So you’ve been considering investing in gold, but you’re not quite sure where to start? Well, you’ve come to the right place! In this article, we’re going to help you determine your suitable gold investment strategy through a handy Risk Tolerance Quiz. Investing in gold can be a lucrative venture, but it’s important to understand your risk tolerance before diving in. Whether you’re a seasoned investor or a complete newbie, this quiz will give you valuable insights into how comfortable you are with taking risks and guide you towards the investment strategy that aligns with your goals. So grab a pen and paper, and let’s get started!

Understanding Risk Tolerance

What is Risk Tolerance?

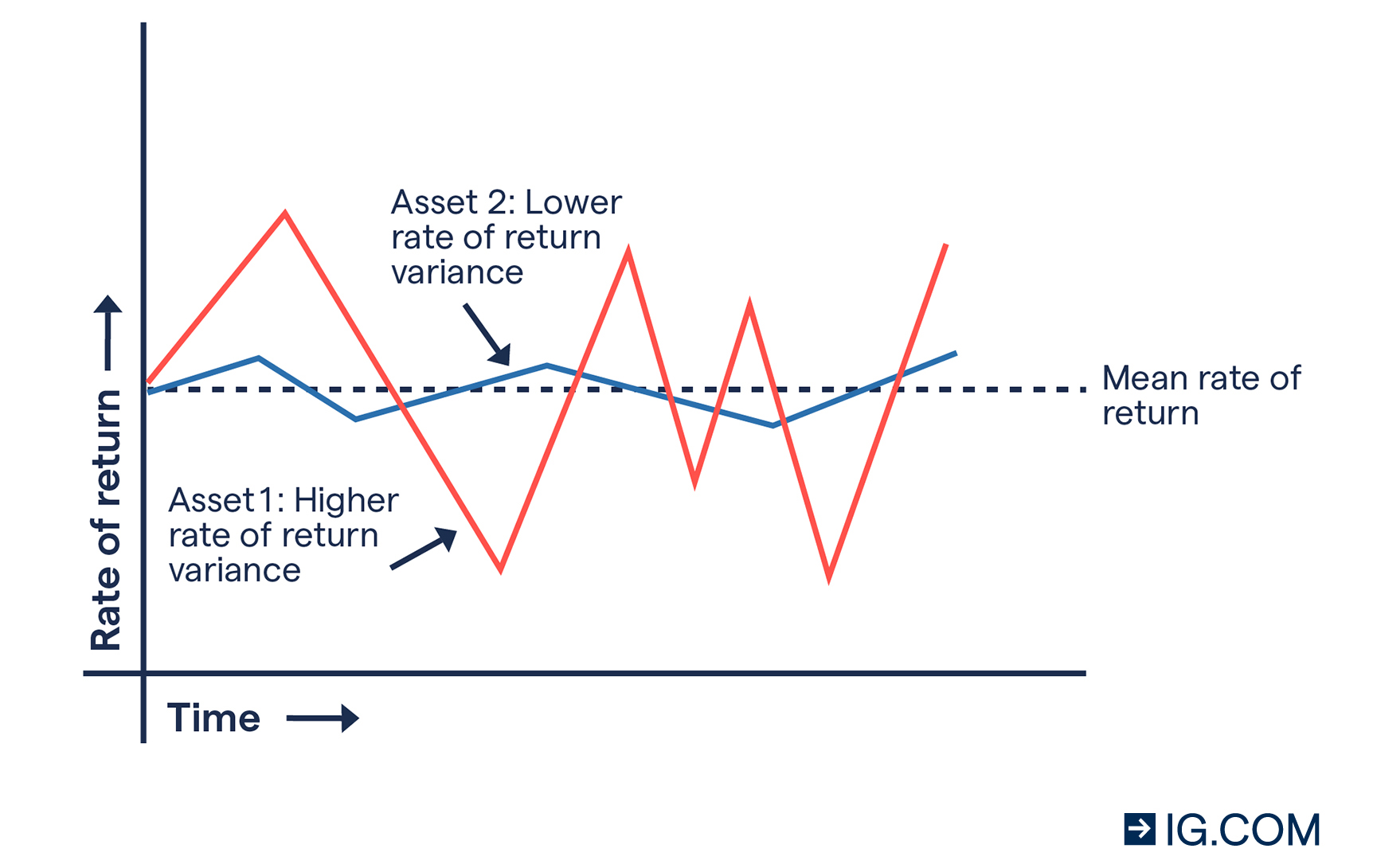

Risk tolerance refers to an individual’s ability to stomach and handle uncertainty and potential losses associated with investment decisions. It defines the level of risk that an investor is willing and capable of taking on. Every individual has a different comfort level when it comes to taking risks, which is influenced by various factors such as financial goals, time horizon, and personal circumstances.

Why is Risk Tolerance Important in Investing?

Understanding your risk tolerance is crucial when it comes to making investment decisions, especially in the realm of gold investments. It helps you align your investment strategy with your personal preferences and financial objectives. By knowing your risk tolerance, you can make more informed choices about the types of investments you should consider and the level of risk you are comfortable with.

Assessing Your Risk Tolerance

Using a Risk Tolerance Quiz

One way to assess your risk tolerance is by taking a risk tolerance quiz. These quizzes are designed to gauge your comfort level with different types of investments and potential risks. The quiz typically consists of a series of questions that require you to evaluate your willingness to endure fluctuations in the value of your investments and your ability to tolerate potential losses.

It is important to note that while risk tolerance quizzes can provide a general idea of your risk tolerance, they should not be used as the sole basis for making investment decisions. The results should be used as a starting point for further discussion and analysis.

Factors That Affect Risk Tolerance

Several factors can influence an individual’s risk tolerance. These factors include:

