Gold is often regarded as a safe and reliable investment option, particularly during times of economic uncertainty. However, as an experienced investor in gold, it’s important to understand the impact of volatility and risk on both short-term and long-term gold investments. Volatility refers to the fluctuations in the price of gold over a given period of time, while risk refers to the potential loss or gain associated with these fluctuations. By understanding the relationship between volatility, risk, and the investment horizon, investors can make informed decisions that align with their financial goals. Whether you’re looking for quick returns or long-term stability, navigating the world of gold investments requires careful analysis and consideration.

Volatility and Risk

Understanding the Impact on Short-Term vs. Long-Term Gold Investments

Welcome to our investment blog! Today, we are going to dive into the fascinating world of gold investments and discuss the concepts of volatility and risk. As an experienced investor in gold, I understand the importance of these factors and how they can impact your investment decisions. Whether you are considering short-term or long-term gold investments, it is crucial to understand the relationship between volatility, risk, and the potential impact on your investment portfolio.

1. What is Volatility?

1.1 Definition of Volatility

Volatility refers to the frequency and magnitude of price fluctuations in an investment. In the context of gold, it represents how much the price of gold tends to deviate from its average value over a given period. In simple terms, the higher the volatility of an asset like gold, the more price fluctuations it experiences.

1.2 Factors Affecting Gold Volatility

Several factors can influence the volatility of gold. One primary factor is market sentiment, which reflects the overall feeling and perception of investors towards gold. Economic indicators, such as inflation, interest rates, and geopolitical events, can also play a significant role in driving gold volatility. Understanding these factors and their potential impact on gold prices is vital when considering short-term or long-term investments.

2. Risk in Gold Investments

2.1 Types of Risks in Gold Investments

While gold is often considered a safe-haven investment, it is not without risks. Understanding the various types of risks associated with gold investments is crucial in making informed investment decisions. Some common types of risks in gold investments include price risk, liquidity risk, counterparty risk, and regulatory risk. Each of these risks poses different challenges and should be carefully evaluated before investing.

2.2 Evaluating Risk in Gold Investments

Evaluating the risk associated with gold investments involves considering factors such as your risk tolerance, investment goals, and market outlook. It is essential to assess your ability to withstand fluctuations in gold prices and potential declines in the value of your investment. Additionally, understanding the current market conditions and trends can help in evaluating the level of risk associated with gold investments.

3. Short-Term Gold Investments

3.1 Characteristics of Short-Term Investments

Short-term gold investments refer to buying and selling gold within a relatively short period, typically less than one year. These investments are often more focused on taking advantage of short-term price movements rather than long-term appreciation. Short-term gold investments require active monitoring and quick decision-making.

3.2 Strategies for Short-Term Gold Investments

For individuals interested in short-term gold investments, various strategies can be employed. These may include trend following, technical analysis, and news-based trading approaches. Trend following involves analyzing historical price patterns to predict price movements. Technical analysis focuses on studying charts and indicators to identify potential trading opportunities. News-based trading involves reacting to market events and news that may impact gold prices.

4. Long-Term Gold Investments

4.1 Characteristics of Long-Term Investments

Long-term gold investments involve buying and holding gold with the expectation of long-term appreciation in value. These investments typically span several years or even decades. Long-term investors in gold often believe in the fundamental value of gold as a store of wealth and a hedge against inflation and geopolitical uncertainties.

4.2 Advantages of Long-Term Gold Investments

One of the significant advantages of long-term gold investments is the potential for capital appreciation over time. Gold has historically shown the ability to maintain its value and even increase it during economic downturns and periods of financial instability. Additionally, holding gold for the long term can act as a hedge against inflation, protecting the purchasing power of your investment.

5. Diversification and Hedging Strategies

5.1 Importance of Diversification

Diversification is a risk management strategy that involves spreading your investments across various asset classes, including gold. Diversifying your investment portfolio can help reduce risk by lowering exposure to any single investment or asset class. By including gold in your investment mix, you can potentially offset losses in other investments during market downturns.

