So, you’ve decided to invest in gold, huh? Smart move! Gold has long been considered a safe haven investment, providing a hedge against inflation and offering stability during times of economic uncertainty. But as with any investment, there are risks involved. That’s where risk management techniques come in. In this article, we’ll explore some effective ways to hedge your gold portfolio, ensuring that you’re protected from potential downturns in the market and maximizing your chances for long-term success. So grab a cup of coffee, sit back, and let’s delve into the world of risk management and gold investments. You’re in for a treat!

Understanding Risk Management Techniques

When it comes to investing in gold, understanding risk management techniques is essential for protecting your portfolio. Risk management refers to the process of identifying, assessing, and prioritizing risks to minimize potential losses. By implementing effective risk management strategies, you can ensure that your investment in the gold market is safeguarded against various risks.

Definition of Risk Management

Risk management involves the identification and evaluation of potential risks and the implementation of strategies to mitigate those risks. In the context of gold portfolio investment, risk management techniques are used to protect against potential losses that may arise due to factors such as price volatility, market liquidity, inflation, currency fluctuations, and political or geopolitical events.

Importance of Risk Management in Investments

Risk management plays a crucial role in preserving the value of your investment in the gold market. By effectively managing risks, you can minimize the impact of adverse events on your portfolio and improve your chances of achieving long-term profitability. Without proper risk management, investors may be exposed to significant losses and volatility, making it essential to prioritize risk management techniques when investing in gold.