-

Financial Goals: Your goals, such as saving for retirement or purchasing a home, can impact your willingness to take on risk. If you have a long-term goal, you may be more willing to tolerate fluctuations in the short-term.

-

Time Horizon: The length of time you have available to achieve your goals can affect your risk tolerance. If you have a longer time horizon, you may be more willing to take on risk as there is more time to recover from any potential losses.

-

Financial Situation: Your financial situation, including your income, expenses, and existing investments, can influence your risk tolerance. If you have a stable financial situation and a higher disposable income, you may be more comfortable taking on higher-risk investments.

-

Knowledge and Experience: Your level of knowledge and experience in investing can impact your risk tolerance. Generally, individuals with more experience may be more comfortable taking on higher levels of risk.

It is essential to consider all these factors when assessing your risk tolerance to ensure that your investment strategy is aligned with your individual circumstances and goals.

Determining Your Suitable Gold Investment Strategy

Introduction to Gold Investments

Gold has long been considered a safe-haven investment, known for its ability to retain value even during times of economic uncertainty. Investing in gold can be an effective way to diversify your portfolio and hedge against inflation. Gold investments come in various forms, including physical gold, gold exchange-traded funds (ETFs), and gold mining stocks.

Benefits of Investing in Gold

There are several benefits to investing in gold:

-

Store of Value: Gold has proven to be a reliable store of value over time. Its value tends to hold steady or increase during periods of economic instability.

-

Inflation Hedge: Gold can act as a hedge against inflation, as its value typically increases when the purchasing power of fiat currencies decreases.

-

Portfolio Diversification: Adding gold to your investment portfolio can help reduce overall risk as it tends to have a low correlation with other asset classes, such as stocks and bonds.

-

Liquidity: Gold is highly liquid, meaning it can be easily bought and sold.

-

Tangible Asset: Unlike stocks or bonds, gold is a physical asset that you can hold in your hand, which can provide a sense of security.

