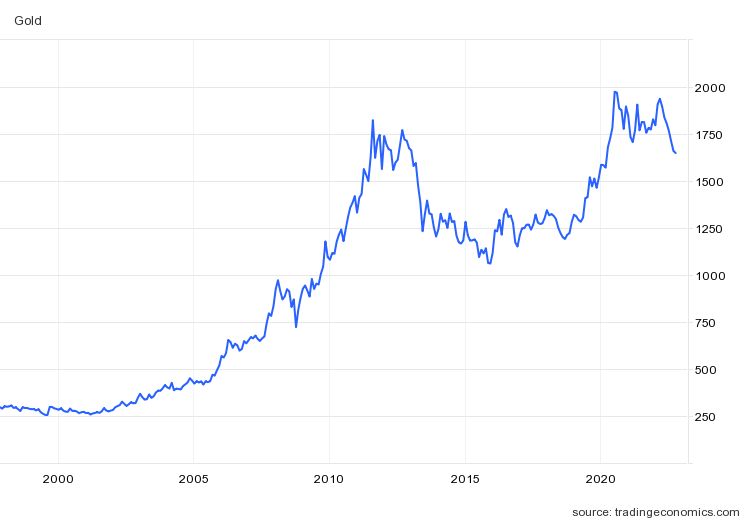

Overview of Gold as an Investment

Gold is a tangible asset that has been prized for its beauty and rarity for centuries. In addition to its aesthetic value, gold is also recognized as a hedge against inflation and currency devaluation. As a result, many investors turn to gold as a way to preserve wealth and protect against economic downturns.

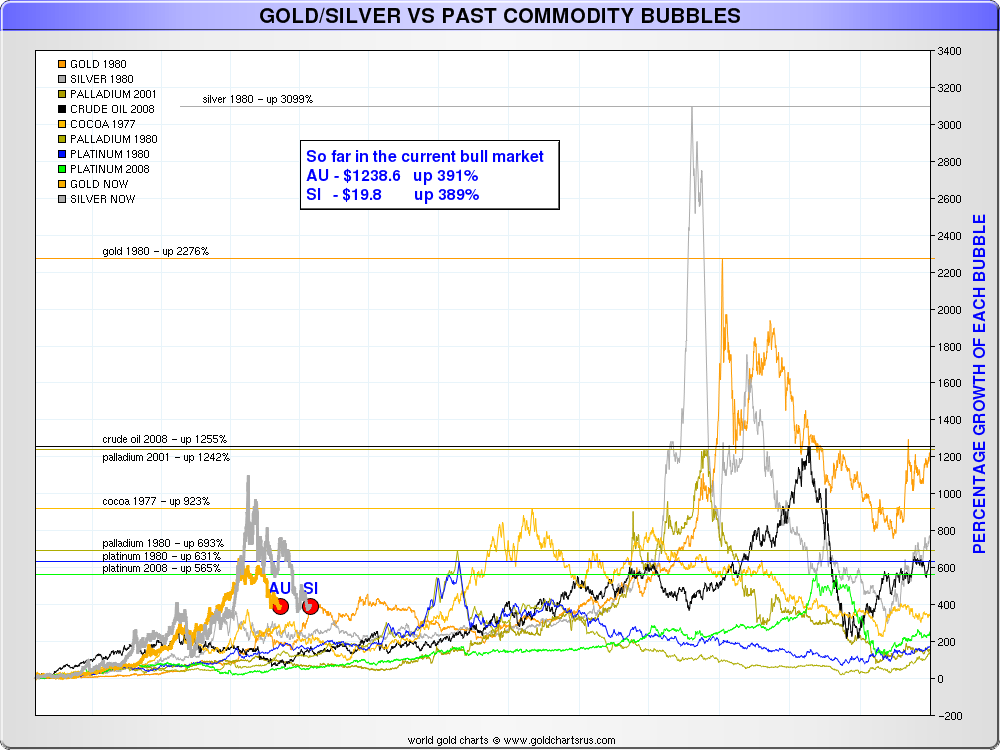

Historical Performance of Gold

One of the key factors that make gold attractive to investors is its historical performance. Over the long term, gold has shown resilience and has often demonstrated the ability to retain or increase in value, even during times of economic crisis. This track record has made gold a popular choice for diversifying investment portfolios.