5.2 Hedging Strategies with Gold Investments

Hedging refers to using investments to reduce the potential impact of adverse price movements in other investments. Gold is often considered a natural hedge against market volatility and inflation. Investors may choose to allocate a portion of their portfolio to gold to provide a cushion during times of economic uncertainty. By strategically incorporating gold in your investment strategy, you can potentially reduce overall portfolio risk.

6. Economic Factors and their Impact on Gold

6.1 Inflation and Gold

Inflation refers to the general increase in the prices of goods and services over time. Historically, gold has demonstrated its ability to retain its purchasing power during inflationary periods, making it an attractive investment option. When inflation rises, investors may flock to gold as a safe asset to protect their wealth, potentially driving up gold prices.

6.2 Interest Rates and Gold

Interest rates have a significant impact on the opportunity cost of holding gold. When interest rates are high, investors may choose to hold interest-bearing assets instead of non-interest-bearing assets like gold. Conversely, when interest rates are low, the relative attractiveness of gold as an investment increases. Monitoring interest rate trends can provide insights into potential shifts in gold prices.

6.3 Geopolitical Events and Gold

Geopolitical events, such as conflicts, political unrest, or trade disputes, can significantly affect gold prices. Gold is often viewed as a safe haven during times of geopolitical uncertainty. Investors may seek the stability of gold when faced with geopolitical risks, potentially leading to increased demand and higher prices.

7. Market Factors and Gold Performance

7.1 Supply and Demand Dynamics

The supply and demand dynamics in the gold market can heavily influence its performance. Gold mining production levels, central bank reserves, and jewelry demand are just a few factors that impact the availability and demand for gold. Understanding these dynamics can provide insights into the potential direction of gold prices.

7.2 Speculation and Market Sentiment

Speculation and market sentiment play a significant role in gold price movements. The perception of gold as a safe haven and its potential to act as a store of value attract speculative traders. Changes in market sentiment, influenced by factors such as economic data and news events, can likewise impact gold prices. Monitoring market sentiment can help investors make better-informed decisions and navigate gold investments successfully.

8. Historical Performance of Short-Term and Long-Term Gold

8.1 Analysis of Short-Term Gold Performance

Analyzing the historical performance of short-term gold investments reveals varying results. Short-term fluctuations in gold prices can make it challenging to consistently predict and profit from short-term movements. However, active traders who closely monitor the market and employ effective trading strategies may find opportunities for short-term gains.