Types of Gold Investments

When it comes to investing in gold, there are various options to consider:

-

Physical Gold: This includes gold coins, bars, and jewelry. Physical gold offers the advantage of ownership and the ability to hold and store the asset directly.

-

Gold ETFs: Gold exchange-traded funds are investment funds that track the price of gold. When you invest in a gold ETF, you do not own physical gold but rather shares in the fund, providing exposure to the price of gold.

-

Gold Mining Stocks: Investing in gold mining companies allows you to indirectly invest in gold. These stocks can offer potential growth as well as exposure to the gold mining industry.

-

Gold Futures and Options: Gold futures and options contracts allow investors to speculate on the future price of gold. However, these investment vehicles are considered more complex and are typically used by experienced traders.

Determining the suitable gold investment strategy depends on your risk tolerance, financial goals, and investment preferences. It is essential to weigh the pros and cons of each option before making a decision.

Considerations for Conservative Investors

Low-Risk Gold Investment Options

For conservative investors who prioritize capital preservation and are risk-averse, there are low-risk gold investment options available. These options minimize exposure to fluctuations in the gold market and offer a more stable return.

-

Physical Gold Bullion: Investing in physical gold bullion, such as coins and bars, provides an opportunity to hold a tangible asset. Physical gold can be stored securely, and its value tends to be more stable compared to other forms of gold investments.

-

Gold ETFs: Gold exchange-traded funds offer a low-risk way to gain exposure to the price of gold without the need for physical storage. ETFs provide diversification as they typically hold a portfolio of gold assets.

-

Gold Certificates: Gold certificates are documents issued by banks or financial institutions that represent ownership of a specific amount of gold. These certificates allow investors to hold gold indirectly without the need for physical storage.

These low-risk options are suitable for conservative investors who prioritize capital safety and seek long-term stability in their investment portfolio.

Diversification Strategies

Diversification is a risk management strategy that involves investing in a variety of assets to reduce exposure to any single investment. For conservative investors interested in gold, diversification can help mitigate risk and minimize the impact of market fluctuations.

-

Asset Allocation: Allocating a portion of your investment portfolio to gold can provide diversification benefits. The exact allocation will depend on your risk tolerance and investment goals.

-

Dollar-Cost Averaging: This strategy involves investing a fixed amount of money in gold at regular intervals, regardless of the current price. Dollar-cost averaging helps reduce the impact of market volatility by buying more gold when prices are low and buying less when prices are high.

-

Holding Multiple Forms of Gold: Combining different types of gold investments, such as physical gold and gold ETFs, provides further diversification. This strategy allows you to benefit from the stability of physical gold while also gaining exposure to the liquidity and convenience of ETFs.

By adopting diversification strategies, conservative investors can potentially minimize risk while still benefiting from the long-term stability and value preservation offered by gold investments.

Strategies for Moderate Risk Tolerance

Balancing Risk and Potential Returns

Investors with a moderate risk tolerance are willing to take on a slightly higher level of risk in search of potential returns. When it comes to gold investments, striking the right balance between risk and potential returns is crucial.

-

Gold Mining Stocks: For moderate risk-tolerant investors, investing in gold mining stocks can provide exposure to the gold market while offering the potential for growth. Gold mining stocks tend to be more volatile than physical gold but can yield higher returns if the mining companies perform well.

-

Gold ETFs with a Higher Risk Profile: Some gold ETFs are designed to provide higher exposure to the price movements of gold. These ETFs often involve more risk and volatility but offer the potential for higher returns. Investors with a moderate risk tolerance may consider allocating a portion of their portfolio to these ETFs.

-

Dollar-Cost Averaging with a Larger Investment: Moderate risk-tolerant investors can capitalize on market fluctuations by employing dollar-cost averaging with larger investment amounts. This approach allows them to potentially benefit from buying more gold during price dips and taking advantage of market upswings.

It is important for moderate risk-tolerant investors to carefully assess their financial goals and risk tolerance before implementing any investment strategy. Balancing risk and potential returns is the key to successful gold investing in this risk category.