Factors Driving Gold Prices

The price of gold is influenced by several factors. One crucial element is the relationship between interest rates and inflation. When interest rates are low and inflation is high, the demand for gold tends to increase, driving up its price. Geopolitical and economic events, such as wars or financial crises, can also impact gold prices. Additionally, fluctuations in currency exchange rates can affect the price of gold, as it is often traded in US dollars.

Role of Gold in Portfolio Diversification

Gold is often included in investment portfolios as a means of diversification. By adding gold to a portfolio that includes stocks, bonds, and other assets, investors can potentially reduce overall risk. Gold’s performance is often uncorrelated with other investments, meaning it may act as a hedge against market volatility and provide stability during turbulent times.

This image is property of thesmartinvestor.com.

High-Yield Investments

While gold offers stability, some investors may seek higher returns through high-yield investments. Let’s explore the characteristics, pros, and cons of these investment options.

Types of High-Yield Investments

High-yield investments refer to investment opportunities that offer above-average returns compared to other options. Examples of high-yield investments include stocks of rapidly growing companies, high-yield bonds, real estate investment trusts (REITs), and peer-to-peer lending.

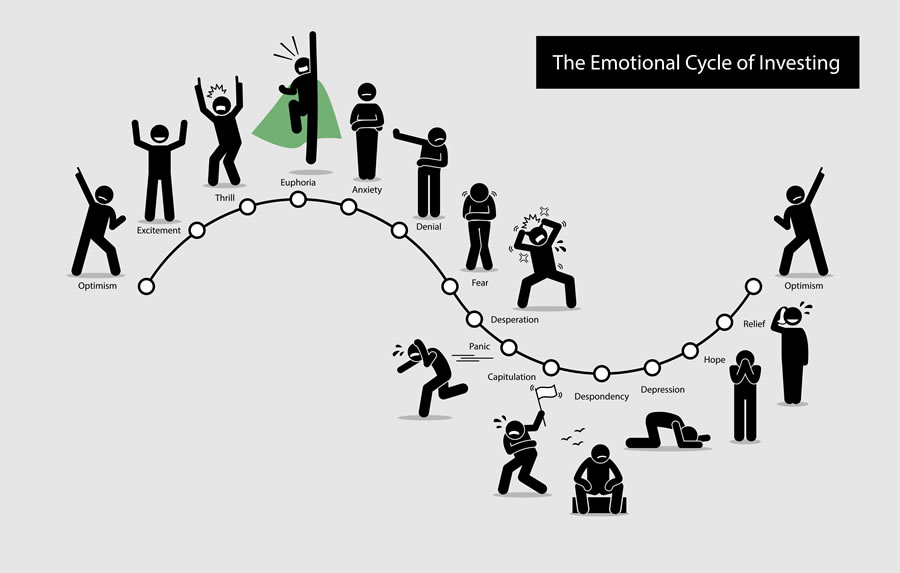

Pros and Cons of High-Yield Investments

The primary advantage of high-yield investments is the potential for significant returns. These investments often outperform safer options, making them attractive to investors seeking growth. However, high-yield investments come with higher risks. The potential for greater returns is accompanied by increased volatility and the possibility of capital loss. It’s crucial for investors to carefully assess their risk tolerance and conduct thorough research before investing in high-yield options.

Volatility and Risk Factors

High-yield investments are generally considered more volatile than safer options like gold. Stocks, for example, can experience significant price fluctuations in response to market and company-specific factors. Bonds issued by lower-rated companies or countries bear higher default risk. Real estate investments are subject to fluctuations in property values and changes in rental demand. Understanding and accepting the risks associated with high-yield investments is essential for investors considering these options.

Balancing Growth and Stability

Investors often strive to strike a balance between achieving growth and maintaining stability in their portfolios. Here, we will explore strategies and considerations for finding the right balance.

Portfolio Allocation Strategies

One common approach to balancing growth and stability is through portfolio allocation. This involves diversifying investments across different asset classes, such as stocks, bonds, real estate, and commodities like gold. By spreading investments across multiple sectors, investors can reduce the impact of any single investment’s performance on the overall portfolio.

Diversification Benefits

Diversification is a crucial aspect of portfolio management. It helps reduce investment risk by offsetting potential losses in one asset class with gains in another. The inclusion of different investment types with varying levels of risk and return can enhance portfolio stability and increase the potential for long-term growth.

Trade-offs and Considerations

Finding the ideal balance between growth and stability requires considering trade-offs. Investments with higher growth potential often come with increased risk and volatility. Conversely, safer investments may offer lower returns. Investors must assess their risk tolerance, time horizon, and financial goals to determine the optimal allocation for their portfolios.