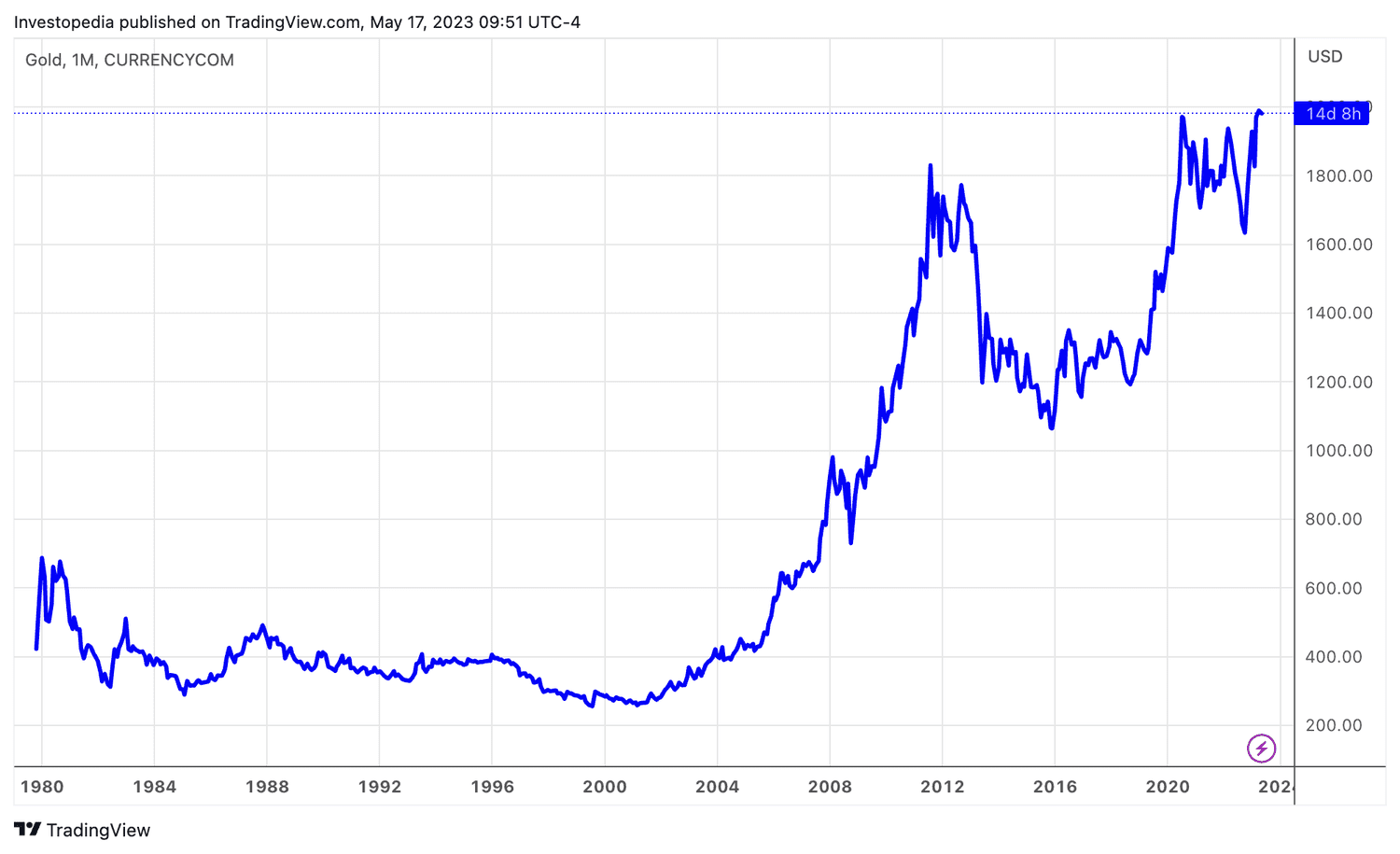

8.2 Analysis of Long-Term Gold Performance

When assessing the historical performance of long-term gold investments, the results have been more favorable. Over extended periods, gold has demonstrated its ability to preserve and increase value. Investors who have held gold for decades have often realized significant returns on their investments, especially during periods of economic turmoil.

9. Factors to Consider in Gold Investment Decision-Making

9.1 Risk Tolerance and Investment Goals

Your risk tolerance and investment goals are critical considerations when making gold investment decisions. Assessing how comfortable you are with the potential risks involved, such as price fluctuations and market uncertainties, is essential. Additionally, identifying your investment goals, whether it be long-term wealth preservation or short-term capital appreciation, will help guide your decision-making process.

9.2 Market Outlook and Trends

Staying informed about the current market outlook and trends is vital in making successful gold investment decisions. Regularly monitoring economic indicators, geopolitical events, and other factors that impact gold prices can provide insights into potential opportunities or risks. By keeping a pulse on the market, you can better position yourself to take advantage of favorable conditions.

9.3 Portfolio Diversification

Lastly, incorporating gold within a well-diversified investment portfolio is an important consideration. By diversifying your investments across multiple assets, including gold, you can help mitigate risk and potentially enhance overall portfolio performance. Understanding how gold fits into your broader investment strategy and considering the optimal allocation to the precious metal is crucial.

In conclusion, volatility and risk are integral aspects to consider when venturing into short-term or long-term gold investments. By understanding the factors driving gold volatility, evaluating the risks associated with gold investments, and considering various investment strategies, you can make more informed decisions. Whether you choose short-term trading or long-term holding, gold investments can offer potential benefits, including diversification, hedging opportunities, and the preservation of wealth. Remember to assess your risk tolerance, stay informed about market trends, and maintain a well-diversified portfolio to maximize the potential returns from your gold investments. Happy investing!