Types of Risks in Gold Portfolio Investment

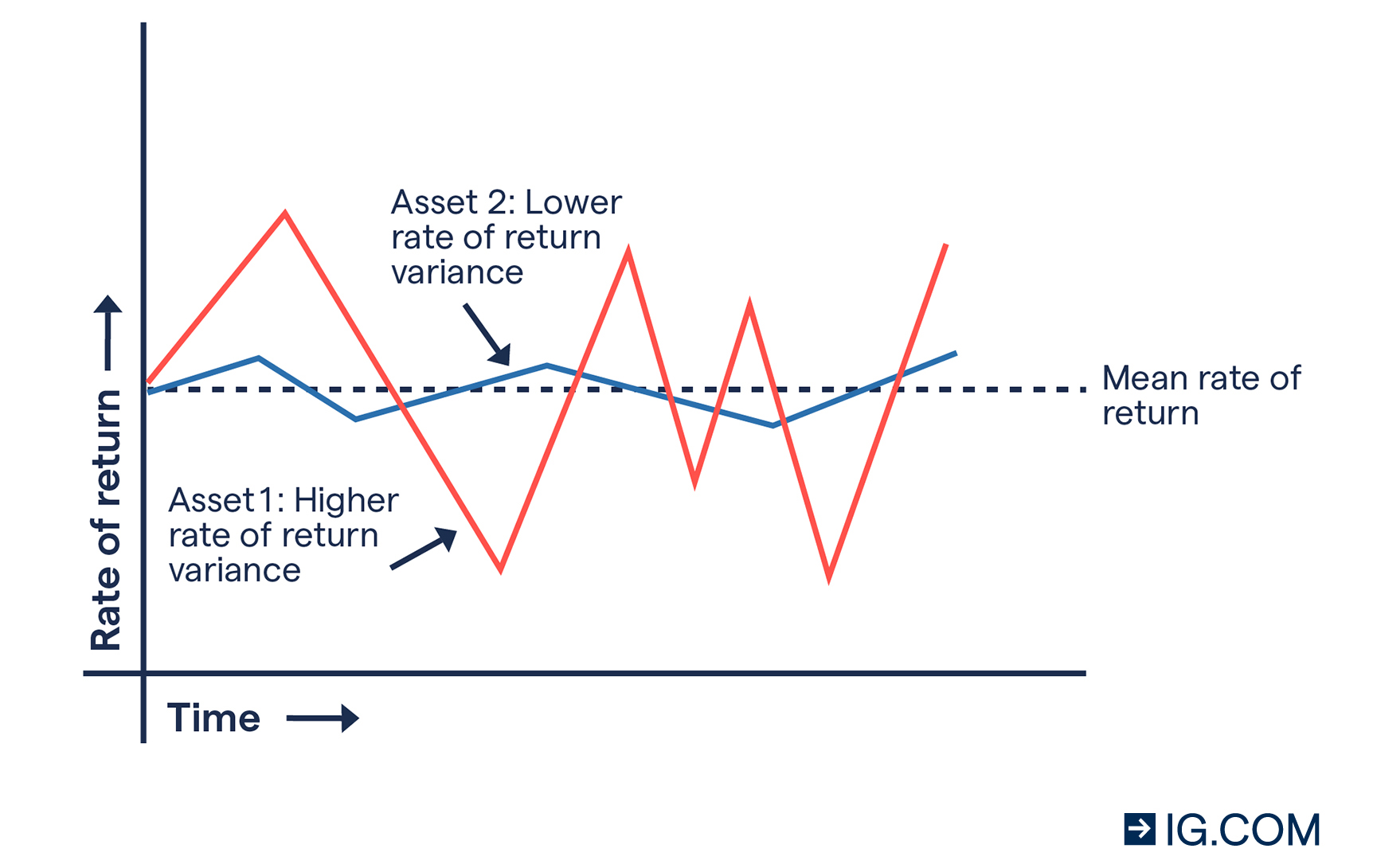

Price Volatility Risk

Price volatility is a key risk in gold portfolio investment. The value of gold can fluctuate significantly, influenced by factors such as economic conditions, market sentiment, and supply and demand dynamics. Price volatility risk arises from the possibility of substantial price fluctuations, which can impact the overall value of your gold investment.

Market Liquidity Risk

Market liquidity risk refers to the potential difficulty in buying or selling gold assets without significantly impacting their market prices. In illiquid markets, investors may find it challenging to execute trades at desired prices, which can hinder portfolio management and liquidity. It is crucial to consider market liquidity risk when investing in gold to ensure smooth transactional capabilities.

Inflation Risk

Inflation risk arises from the potential devaluation of currency due to rising inflation rates. Gold is often considered a hedge against inflation, as its value typically increases during inflationary periods. However, if inflation outpaces the increase in the value of gold, investors may experience a decrease in purchasing power and erosion of the real value of their gold investments.

Currency Risk

Currency risk, also known as exchange rate risk, refers to the impact of currency fluctuations on the value of your gold investments. Since gold is priced in U.S. dollars, fluctuations in exchange rates between the dollar and your local currency can affect the value of your gold holdings. Currency risk can either amplify or diminish investment returns depending on the direction of exchange rate movements.

Political and Geopolitical Risk

Political and geopolitical risks are associated with events or developments that occur within a specific country or on a global scale. These risks can include changes in government policies, geopolitical tensions, trade disputes, or social unrest. Such events may have a profound impact on the gold market, leading to significant price fluctuations and potential losses for investors.

Traditional Risk Management Techniques

To manage the risks associated with gold portfolio investment, several traditional risk management techniques can be employed. By diversifying your portfolio, strategically allocating assets, and regularly rebalancing your holdings, you can reduce vulnerability to specific risks and navigate market volatility more effectively.

Diversification

Diversification involves spreading your investment across various asset classes, sectors, and geographic regions to minimize exposure to individual risks. By diversifying your gold portfolio with other types of investments, such as stocks, bonds, or real estate, you can reduce the impact of gold-specific risks and increase the potential for overall portfolio stability.

Asset Allocation

Asset allocation refers to the process of determining the optimal distribution of investments across different asset classes. By strategically allocating your investments between gold and other assets, such as stocks, bonds, or cash, you can balance risk and potential returns based on your financial goals, risk tolerance, and market conditions.

Portfolio Rebalancing

Portfolio rebalancing involves periodically assessing and adjusting the allocation of assets within your portfolio to maintain desired risk levels and align with your investment objectives. Through regular rebalancing, you can sell overperforming assets and buy underperforming assets, ensuring that your portfolio remains in line with your risk management goals.