This image is property of www.oaktreecapital.com.

Long-term vs. Short-term Performance

When evaluating investment performance, it’s essential to consider both long-term and short-term perspectives. Let’s explore how to assess the performance of investments under different timeframes.

Understanding Long-term Performance

Long-term performance refers to the returns generated by investments over an extended period, typically five years or more. It provides a broader perspective on how investments have performed through various market cycles. Evaluating long-term performance helps investors identify trends, assess the effectiveness of their investment strategies, and determine if their goals are being met.

Assessing Short-term Performance

Short-term performance focuses on returns over shorter durations, ranging from a few days to a few months. While short-term performance can be influenced by factors such as market sentiment and news events, it may not accurately reflect the long-term prospects of an investment. It’s essential to look beyond short-term fluctuations and consider the underlying fundamentals and goals of the investment.

Approaches to Evaluating Investment Performance

There are various approaches to evaluating investment performance. One commonly used method is comparing the investment’s returns to a benchmark index that represents the overall market or a specific industry. Analyzing factors such as risk-adjusted returns, volatility, and consistency of performance can also provide insights into an investment’s performance. It’s important to consider multiple metrics and indicators to get a comprehensive view of investment performance.

Factors Affecting Gold

To fully understand the potential of gold as an investment, it’s essential to consider the factors that can influence its price and performance. Let’s explore some key factors that impact the dynamics of the gold market.

Interest Rates and Inflation

Gold prices often have an inverse relationship with interest rates. When interest rates are low, gold becomes more attractive as an investment since it offers a store of value and hedges against inflation. Conversely, higher interest rates can decrease the demand for gold, as investors seek higher-yielding alternatives. Inflation can also impact gold prices, as it erodes the value of fiat currency and drives up the demand for precious metals.

Geopolitical and Economic Events

Geopolitical and economic events can have a significant impact on gold prices. Uncertainty and instability caused by events such as political tensions, trade disputes, or economic recessions often drive investors towards safe haven assets like gold. Conversely, periods of economic strength and stability may result in reduced demand for gold as investors seek higher-risk, higher-yielding investments.

Currency Fluctuations

Since gold is traded internationally and priced in US dollars, currency fluctuations can impact its price. When the value of the US dollar weakens, gold becomes relatively cheaper for investors holding other currencies, increasing demand and driving up prices. Conversely, a stronger US dollar can decrease the demand for gold from international investors.

Supply and Demand Dynamics

As with any commodity, the supply and demand dynamics of gold influence its price. The mining industry’s ability to meet demand, the amount of recycled gold in the market, and central bank activity regarding gold reserves can all impact supply. On the demand side, factors such as jewelry production, industrial use, and investment demand from individuals and institutions play a role in shaping the market for gold.

This image is property of www.investopedia.com.

Key Considerations for Investors

When making investment decisions, several key considerations should be taken into account. Let’s explore these factors to help you make informed investment choices.

Risk Tolerance and Time Horizon

Assessing your risk tolerance and time horizon is crucial in determining your investment strategy. Understanding how much risk you are willing to take and how long you can remain invested will guide you towards appropriate investments. Conservative investors with a lower risk tolerance may prefer safer options like gold, while more aggressive investors may be open to high-yield investments.

Financial Goals and Objectives

Clarity on your financial goals and objectives is essential when making investment decisions. Whether you are saving for retirement, funding education, or seeking to grow your wealth, aligning your investments with your specific goals can help ensure you stay on track. Consider factors such as desired returns, investment timeframe, and liquidity needs when evaluating potential investment options.

Market Conditions and Economic Outlook

Staying informed about market conditions and the broader economic outlook can help guide your investment decisions. Analyzing trends, understanding the potential impact of economic indicators, and studying market forecasts can provide valuable insights. However, it’s important to note that markets are inherently unpredictable, and past performance is not indicative of future results.

Conclusion

In conclusion, understanding the balance between growth and stability is vital for successful investment strategies. Gold, as a safe haven investment, provides stability and acts as a portfolio diversifier. On the other hand, high-yield investments offer the potential for higher returns but come with increased risks. By considering factors such as risk tolerance, time horizon, and financial goals, investors can find the right balance in their portfolios. Staying informed about market conditions and the factors affecting specific investments, such as gold, will ultimately lead to better investment decisions. Remember, the key to successful investing is diversification, careful analysis, and aligning investments with your individual circumstances and objectives.