So you’re preparing for retirement and considering different investment options to secure your future. Well, let me tell you, my friend, you’ve come to the right place! Today, we’re going to talk about how gold fits into your pension plan. Gold, as we all know, has been a timeless symbol of wealth and prosperity. But did you know that it can also play a crucial role in diversifying your investment portfolio? In this article, we’ll explore the benefits of investing in gold for retirement and how it can act as a hedge against economic uncertainties. Get ready to uncover the secrets of this shiny yellow metal and discover how it can potentially provide stability and growth for your golden years.

This image is property of i0.wp.com.

Understanding Retirement Planning

Introduction to Retirement Planning

Retirement planning is an essential component of financial security and peace of mind in your golden years. It involves setting aside funds and making strategic investment decisions to ensure a comfortable retirement lifestyle. By planning ahead, you can mitigate the financial challenges that may arise after you stop working.

Importance of Retirement Planning

Retirement planning is crucial for several reasons. First and foremost, it allows you to maintain your standard of living when you retire. Without proper planning, you may find yourself facing financial hardships or having to compromise on your lifestyle. Planning helps you save and invest efficiently, ensuring a steady income stream even after you stop working. Additionally, retirement planning can provide a sense of security and alleviate concerns about future financial instability.

Introduction to Investing

Importance of Investing

Investing is a fundamental aspect of retirement planning. It involves allocating your savings to various assets to generate income or appreciate in value over time. Investing allows your money to work for you, potentially grow in value, and outpace inflation. By investing early and consistently, you can accumulate a substantial retirement fund and increase your chances of a comfortable retirement.

Types of Investments

There is a wide range of investment options available, each with its own benefits and risks. Common types of investments include stocks, bonds, real estate, mutual funds, and commodities, such as gold. Each investment option has unique characteristics that can contribute to the diversification and growth of your retirement portfolio. It is important to understand the features of each investment type before making any decisions.

This image is property of imgnew.outlookindia.com.

The Role of Gold in Investment

Introduction to Gold Investment

Gold has been revered as a valuable asset for centuries. It is often considered a safe-haven investment, especially during times of economic uncertainty. Gold can act as a hedge against inflation and currency fluctuations, making it an attractive addition to a well-diversified investment portfolio. Understanding the role gold plays in investment can help you make informed decisions when considering its inclusion in your retirement plan.

Benefits of Investing in Gold

Investing in gold offers several benefits, particularly when it comes to retirement planning. Firstly, gold has a low correlation with traditional financial assets like stocks and bonds. This means when other markets may experience volatility, gold can provide stability to your portfolio. Gold is also a tangible asset with intrinsic value, making it resistant to economic downturns. Additionally, gold has demonstrated the potential for long-term capital appreciation, making it an attractive investment for those seeking wealth preservation and growth.

Types of Retirement Accounts

Traditional IRA

A Traditional Individual Retirement Account (IRA) allows you to contribute pre-tax income, reducing your current taxable income. The contributions and any earnings grow tax-deferred until withdrawal during retirement. Withdrawals from a Traditional IRA are typically subject to income tax based on your tax bracket during retirement. This type of retirement account is an excellent option for individuals looking to lower their current taxable income and potentially pay fewer taxes during retirement.

Roth IRA

A Roth IRA is funded with after-tax income, meaning your contributions are not tax-deductible. However, the earnings in a Roth IRA grow tax-free, and qualified withdrawals in retirement are also tax-free. Contributing to a Roth IRA can be advantageous if you anticipate being in a higher tax bracket during retirement or if you want to have tax-free income during your golden years.

401(k)

A 401(k) is an employer-sponsored retirement account that allows employees to contribute a portion of their salary on a pre-tax basis. Some employers even offer matching contributions, which can significantly boost your retirement savings. Contributions to a 401(k) grow tax-deferred, and taxes are only paid upon withdrawal during retirement. A 401(k) is an excellent way to save for retirement, especially if your employer offers a matching contribution.

This image is property of www.investopedia.com.

Diversification in Retirement Planning

Importance of Diversification

Diversification plays a critical role in retirement planning. It involves spreading your investments across different asset classes to minimize risk and potentially maximize returns. By diversifying your portfolio, you reduce the reliance on a single investment and increase the likelihood of consistent and stable growth. Diversification helps mitigate the impact of market volatility and enables you to navigate various economic conditions more effectively.

Asset Allocation

Asset allocation is a key component of diversification. It refers to the strategic distribution of your investment portfolio across different asset classes, such as stocks, bonds, real estate, and commodities. The right asset allocation will depend on your risk tolerance, investment goals, and time horizon until retirement. Allocating a portion of your portfolio to gold can enhance diversification by adding an alternative investment that behaves differently from traditional financial assets.

Understanding Gold Investments

Physical Gold

Physical gold refers to investing in tangible gold assets, such as gold bars or coins. Owning physical gold provides a sense of security as it is directly held and tangible. It can be stored at home or in a secure vault. Physical gold is a popular option for investors seeking to possess the precious metal and potentially benefit from long-term appreciation.

Gold ETFs

Gold Exchange-Traded Funds (ETFs) are investment funds that trade on stock exchanges and aim to track the price movements of gold. Investing in gold ETFs allows you to gain exposure to gold without the need for physical ownership. Gold ETFs offer liquidity and ease of trading, making them a convenient option for investors looking to diversify their retirement portfolio with gold.