Allocation Between Gold and Other Assets

Moderate risk-tolerant investors should also consider their allocation between gold and other asset classes. While gold can provide diversification benefits, it is essential to have a well-diversified portfolio that includes various asset classes.

-

Stocks and Bonds: Investing in a combination of stocks and bonds alongside gold can help moderate risk-tolerant investors achieve a balanced portfolio. Stocks offer the potential for growth, while bonds provide stability and income.

-

Real Estate: Real estate investments can further diversify a portfolio by introducing an alternative asset class. Investing in real estate investment trusts (REITs) or rental properties can complement gold investments.

-

Cash and Cash Equivalents: Holding cash or cash equivalents, such as money market funds, allows investors to have liquidity and flexibility in their portfolio. Cash can be used to take advantage of investment opportunities or act as a safety net during market downturns.

The allocation between gold and other assets should be determined based on individual circumstances, risk tolerance, and investment objectives. Regularly evaluating and rebalancing the portfolio is also vital to maintain the desired asset allocation and risk profile.

Aggressive Investment Strategies

High-Risk Gold Investment Opportunities

Aggressive investors with a high risk tolerance are comfortable taking on significant risk in pursuit of potential high returns. Gold investments for aggressive investors involve higher levels of risk and volatility, but they also offer the potential for substantial gains.

-

Gold Futures and Options: Trading gold futures and options contracts is a high-risk strategy. It requires advanced knowledge and experience, as well as the ability to withstand substantial losses. These investment vehicles allow aggressive investors to speculate on the future price movements of gold, potentially amplifying their returns.

-

Junior Gold Mining Stocks: Junior gold mining stocks are shares of smaller, less-established mining companies. These stocks are highly speculative and volatile, but for aggressive investors seeking high growth potential, they can offer significant rewards.

-

Leveraged Gold ETFs: Leveraged gold exchange-traded funds aim to provide amplified returns relative to the underlying gold price. However, they also amplify the downside risk, making them suitable only for aggressive investors who can withstand significant losses.

Aggressive investment strategies require careful consideration and are typically suited for experienced investors who have a deep understanding of market dynamics and are willing to take substantial risks.

Leveraged Gold Investments

Leveraged gold investments involve borrowing money to amplify potential returns. These investments are inherently risky and should only be considered by aggressive investors who fully understand the associated risks and have the financial means to withstand potential losses.

-

Margin Trading: Margin trading allows investors to borrow funds from a brokerage to purchase additional gold. While this can increase potential returns, it also magnifies losses if the price of gold decreases. Margin trading requires a high level of experience and should be approached with caution.

-

Gold Options Trading: Trading gold options contracts with leverage can provide opportunities for aggressive investors to profit from short-term price movements. However, options trading requires a solid understanding of financial derivatives and can result in substantial losses if not executed correctly.

It is crucial for aggressive investors to consider their risk tolerance, financial stability, and investment objectives before engaging in leveraged gold investments. Seeking advice from a financial advisor with expertise in these investment strategies is highly recommended.

Creating a Customized Investment Plan

Consulting with a Financial Advisor

Creating a customized investment plan is a crucial step in aligning your gold investments with your specific goals and risk tolerance. Working with a qualified financial advisor can provide valuable insights and guidance throughout the process.

A financial advisor can help assess your risk tolerance, evaluate your financial situation, and understand your long-term objectives. They can also provide recommendations on suitable gold investment strategies and help you create a diversified portfolio that maximizes your potential for success.

Analyzing and Adjusting Your Plan

Once you have a customized investment plan in place, it is essential to monitor and regularly analyze its performance. Market conditions and personal circumstances can change over time, necessitating adjustments to your investment strategy.

Reviewing your plan periodically allows you to assess whether it is still aligned with your financial goals and risk tolerance. If necessary, you can make adjustments to rebalance your portfolio, consider new investment opportunities, or reallocate your assets.