Hedging as a Risk Management Technique

Hedging is a risk management technique that involves taking offsetting positions in different financial instruments to protect against potential losses. In the context of gold portfolio investment, various hedging instruments can be used to mitigate the risks associated with price volatility, market liquidity, inflation, currency fluctuations, and political or geopolitical events.

Definition of Hedging

Hedging refers to the implementation of strategies to protect an investment against adverse price movements. In the gold market, hedging involves using financial instruments to offset potential losses incurred due to changes in the price of gold. By hedging, investors aim to limit downside risk while maintaining exposure to potential upside movements in the gold market.

Benefits of Hedging

Hedging offers several benefits for investors in gold portfolios. It can provide protection against price volatility, minimize losses during market downturns, enhance portfolio stability, and offer peace of mind for risk-averse investors. By utilizing hedging techniques, investors can effectively manage risk and create a more balanced and resilient investment portfolio.

Types of Hedging Instruments

There are various hedging instruments available for managing risks in a gold portfolio. These instruments allow investors to establish positions that offset potential losses in the value of their gold holdings. Some common hedging instruments used in gold portfolio management include:

Gold Futures Contracts

Gold futures contracts are standardized agreements to buy or sell a specific quantity of gold at a predetermined price and future date. By entering into a futures contract, investors can protect against potential losses arising from adverse price movements in the gold market.

Gold Options

Gold options provide investors with the right, but not the obligation, to buy or sell gold at a specified price within a predetermined time frame. Options offer flexibility and the ability to limit downside risk while maintaining exposure to potential price appreciation in the gold market.

Gold Forward Contracts

Gold forward contracts are customized agreements between two parties to buy or sell gold at a future date at a negotiated price. Forward contracts allow investors to establish a fixed price for future gold transactions, providing protection against price fluctuations.

Gold ETFs

Gold exchange-traded funds (ETFs) are investment funds that trade on stock exchanges and aim to replicate the performance of the gold market. By investing in gold ETFs, investors can gain exposure to the price of gold without physically owning the metal, effectively hedging against gold-specific risks.

Gold Mining Stocks

Investing in gold mining stocks can serve as a form of hedging in a gold portfolio. Gold mining stocks are shares of companies involved in gold exploration and production. During periods of rising gold prices, mining stocks tend to outperform, offering potential upside while providing exposure to the gold market.

Gold Bullion Coins and Bars

Physical gold in the form of bullion coins and bars can also be utilized for hedging purposes. By owning physical gold, investors can protect against potential losses in the value of their gold portfolio and benefit from the intrinsic value of the metal.

Using Gold Futures Contracts for Hedging

Overview of Gold Futures Contracts

Gold futures contracts are financial instruments that allow investors to establish positions in gold at a predetermined price and future date. These contracts are traded on futures exchanges, such as the Chicago Mercantile Exchange (CME), and provide a means of hedging against price fluctuations in the gold market.

How Gold Futures Contracts Work

When entering into a gold futures contract, an investor agrees to buy or sell a specified quantity of gold at a predetermined price and future date. By taking a long position, an investor agrees to buy gold at a future date, while a short position involves an agreement to sell gold. By establishing a futures position opposite to their gold holdings, investors can offset potential losses resulting from adverse price movements.

Advantages of Gold Futures for Hedging

Gold futures contracts offer several advantages for investors looking to hedge their gold portfolios. First, futures contracts provide standardized terms, ensuring transparency and ease of trading. Additionally, futures contracts allow investors to establish positions with a fraction of the capital required to physically own gold, increasing accessibility. Furthermore, the ability to take both long and short positions enables investors to hedge against potential losses or profit from upward price movements in the gold market.

Utilizing Gold Options for Portfolio Hedging

Introduction to Gold Options

Gold options are derivative contracts that provide investors with the right, but not the obligation, to buy or sell gold at a specified price within a predetermined time frame. Options offer a flexible hedging tool for gold portfolio management, allowing investors to establish positions that protect against potential losses while maintaining exposure to potential price appreciation in the gold market.

