In this article, we will explore the world of buying and selling gold and uncover the untapped potential of liquidity in this market. As an experienced investor in gold, I have witnessed firsthand the ease and convenience of buying and selling this precious metal. Whether you are a seasoned investor or just starting out, understanding the intricacies of gold’s liquidity can provide you with a valuable edge in the investment world. So sit back, grab a cup of coffee, and prepare to delve into the fascinating realm of gold investments.

Why Invest in Gold

As an investor, you are always on the lookout for opportunities that can help you earn solid returns and safeguard your wealth. One such investment that has stood the test of time is gold. Gold has been recognized for its value and beauty since ancient times, and it continues to be a popular choice among savvy investors. In this article, we will explore the various reasons why investing in gold can be a wise decision for you.

Historical Perspective

One of the key reasons why gold is considered a valuable investment is because of its long history of retaining its value over time. Unlike paper currencies or other assets, gold has maintained its purchasing power and intrinsic worth for centuries. This historical perspective gives investors confidence in gold’s ability to withstand economic uncertainties and market fluctuations.

Hedge Against Inflation

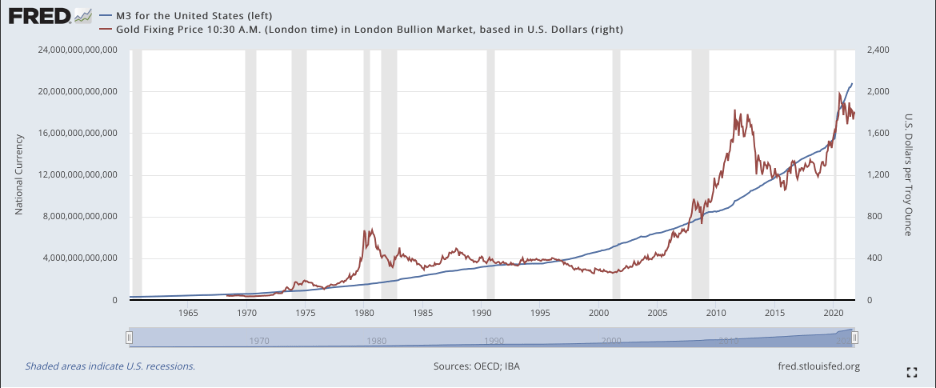

Inflation is the gradual decrease in the purchasing power of money over time. As prices of goods and services rise, the value of your money erodes. However, gold has proven to be an effective hedge against inflation. During periods of inflation, the price of gold tends to rise, preserving the real value of your investment. By investing in gold, you can protect your wealth from the erosion caused by inflation.

Portfolio Diversification

Diversification is a crucial strategy for any investor. By spreading your investments across different asset classes, you can reduce the overall risk of your portfolio. Gold provides an excellent diversification opportunity as its price movements are often unrelated to other investments such as stocks or bonds. Adding gold to your portfolio can help mitigate the impact of market volatility and provide stability during uncertain times.

Types of Gold Investments

Now that we have seen the reasons why investing in gold is beneficial, let’s explore the various options available for investing in this precious metal.

Physical Gold

Physical gold is perhaps the most traditional form of gold investment. This includes gold bars, coins, and even jewelry. Owning physical gold allows you to have a tangible asset that you can touch and hold. It provides a sense of security and ownership. Physical gold can be purchased from local coin shops, reputable online dealers, or even at auctions.

Gold ETFs

Gold Exchange-Traded Funds (ETFs) offer a convenient and cost-effective way to invest in gold without the hassle of owning and storing physical gold. These funds are designed to track the price of gold and are traded on stock exchanges, just like regular stocks. Investing in gold ETFs allows you to have exposure to the gold market without the need for physical possession.

Gold Mining Stocks

Investing in gold mining stocks provides an indirect exposure to the gold market. When you buy shares of a gold mining company, you are essentially investing in their ability to extract and sell gold. The value of these stocks is influenced by both the price of gold and the company’s operational performance. Investing in gold mining stocks can offer potential high returns, but it also carries higher risk compared to physical gold or ETFs.

The Advantages of Investing in Gold

Now that we have explored the different types of gold investments, let’s delve into the advantages that investing in gold offers.

Tangible Asset

One of the significant advantages of investing in gold is that it is a tangible asset. Unlike stocks or bonds, which are merely pieces of paper, gold is a physical asset that you can hold in your hand. This inherent tangibility provides a sense of security and stability, especially during times of economic uncertainty.

Liquidity

Gold is widely accepted and recognized as a valuable asset around the world. It has a deep and liquid market, meaning it can be easily bought and sold. Whether you own physical gold or invest in gold ETFs, you can rely on the liquidity of gold to convert your investment into cash quickly if needed. This liquidity makes gold an attractive investment option in times of financial emergencies.

Global Recognition

Gold is a universally recognized form of money and wealth. It has been used as a medium of exchange and a store of value in various cultures throughout history. This global recognition provides reassurance that your gold investment will retain its value regardless of geographic location or economic conditions.

Understanding Gold Markets

To make informed investment decisions in gold, it is essential to understand the dynamics of the gold market.

Spot Price

The spot price of gold refers to the current market price for immediate delivery of gold. It is influenced by various factors, such as supply and demand, market sentiment, and economic indicators. The spot price serves as a benchmark for gold trading worldwide.

Market Forces

Gold prices are driven by market forces, including investor sentiment, economic conditions, and geopolitical events. Factors such as interest rates, inflation, and currency fluctuations can impact the demand and supply of gold, ultimately affecting its price.