Consulting with your financial advisor on a regular basis can help ensure that your investment plan remains optimized and adaptable to changing market conditions.

Monitoring and Tracking Your Gold Investments

Evaluating Performance Metrics

Monitoring the performance of your gold investments is essential to gauge their effectiveness and make informed decisions. Several performance metrics can help you evaluate the success of your investments.

-

Return on Investment (ROI): ROI measures the profitability of an investment relative to its cost. It is calculated by dividing the gain or loss from the investment by the initial investment amount.

-

Annualized Return: Annualized return provides a standardized way to compare the performance of different investments over time. It calculates the average annual return of an investment, taking into account the length of investment.

-

Sharpe Ratio: The Sharpe ratio measures the risk-adjusted return of an investment. It considers both the return and the volatility of the investment, allowing you to assess whether the return is justified given the level of risk taken.

-

Tracking Error: Tracking error measures the deviation of an investment’s performance from its benchmark. It helps evaluate the effectiveness of the investment strategy and the ability to replicate the performance of the chosen benchmark.

By regularly evaluating these performance metrics, you can gain insights into the efficacy of your gold investments and make informed decisions about potential adjustments to your portfolio.

Rebalancing Your Portfolio

Rebalancing involves adjusting the allocation of assets in your portfolio to maintain your desired risk profile and investment objectives. Over time, market movements and changes in the value of different investments can cause your portfolio to deviate from its intended allocation.

Rebalancing typically involves selling assets that have performed well and buying assets that have underperformed to bring the portfolio back in line with its target allocation. When rebalancing your portfolio, it is essential to consider your risk tolerance and long-term goals. Regular rebalancing helps ensure that your portfolio remains diversified and aligned with your investment strategy.

Handling Market Volatility

Navigating Price Fluctuations

Gold, like any other investment, can experience significant price fluctuations. These fluctuations can be driven by a variety of factors, including geopolitical events, economic conditions, and investor sentiment. Navigating market volatility requires a long-term perspective and a disciplined approach.

During periods of market volatility, it is essential to stay informed and maintain a calm and rational mindset. Avoid making impulsive investment decisions based on short-term market movements. Instead, focus on your long-term investment objectives and stay committed to your investment plan.

Reassessing Risk Tolerance

Market volatility can also serve as an opportunity to reassess your risk tolerance. Periods of heightened volatility can test your emotional resilience and ability to withstand losses. It is crucial to revisit your risk tolerance during these times and ensure that your investment strategy is still aligned with your comfort level.

If you find that market volatility is causing significant distress or anxiety, it may be an indication that your risk tolerance is lower than initially assessed. In such cases, it may be appropriate to adjust your investment strategy and potentially reduce exposure to higher-risk assets.

Conclusion

Importance of Regular Review

Regularly reviewing and evaluating your gold investments is crucial to ensure they remain aligned with your financial goals and risk tolerance. Market conditions and personal circumstances can change over time, requiring adjustments to your investment strategy.

By understanding your risk tolerance, creating a customized investment plan, and utilizing diversification strategies, you can navigate the world of gold investments with confidence. Consultation with a financial advisor, careful monitoring of performance metrics, and a long-term approach will help you achieve your investment objectives and maximize your potential for success.

Long-Term Approach to Gold Investing

Gold investments, due to their stability and long-term value preservation qualities, are best approached with a long-term perspective. While short-term market fluctuations can cause temporary price volatility, gold has proven to retain value over time.

By staying informed, maintaining a disciplined mindset, and evaluating your investment plan regularly, you can cultivate a long-term approach to gold investing. This approach allows you to capitalize on the unique benefits of gold while minimizing the impact of short-term market uncertainty.

Remember, a well-constructed and diversified investment portfolio, tailored to your risk tolerance and financial goals, is the key to achieving long-term success in gold investing.