If you’re interested in the world of investments, particularly in the gold market, you’ve probably heard about the emotions that can come into play when making decisions. From fear to greed, these emotions can greatly impact your investment strategy. In this blog post, we’re going to take a deep dive into the emotional aspects of investing in gold and explore ways to overcome fear and greed. By understanding these emotions and learning how to navigate them, you can make more informed decisions and potentially increase your chances of success in the gold market. So, let’s get started!

The Importance of Emotional Intelligence in Gold Investing

Gold investing can be a fruitful endeavor, but it is not without its emotional challenges. The ability to recognize and manage emotions is crucial when it comes to making investment decisions. Fear and greed are two prominent emotions that can greatly impact our behavior and decision-making process. Understanding and effectively managing these emotions is essential for successful gold investing.

Recognizing Fear and Greed

Before delving into the emotional aspects of gold investing, it is important to first understand the emotions of fear and greed. Fear is a natural response to potential loss or risk, while greed is a desire for excessive gain. Both of these emotions can cloud our judgment and lead to irrational decisions.

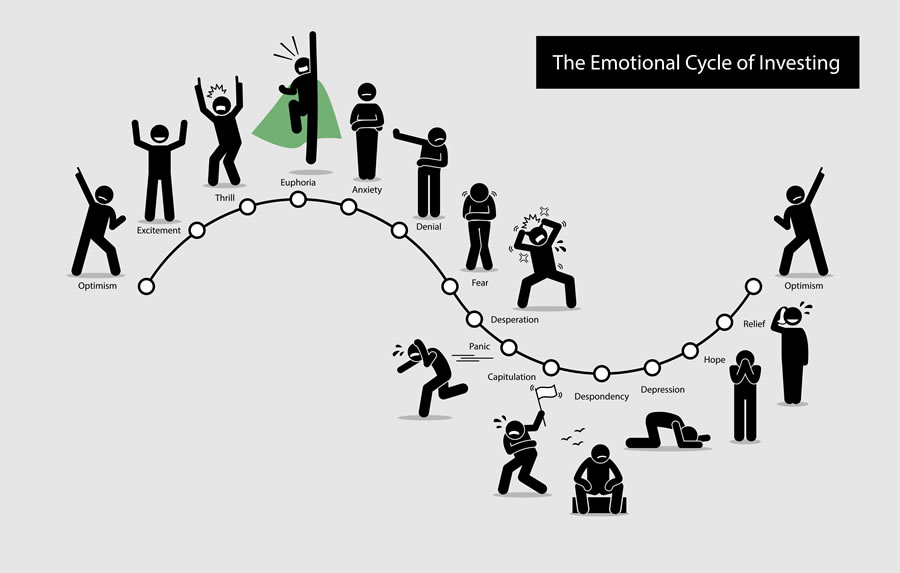

The Impact of Emotions on Investment Decisions

Emotions play a significant role in our investment decisions, often overriding rational analysis and leading to impulsive actions. When fear takes hold, we may panic and sell our gold investments at a loss, fearing further decline in value. On the other hand, when greed consumes us, we may make reckless decisions in pursuit of quick profits. Emotions can lead to buying high and selling low, the opposite of what successful investors strive for.

Strategies for Overcoming Emotional Biases

Overcoming our emotional biases is crucial for successful gold investing. Here are some strategies that can help manage fear and greed:

Understanding Fear in Gold Investing

Fear is a common emotion experienced by gold investors due to the precious metal’s volatility and the potential for financial loss. It is important to identify the sources of fear and understand how they can impact investment behavior.

Identifying the Sources of Fear

Fear in gold investing can stem from various sources, such as economic uncertainty, geopolitical tensions, or market fluctuations. Understanding the specific triggers that evoke fear can help investors develop strategies to overcome them.

Common Fears Associated with Gold Investing

Some common fears associated with gold investing include the fear of missing out on potential gains, the fear of losing money, and the fear of making wrong investment decisions. These fears can be debilitating and prevent investors from taking calculated risks.

The Effects of Fear on Investment Behavior

When fear takes over, investors may become overly cautious, missing out on potential opportunities for growth. Fear can also lead to selling investments prematurely, missing out on long-term gains. Understanding the effects of fear on investment behavior is crucial for making rational decisions.

Managing Fear in Gold Investing

Managing fear is essential for successful gold investing. Here are some strategies to help overcome fear and make informed investment decisions.

Rational Analysis and Decision Making

Rational analysis involves researching and analyzing market trends, historical data, and other relevant information to make sound investment decisions. By relying on facts and data, investors can mitigate the impact of fear on their decision-making process.

Setting Realistic Expectations

Setting realistic expectations is key to managing fear. While gold investing can yield significant returns, it is important to understand that there will be periods of volatility and fluctuation. Setting realistic expectations helps investors stay focused on the long-term goals and avoid making impulsive decisions based on short-term market movements.

Seeking Professional Advice and Guidance

Seeking professional advice and guidance can provide invaluable support when managing fear in gold investing. Financial advisors and experts can offer objective insights and help investors navigate through emotionally challenging situations.

Recognizing Greed in Gold Investing

Greed, like fear, can have a detrimental impact on gold investment decisions. Recognizing the signs of greedy behavior is crucial for maintaining a balanced and disciplined approach to investing.

The Dangers of Greed

Greed can lead investors to take excessive risks, chase quick profits, and ignore fundamental analysis. It can cloud judgment and lead to impulsive decisions that can result in substantial financial loss.

Signs of Greedy Behavior in Investors

Some signs of greedy behavior in gold investors include a constant desire for higher returns, ignoring risk warnings, and an obsession with short-term gains. Recognizing these signs can help investors curb their greedy instincts and make more informed decisions.