Supply and Demand

The supply and demand dynamics of gold play a crucial role in determining its price. Gold production, central bank reserves, and consumer demand all contribute to the supply and demand balance. Understanding the factors affecting supply and demand can help you anticipate price movements and make informed investment decisions.

Buying Physical Gold

If you are interested in owning physical gold, there are several avenues available for purchasing it.

Local Coin Shops

Local coin shops are a convenient option for buying physical gold. These shops specialize in the buying and selling of coins and bullion. They often carry a variety of gold products and can provide valuable insights and expertise to help you make the right purchase.

Online Dealers

Reputable online dealers offer a wide range of gold products and provide the convenience of shopping from your own home. It is essential to choose a trusted online dealer with a proven track record and secure payment options.

Security and Storage Options

Once you have purchased physical gold, it is crucial to ensure its safe storage. Options for storing gold include home safes, bank safe deposit boxes, and independent storage facilities. Consider factors such as security, accessibility, and insurance when selecting a storage solution for your gold.

Selling Physical Gold

When the time comes to sell your physical gold, there are various options available to you.

Selling to a Dealer

Local coin shops and online dealers are often willing to buy back gold at competitive prices. Selling to a reputable dealer ensures a smooth and transparent transaction. It is advisable to shop around and compare offers to get the best price for your gold.

Online Platforms

In addition to selling back to dealers, online platforms offer opportunities to sell your physical gold directly to other investors. These platforms connect buyers and sellers, providing a transparent and efficient marketplace for trading gold.

Setting the Right Price

When selling your physical gold, it is crucial to set the right price to ensure a fair transaction. Consider factors such as the current spot price, market conditions, and any additional premiums or fees associated with selling. Researching and staying informed about current market trends can help you determine the appropriate price for your gold.

Gold ETFs: Convenience and Flexibility

Gold ETFs offer investors a convenient and flexible way to gain exposure to the gold market.

What are ETFs

Exchange-Traded Funds (ETFs) are investment funds that trade on stock exchanges. Gold ETFs are designed to track the price of gold and provide investors with a way to invest in gold without owning physical gold. These funds offer the benefits of diversification, liquidity, and ease of buying and selling.

Ease of Buying and Selling

Investing in gold ETFs provides ease of buying and selling, similar to trading stocks. You can buy or sell shares of a gold ETF through your brokerage account, just like any other stock. This convenience allows you to take advantage of price movements and adjust your investment strategy as needed.

Tracking the Gold Price

Gold ETFs track the price of gold, so when the price rises, the value of your investment increases. This gives you direct exposure to the price movements of gold without needing to own physical gold. Investing in gold ETFs can be an efficient way to align your investment strategy with the performance of the gold market.

Investing in Gold Mining Stocks

Investing in gold mining stocks offers a unique opportunity to gain exposure to the gold market through mining companies.

Evaluating Mining Companies

When investing in gold mining stocks, it is crucial to evaluate the financial health and operational performance of the mining companies. Consider factors such as production costs, reserves, management expertise, and geopolitical risk. Thorough research and analysis can help you identify promising mining companies with the potential for long-term growth.

Managing Risks

Investing in gold mining stocks carries higher risks compared to other forms of gold investment. Factors such as operational failures, regulatory changes, and fluctuations in the price of gold can impact the performance of mining stocks. Diversifying your investment across multiple mining companies can help mitigate risks and improve your chances of positive returns.

Potential for High Returns

While investing in gold mining stocks involves risks, it also offers the potential for high returns. Successful mining companies can experience exponential growth during bullish gold markets. By selecting mining stocks wisely and staying informed about market trends, you can position yourself to benefit from the potential upside in gold mining stocks.

Factors Affecting Gold Prices

To make informed investment decisions in gold, it is essential to understand the factors that influence its price.

Economic Indicators

Economic indicators, such as interest rates, inflation rates, and GDP growth, can significantly impact gold prices. For example, lower interest rates and higher inflation tend to drive up the price of gold as investors seek to protect their wealth from the eroding effects of inflation.

Geopolitical Events

Geopolitical events, such as wars, political instability, and trade disputes, can create market uncertainties and drive up the demand for safe-haven assets like gold. These events often result in increased investment in gold as a hedge against potential economic and financial risks.

Central Bank Policies

Central banks play a crucial role in gold markets. Changes in monetary policies, such as quantitative easing or tightening, can affect the demand and supply of gold. Central bank gold reserves and buying/selling activities can also influence the price of gold.

Tips for Buying and Selling Gold

Here are some practical tips to consider when buying and selling gold:

Research and Staying Informed

Before making any investment decisions, it is essential to conduct thorough research and stay informed about current market trends. Stay updated on economic indicators, geopolitical events, and central bank policies that can impact gold prices. Knowledge empowers you to make informed decisions and navigate the gold market effectively.

Establishing a Budget

It is crucial to establish a budget for your gold investments. Determine how much you are willing to allocate to gold and ensure that it aligns with your overall investment strategy. Setting a budget helps you avoid impulsive or emotional investment decisions that can lead to financial strain.

Diversifying Your Investments

Diversification is key to reducing risk in your investment portfolio. Consider allocating a portion of your portfolio to gold to diversify across asset classes. By spreading your investments across different sectors and markets, you can potentially mitigate the impact of market volatility and improve your chances of achieving long-term financial goals.

In conclusion, investing in gold can offer a range of benefits, including protection against inflation, portfolio diversification, and the potential for steady returns. Whether you choose to invest in physical gold, gold ETFs, or gold mining stocks, it is important to conduct thorough research, stay informed, and assess your risk tolerance. By understanding the dynamics of the gold market and following sound investment strategies, you can maximize the potential of your gold investments and secure your financial future.