Benefits of Gold Options for Hedging

Gold options offer several benefits for investors seeking to hedge their gold portfolios. First, options provide limited downside risk, as investors are not obligated to exercise their option if market conditions are unfavorable. This flexibility allows for greater risk management and potential profit during periods of price fluctuation. Moreover, options enable investors to establish positions with a fraction of the capital required to physically own gold, providing cost-effectiveness and diversification benefits.

Key Terminologies in Gold Options

To effectively utilize gold options for portfolio hedging, understanding key terminologies is crucial. Some important terms include:

- Call Option: A call option gives the holder the right to buy gold at a specified price within a predetermined time frame.

- Put Option: A put option gives the holder the right to sell gold at a specified price within a predetermined time frame.

- Strike Price: The strike price is the predetermined price at which the option can be exercised.

- Expiry Date: The expiry date is the last date on which the option can be exercised.

- Premium: The premium is the price paid to acquire the option.

Hedging Strategies with Gold Options

Various hedging strategies can be employed using gold options to manage the risks associated with gold portfolio investment. These strategies include:

- Protective Put: Investors can purchase put options to protect against potential downside risk. Put options act as insurance, enabling investors to sell their gold holdings at a predetermined price in case of adverse price movements.

- Covered Call: By selling call options on existing gold holdings, investors can generate income while potentially limiting their upside potential. Covered calls allow investors to profit from the option premium received while still owning the underlying gold assets.

- Collar Strategy: The collar strategy involves purchasing protective puts and selling covered calls simultaneously. This strategy limits both downside risk and upside potential, providing a balance between protection and income generation.

Implementing Gold Forward Contracts in Risk Management

Understanding Gold Forward Contracts

Gold forward contracts are customized agreements between two parties to buy or sell gold at a future date at a negotiated price. Similar to futures contracts, forward contracts provide a means of hedging against potential losses resulting from adverse price movements in the gold market.

Advantages of Gold Forward Contracts

Gold forward contracts offer several advantages for investors looking to manage risk in their gold portfolios. First, forward contracts allow for customized terms, enabling investors to establish specific delivery dates and negotiate prices tailored to their needs. Additionally, forward contracts enable investors to lock in a fixed price for future gold transactions, providing protection against price fluctuations and ensuring predictable cash flows.

Factors to Consider in Gold Forward Contracts

When implementing gold forward contracts as a risk management technique, it is essential to consider various factors. These factors include:

- Counterparty Risk: Forward contracts involve a contractual agreement between two parties, and the creditworthiness and reliability of the counterparty must be assessed.

- Delivery Logistics: Forward contracts require physical delivery of gold at a future date. Consideration must be given to storage, transportation, and associated costs.

- Price Volatility: While forward contracts offer protection against adverse price movements, they also involve potential opportunity cost if gold prices increase significantly.

- Contract Size: It is crucial to determine the appropriate contract size based on individual investment objectives and risk tolerance.

Leveraging Gold ETFs for Risk Management

Introduction to Gold ETFs

Gold exchange-traded funds (ETFs) are investment funds that trade on stock exchanges and aim to replicate the performance of the gold market. Gold ETFs provide investors with exposure to the price of gold without physically owning the metal, offering an efficient and cost-effective means of risk management in a gold portfolio.

Benefits of Gold ETFs for Hedging

Gold ETFs offer several benefits for investors seeking to hedge their gold portfolios. First, ETFs provide easy access to the gold market, allowing investors to buy and sell shares on stock exchanges like any other stock. Additionally, gold ETFs offer liquidity, enabling investors to swiftly adjust their exposure to gold based on market conditions. Moreover, ETFs provide diversification benefits by holding a basket of gold assets, minimizing risks associated with individual gold holdings.

Factors to Consider in Gold ETFs

When considering gold ETFs for risk management, it is essential to evaluate various factors. These factors include:

- Expense Ratios: Gold ETFs charge management fees, often expressed as expense ratios, which can impact overall returns. Investors should compare expense ratios and consider their impact on the performance of the ETF.

- Liquidity: Liquidity is crucial when trading ETF shares. It is important to assess the average daily trading volume and bid-ask spreads to ensure smooth transactional capabilities.