How Greed Impacts Investment Decisions

Greed can lead to impulsive buying decisions without conducting thorough research or considering the long-term prospects of an investment. It can also lead to holding onto losing investments in the hopes of a quick turnaround, even when the evidence suggests otherwise.

Curbing Greed in Gold Investing

Curbing greed is crucial for maintaining a disciplined and responsible approach to gold investing. Here are some strategies to help investors overcome greedy tendencies.

Creating and Adhering to a Plan

Creating a well-defined investment plan and sticking to it helps investors avoid impulsive decisions driven by greed. A plan should include specific investment goals, risk tolerance, and a diversified portfolio strategy.

Practicing Patience and Discipline

Patience and discipline are essential virtues when it comes to gold investing. Investors should resist the urge to make impulsive decisions based on short-term market movements and instead focus on the long-term potential of their investments.

Utilizing Risk Management Strategies

Implementing risk management strategies, such as setting stop-loss orders or diversifying investments, can help curb the impact of greed. These strategies ensure that investors have predefined exit points and a diversified portfolio, reducing the potential negative impact of impulsive decisions driven by greed.

The Role of Education and Research

Building a strong knowledge base is essential for successful gold investing. Education and research not only provide investors with valuable insights but also help them avoid misleading information and make informed decisions.

Developing a Strong Knowledge Base

Investors should dedicate time to understanding the dynamics of the gold market, including the factors that influence its price, historical performance, and the correlation with other asset classes. Staying informed on market trends and news is crucial for making informed decisions.

Staying Informed About Market Trends

Staying up-to-date with market trends helps investors identify potential opportunities and risks. It also enables them to make informed decisions based on current market conditions rather than being influenced by short-term fluctuations.

Avoiding Misleading Information

In the age of information overload, it is crucial for investors to be discerning and critical when evaluating information sources. Avoiding misleading information and relying on reputable sources can help investors make well-informed decisions.

Taking a Long-Term Perspective

Investing in gold requires a long-term perspective to weather market volatility and achieve maximum returns. Understanding market cycles and resisting the urge to panic sell are crucial components of successful gold investing.

Investing for the Long-Term

Gold is a long-term investment that can provide a hedge against inflation and diversify a portfolio. Investors should adopt a patient approach and hold their investments for an extended period to reap the benefits of potential long-term growth.

Understanding Market Cycles

Gold, like any other asset, experiences cyclical patterns. Understanding these cycles and having a long-term perspective allows investors to make informed decisions and avoid reacting impulsively to short-term market fluctuations.

Avoiding Panic Selling

During times of market volatility, it is common for investors to experience fear and consider panic selling. However, panic selling usually leads to losses and prevents investors from capitalizing on potential market recoveries. Keeping a level head and avoiding impulsive decisions can lead to better long-term investment outcomes.

Building a Diversified Portfolio

Diversification is a risk management strategy that involves allocating funds across different asset classes. It can help minimize the impact of market fluctuations and reduce the overall risk of a portfolio.

The Benefits of Diversification

Diversification is important in gold investing as it reduces the reliance on a single asset class. By diversifying, investors can spread their risk and potentially achieve more stable returns over time.

Allocating Funds Across Different Asset Classes

A diversified portfolio includes a mix of assets such as stocks, bonds, real estate, and gold. By allocating funds across different asset classes, investors can minimize the impact of any single asset’s performance on their overall portfolio.

Minimizing Risk through Portfolio Allocation

Portfolio allocation is a strategic approach to diversification, where investors determine the optimal distribution of their assets based on their risk tolerance and investment goals. This approach minimizes risk and maximizes the potential for long-term growth.

Embracing a Stoic Mindset

Gold investors must embrace a stoic mindset and accept the inherent volatility of the precious metal. Detaching from short-term price fluctuations and focusing on factors within their control can help investors stay level-headed and make rational decisions.

Accepting the Volatility of Gold

Gold is known for its price volatility, which can fluctuate significantly in the short term. Accepting this volatility as a natural part of gold investing helps investors avoid emotional reactions and make informed decisions.

Detaching from Short-Term Price Fluctuations

Short-term price fluctuations can trigger emotional responses, leading to impulsive decisions. Detaching from these fluctuations and maintaining a long-term perspective allows investors to make rational decisions based on their investment strategy.

Focusing on Factors within Your Control

Not all factors that influence the price of gold are within an investor’s control. Focusing on factors such as research, analysis, and risk management strategies that are within their control helps investors feel empowered and make objective decisions.

Emotional Support and Community

Gold investing can be emotionally challenging, especially during times of market volatility. Seeking emotional support from like-minded investors can provide a sense of community and help investors navigate through difficult periods.

Finding Like-Minded Investors

Connecting with like-minded investors can provide valuable emotional support and the opportunity to exchange ideas and insights. Online forums, investment groups, and social media platforms can serve as a resource for finding a community of fellow gold investors.

Joining Investment Clubs or Groups

Investment clubs or groups offer a social network of individuals with a shared interest in gold investing. Joining these clubs or groups provides opportunities for learning, networking, and mutual support among members.

Seeking Emotional Support from Friends and Family

Emotional support from friends and family can be invaluable during times of market uncertainty. Discussing fears, concerns, and investment strategies with trusted individuals can help alleviate anxiety and provide a fresh perspective.

In conclusion, understanding and managing emotions is crucial for successful gold investing. Recognizing the impact of fear and greed on investment decisions, adopting strategies to overcome emotional biases, and seeking emotional support and community can contribute to a balanced and informed approach to gold investing. By staying educated, practicing patience, and maintaining a long-term perspective, investors can navigate the emotional challenges of gold investing and maximize their potential for long-term success.