Gold Mining Stocks

Investing in gold mining stocks involves purchasing shares in companies involved in gold exploration, extraction, and production. These stocks tend to be more volatile than physical gold or gold ETFs due to factors such as operational risks, production costs, and the overall performance of the mining sector. Gold mining stocks offer investors the potential for leveraged exposure to the gold market and can be an alternative way to invest in gold within a retirement account.

This image is property of cdn.due.com.

Benefits of Including Gold in Pension Plan

Hedging against Inflation

Gold has historically been considered a hedge against inflation. As the value of currencies fluctuates, gold tends to retain its purchasing power. By including gold in your pension plan, you can potentially protect your retirement savings from the erosive effects of inflation and ensure the preservation of your purchasing power over time.

Portfolio Protection

Gold can act as a portfolio diversifier and provide protection during times of economic uncertainty or market volatility. When traditional financial assets experience downturns, gold may remain relatively stable or even appreciate in value. By including gold in your pension plan, you can potentially reduce the overall volatility of your portfolio and safeguard against unforeseen events.

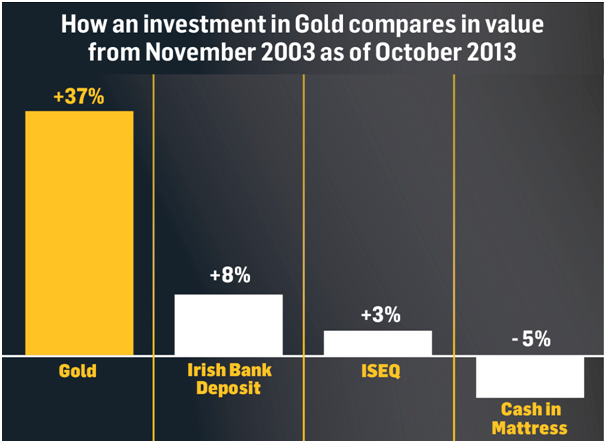

Potential for Capital Appreciation

One of the significant benefits of investing in gold is its potential for long-term capital appreciation. While the price of gold can fluctuate in the short term, its value has steadily increased over the long run. By including gold in your pension plan, you can potentially benefit from the appreciation of this precious metal and enhance the overall growth of your retirement portfolio.

Risks and Considerations

Market Volatility

Investing in gold, like any other asset, comes with its share of risks. Gold prices can be volatile and subject to market fluctuations. It is essential to be aware of these fluctuations and understand that short-term price movements should not deter your long-term investment strategy. By focusing on the fundamentals of gold as a store of value and long-term asset, you can navigate market volatility more effectively.

Storage and Insurance Costs

If you choose to invest in physical gold, you need to consider the costs associated with storage and insurance. Storing gold securely may require renting a safety deposit box or utilizing the services of a reputable custodian. These costs should be factored into your overall retirement planning and budgeted accordingly.

Liquidity

Gold, especially physical gold, may not be as liquid as other financial assets. It may take time to convert your gold holdings into cash, especially during periods of economic turmoil. While gold ETFs and gold mining stocks offer greater liquidity, physical gold requires careful consideration of liquidity needs before investing a significant portion of your retirement portfolio.

This image is property of dzswc0o8s13dx.cloudfront.net.

Tax Implications of Gold Investments in Retirement Accounts

Tax Advantages of Traditional IRA and 401(k)

Investing in gold within a Traditional IRA or 401(k) can offer potential tax advantages. Contributions to these retirement accounts are typically tax-deductible, allowing you to reduce your current taxable income. Any earnings generated by your gold investments within these accounts grow tax-deferred until withdrawal during retirement. However, withdrawals from these retirement accounts are subject to income tax based on your tax bracket during retirement.

Tax Considerations for Roth IRA

In a Roth IRA, contributions are made with after-tax income, meaning there are no immediate tax benefits. However, the appreciated value of gold investments within a Roth IRA can be withdrawn tax-free during retirement, as long as certain conditions are met. This tax advantage makes a Roth IRA an attractive option for including gold in your retirement plan without the burden of future taxes on your investment gains.

Tips for Including Gold in Your Pension Plan

Consult with a Financial Advisor

Before including gold in your pension plan, it is advisable to consult with a qualified financial advisor. They can assess your individual financial situation, risk tolerance, and investment goals to determine the most appropriate allocation for gold within your retirement portfolio. A financial advisor can provide valuable guidance and ensure that your retirement plan aligns with your short-term and long-term objectives.

Determine Allocation Percentage

Deciding on the allocation percentage for gold within your pension plan requires careful consideration. Your allocation should reflect your risk tolerance, investment horizon, and future financial goals. A financial advisor can help you determine the optimal allocation that aligns with your unique circumstances and objectives.

Research Gold Investment Options

When considering gold for your pension plan, it is crucial to research and understand the different investment options available. Evaluate the features, advantages, and risks of physical gold, gold ETFs, and gold mining stocks. Consider factors such as liquidity, storage costs, and potential returns. A thorough understanding of these options will enable you to make informed decisions and select the most suitable investment vehicles for your retirement portfolio.

In conclusion, understanding retirement planning, the role of gold in investment, and the types of retirement accounts is crucial for a successful and secure retirement. By diversifying your portfolio, including gold investments, and considering the associated risks and tax implications, you can enhance the growth potential of your pension plan. Remember to seek the guidance of a financial advisor and conduct thorough research before making any investment decisions. With adequate knowledge and careful planning, you can build a robust retirement portfolio that includes the lasting value of gold.