- Tracking Error: Gold ETFs aim to replicate the performance of the gold market, but slight deviations, known as tracking error, may occur. Investors should examine the historical tracking error of an ETF to assess its effectiveness in mirroring gold prices.

- Custodian and Security: ETFs hold physical gold as their underlying asset. It is important to research the custodian and security measures employed by the ETF to ensure the safety of investors’ gold holdings.

Exploring Gold Mining Stocks in Hedging Strategies

Understanding Gold Mining Stocks

Gold mining stocks are shares of companies involved in gold exploration and production. These stocks can serve as a form of hedging in a gold portfolio, offering exposure to the gold market while providing potential upside during periods of rising gold prices.

Advantages of Gold Mining Stocks for Hedging

Investing in gold mining stocks offers several advantages for investors seeking to hedge their gold portfolios. First, mining stocks provide leverage to the price of gold. When gold prices increase, the profitability and value of gold mining companies often rise significantly, potentially outperforming the physical gold market. Additionally, gold mining stocks provide diversification benefits, as their value can be influenced by factors beyond the price of gold, such as company management, production efficiency, and geopolitical considerations.

Risks Associated with Gold Mining Stocks

While gold mining stocks can offer significant potential upside, they are also exposed to certain risks. These risks include:

- Operational Risks: Mining companies face operational challenges, such as technical difficulties, labor disputes, regulatory hurdles, and environmental concerns.

- Geopolitical Risks: Gold mining operations can be affected by geopolitical factors, including changes in government policies, security issues, and nationalization risks.

- Production Risks: Mining companies’ profitability and value depend on efficient production processes and the ability to extract gold at reasonable costs. Any disruptions or declines in production can impact the financial performance of mining stocks.

- Market Volatility: Gold mining stocks are subject to market volatility, which can be influenced by factors beyond the price of gold, such as investor sentiment, macroeconomic conditions, and industry-specific developments.

Adding Gold Bullion Coins and Bars for Risk Management

Overview of Gold Bullion

Gold bullion refers to physical gold in the form of coins or bars. These tangible assets can serve as a risk management tool in a gold portfolio, providing protection against potential losses in the value of gold holdings.

Benefits of Gold Bullion for Hedging

Adding gold bullion coins and bars to a portfolio offers several benefits for investors seeking to manage risk. First, gold bullion is a tangible asset with intrinsic value, making it resistant to inflation and currency fluctuations. Additionally, gold bullion offers portfolio diversification, as it is uncorrelated with traditional financial assets, such as stocks and bonds. Moreover, owning physical gold provides a sense of security and acts as a hedge against political and economic uncertainties.

Key Considerations in Gold Bullion Investment

When considering gold bullion for risk management, it is important to keep the following considerations in mind:

- Authenticity and Purity: Ensure the authenticity and purity of gold bullion by purchasing from reputable dealers and verifying the certifications and markings on the coins or bars.

- Storage and Security: Physical gold requires secure storage to protect against loss, theft, and damage. Consider options such as secure vaults, safety deposit boxes, or professional storage services.

- Transaction Costs: Buying and selling physical gold may involve transaction costs, including premiums and fees. Assess these costs and factor them into the overall investment strategy.

- Liquidity: Physical gold may not be as liquid as other investments. Consider the ease of buying or selling gold coins and bars when needed.

- Insurance: Protecting physical gold through insurance coverage is essential to mitigate potential losses from theft, loss, or damage. Explore insurance options and evaluate their cost and coverage.

By understanding and implementing risk management techniques, such as hedging, diversification, and asset allocation, investors can navigate the risks associated with gold portfolio investment. Whether through the use of futures contracts, options, forwards, ETFs, mining stocks, or physical bullion, these strategies offer opportunities to protect against market volatility and enhance the stability of a gold portfolio. As an investor, it is crucial to evaluate the individual merits and considerations of each risk management technique and select those that align with your investment goals and risk tolerance. Remember, risk management is a continuous process that requires monitoring and adjustments as market conditions and individual circumstances evolve.